This post was originally published on this site

Shares of Netflix Inc. rallied again Thursday, as they extended their best-ever two-week stretch of gains into record territory, as the streaming video giant’s content slate is set to “kick into gear.”

The stock

NFLX,

may also be getting a boost after Apple Inc.

AAPL,

agreed to allow developers like Netflix to provide a link to create a paid account that sidesteps Apple’s in-app purchase commissions.

The stock jumped 2.2% in midday trading, to climb above the Jan. 20 record close of $586.34. It was headed for a sixth straight gain, just seven days after rising for eight straight days, which was the longest win streak since the eight-day stretch ended Jan. 29, 2018.

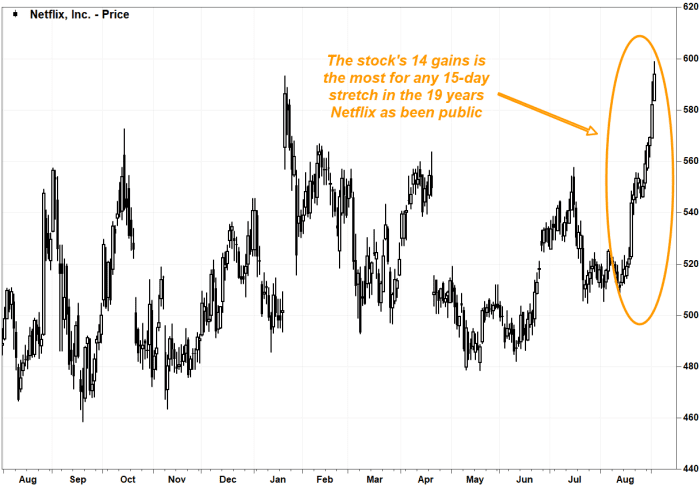

A run of 14 gains would be the most for any 15-day period since Netflix went public in May 2002. The stock has soared 16.5% over the past 15 session, the best 15-day performance since it shot up 19.2% over the 15 days ended Sept. 1, 2020.

The previous record for most daily gains in a 15-day period was two, which occurred in January 2018 and May-June 2014.

Analyst Justin Patterson at KeyBanc Capital reiterated his overweight rating on Netflix and his $645 stock-price target.

After a year of COVID-19-related ups and downs, with the pandemic leading to record net subscriber growth in the first half of 2020, and causing new releases to be delayed this year, Patterson said Netflix’s September content slate “kicks into gear” this week. Read MarketWatch’s “What’s Worth Streaming” column.

Don’t miss: What’s new on Netflix in September 2021 — and what’s leaving.

“After a light year, content gets back on track in September,” Patterson wrote in a note to clients. “Netflix’s improving content slate begins this Friday with the release of ‘Money Heist’ (La Casa de Papel).”

FactSet, MarketWatch

Netflix’s recent stock rally coincidentally comes as Patterson said that over the past two weeks, he has fielded more questions from investors on how Netflix’s content slate and net subscriber additions are faring.

“Based on Google Trends data, we believe ‘Money Heist’ is sufficient for international upside (highly relevant in India, [Europe, Middle East and Africa] and Latin America),” Patterson wrote. “We believe this creates a scenario where Netflix can exceed our and the Street’s paid net add estimates of 3.5M and 3.6M, respectively, but that upside would come more form international performance (we expect [United States and Canada] falls between 0.2M-0.4M paid net adds).”

Netflix shares have rallied 19.2% over the past three months, while the SPDR Communication Services Select Sector exchange-traded fund

XLC,

has gained 9.1% and the S&P 500 index

SPX,

has tacked on 7.8%. But the stock has underperformed year to date, rising 10% while the communication services ETF has run up 27% and the S&P 500 has climbed 20.8%.