This post was originally published on this site

There are some signs of a recovery attempt following Monday’s wipeout, chiefly for techs. The Nasdaq Composite

COMP,

is teetering toward correction territory and the S&P 500

SPX,

and Dow industrials

DJIA,

are halfway there. With jobs data looming for Friday, even the bravest dip buyers may have second thoughts.

Don’t look for reassurance in our call of the day, where the founder and CEO of BullAndBearProfits.com, Jon Wolfenbarger, predicts U.S. stocks may be “on the verge of starting the biggest bear market since the Great Depression.”

“Now with the Fed talking about tapering and money supply growth slowing

significantly from 39% y/y in February to only 8% y/y in August, perhaps that is

enough of a ‘tight monetary policy’ to change investor psychology to a more

bearish mood? We will see,” he said in a Monday interview and follow-up comments with MarketWatch.

Wolfenbarger, who spent 22 years as an equity analyst at Allianz Global Investors, said while he’s not a permabear — his newsletter offers strategies for profiting when markets go both ways — investors should heed some warnings signs.

Overbullish sentiment, economic weakness, excessive debt levels and limited policy tools are key ingredients for a market rout worse than that seen in 2008-09, he said, adding that a top for the S&P 500 reached a few weeks ago could have been the start.

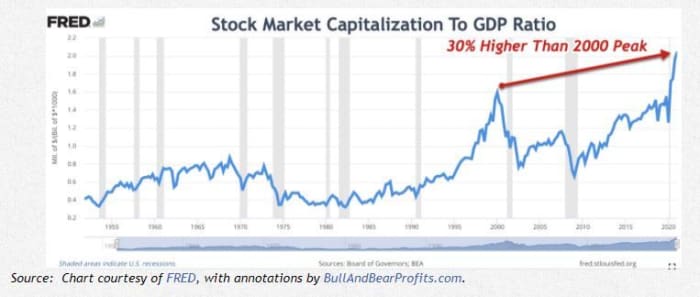

One chart he’s watching that predicts future long-term stock returns — a favorite of legendary investor Warren Buffett, the chairman and CEO of Berkshire Hathaway

BRK.A,

BRK.B,

— shows equities 30% above the prior all-time high seen in the tech bubble peak of 2000.

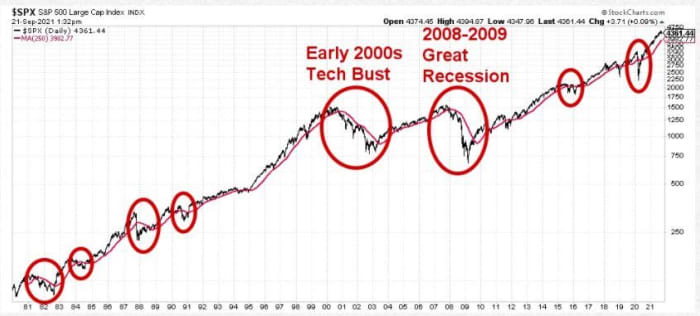

Wolfenbarger is watching S&P 500 moving averages closely. If the 250-day, currently at 4,020, were to “really break through” that could trip a major drop for stock. His below chart shows the S&P 500 price (black line) with its 250-dma since 1980. The red circles indicate when it fell below the 250-dma and the 250-dma slope was falling.

As for what investors should do — Wolfenbarger advised using exchange-traded funds that actually go up in bear markets, which could be the iShares 20+ Year Treasury Bond ETF

TLT,

or SPDR Gold Shares

GLD,

though he prefers inverse ETFs such as ProShares UltraShort S&P 500

SDS,

and the ProShares Short S&P 500

SH,

“I personally think it’s easier for most people to just buy an inverse ETF because it moves the same way as a normal stock and ETF, and the SH went up 89% in the last bear market,” he said, adding that SDS went up 184%.

Wolfenbarger said he has honed his strategies after adhering for years to Buffett’s advice of just buying and holding an S&P 500 index fund.

“But then I started looking at history and you know it took 25 years for the market to get back to the 1929 peak, and I don’t have 25 years,” said Wolfenbarger, who is in his early 50s. “Any given investment can go down 50% to 90% and it can stay down for decades, at least 10 to 20 years.”

The buzz

The August trade deficit and Institute for Supply Management’s services index for September are both on tap for Tuesday.

The Federal Reserve has asked for an independent review of whether trading activity by some top officials broke the law, a representative for the central bank said.

Facebook

FB,

CEO Mark Zuckerberg apologized for the outage on Monday that took out the website as well as social-media apps WhatsApp and Instagram. The six-hour outage cost him $6 billion personally and wiped $40 billion off market cap.

And former Facebookworker Frances Haugen will testify before a Senate subcommittee, after she said in prepared testimony that the company gave priority to profits over safety.

Read: AMC stock fails to capitalize on a blockbuster weekend, and meme stock traders are miffed

A jury has ordered electric-car company Tesla

TSLA,

to pay $130 million to a Black former employee over a racially hostile work environment.

Reinsurer Swiss Re

SREN,

said Hurricane Ida may have triggered up to $30 billion in claims.

Farewell to Tobias Levkovich, Citigroup’s beloved and well-respected chief U.S. equity strategist, who died on Oct. 1 after being struck by a car last month. Here’s a prescient call he made in August, as well as an interview he kindly gave MarketWatch in late 2019.

Check out MarketWatch’s new podcast, Best New Ideas in Money, and listen to MarketWatch head of content Jeremy Olshan and economist Stephanie Kelton discuss the next phase of money’s evolution with tech, money and business leaders. Listen here.

The markets

Stock futures

YM00,

NQ00,

are mixed bag, with the 10-year Treasury yield

TMUBMUSD10Y,

holding steady just under 1.5%, while the dollar

DXY,

is higher. In Asia, the big mover was the Nikkei

NIK,

which slid 2.1% after Wall Street’s tumble. China markets remain closed for a holiday, and the Hang Seng Index

HSI00,

ended modestly higher. U.S. oil prices

CL00,

are rising again after surging to levels not seen since 2014.

The charts

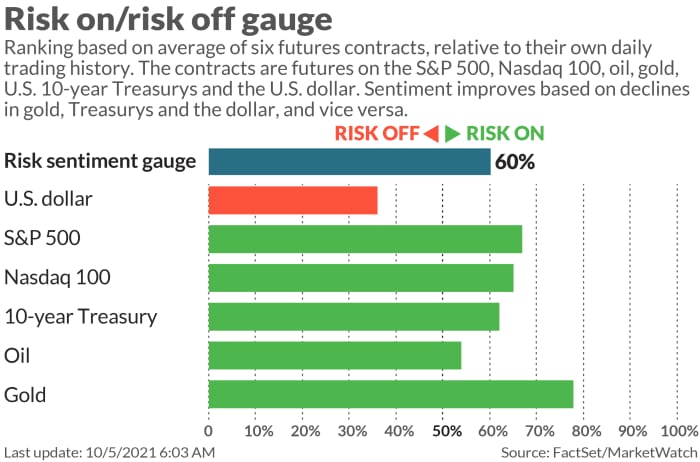

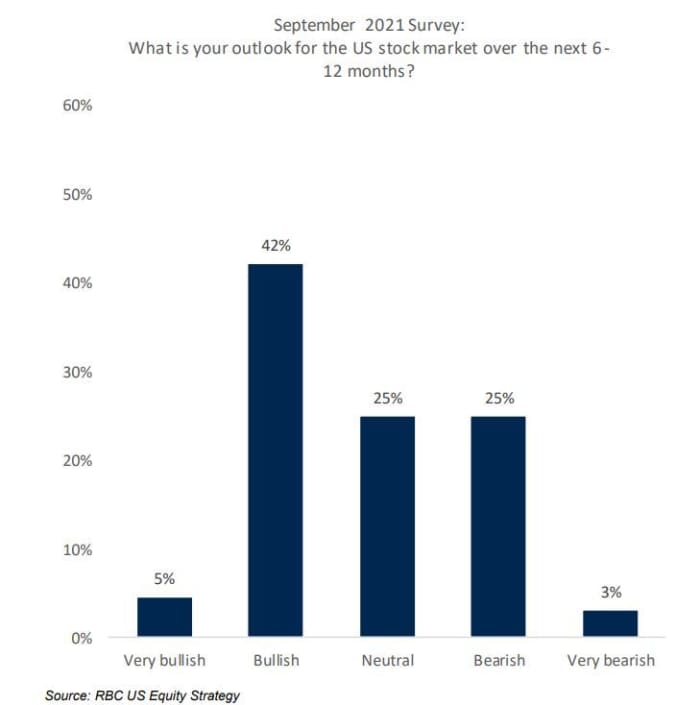

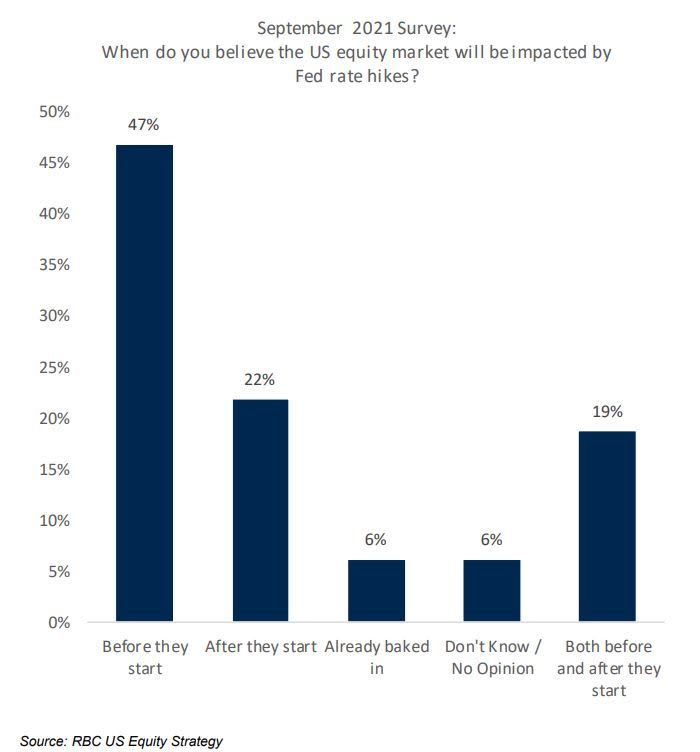

A team at RBC led by its head of U.S. equity strategy, Lori Calvasina, took the pulse of investors for September. Among their findings, a very bearish outlook on stocks jumped from 14% in June to 28% in September, “still shy of its 2Q19 high, but a sharp increase nonetheless.”

Elsewhere, most investors see stocks taking a hit even before the first Fed rate increase:

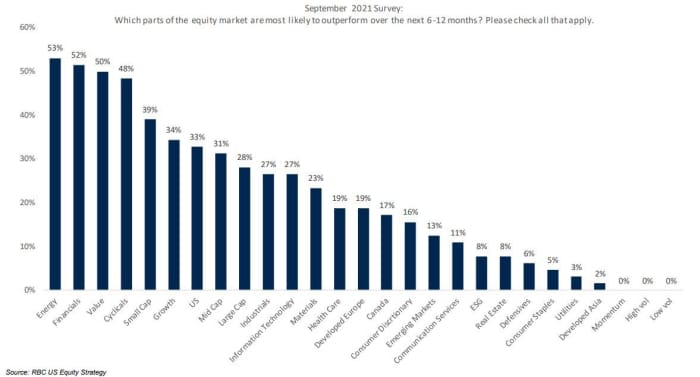

And here’s a look at investors’ preferred sectors going forward in the next year:

Random read

The ancient roots of Halloween, traced to Ireland’s “hellishcaves.”

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.