This post was originally published on this site

New Jersey’s fiscal condition was on an “unsustainable trajectory” even before the COVID-19 pandemic hit, and the state urgently needs to adopt reforms, according to a report published in late September.

The report, Toward a Fiscally Sustainable New Jersey, is a project of the Garden State Initiative, a follow-up to a task force created in 2012 to address what was at the time a state budget crisis. But nine years later, “the problems described in the 2012 report had not been sufficiently addressed,” the authors write.

That task force was helmed by former Federal Reserve chairman Paul Volcker and former New York Lieutenant Governor Richard Ravitch. The 2021 report was authored by ex-New Jersey Governor Thomas Kean and Thad Calabrese, a professor of public finance at New York University.

“After a decade of economic recovery, New Jersey remains very much stuck with a degraded fiscal condition similar to its position prior to the economic expansion of the post-2008 recession.”

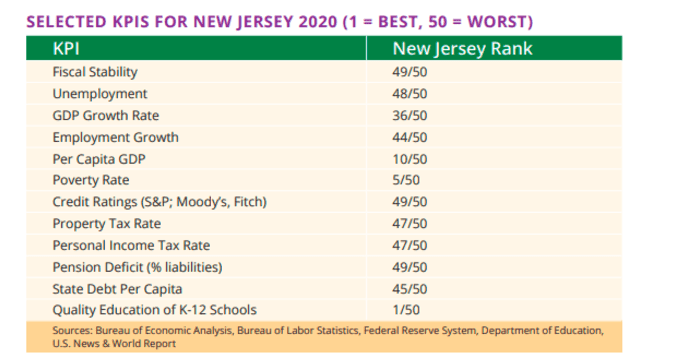

The report shows that in a 2020 U.S. News & World Report survey, the Garden State ranks 49 out of 50 in terms of fiscal stability, as visualized in the chart below.

What’s to be done?

“New Jersey has a spending problem, not a revenue problem,” the authors write –– unusual among states and municipalities that have trouble balancing their budgets. The state has the third-highest income tax rate in the country and the second-highest corporate tax rate.

And it suffers from a concentration problem: taxpayers who earn more than $100,000 annually make up about 24% of tax returns filed but pay about 86% of all income taxes, the authors write. “Among the state’s greatest priorities should be ensuring that the outmigration of high-income individuals does not continue.”

Read: In one chart, how U.S. state and local revenues got thumped by the pandemic — and recovered

Another urgent priority: continuing to reform pension and health care benefits for retirees. “Liabilities are growing faster than the state’s economy,” the report says, and “there is no reasonable chance that the state can get these liabilities under control because political leaders have kicked the can down the road for too long.”

Because these costs consume ever-larger portions of the current budget, they’re crowding out expenses for other public services. Reforms might include raising the age at which current employees become eligible to collect benefits, or requiring bigger contributions from workers.

Construction costs in New Jersey are four to six times higher than the national average, which helps explain why the state has a large backlog of deferred infrastructure spending, estimated at $50 billion over the next decade.

“Infrastructure improvements are critical to economic development and an enhanced quality of life for millions of citizens,” the report points out. “Elected officials must find ways to bring these costs down significantly,” or risk piling on more debt.

The final recommendation sounds straightforward, but is likely challenging. The state should “refocus spending to achieve a structurally balanced budget relative to revenues that is sustainable over the long-term,” the authors write. “The state should carefully analyze the entirety of its budget to determine which service areas are less critical and what efficiencies could be implemented in these nonvital services in order to protect more vital services and ensure the greatest returns to taxpayers.”

The more than $9 billion of federal dollars that will flow to the state courtesy of stimulus legislation passed by Congress during the coronavirus pandemic should be considered a “down payment” for fixing long-simmering problems, not creating new spending boondoggles, the report suggests.

Read next: These public pension systems used to have too much money. Now they’re in crisis. What happened?