This post was originally published on this site

It’s not great that there’s a major central bank officially predicting an economic contraction. Nor is it terrific that U.S. productivity fell by the most since 1947 on rising labor costs. And let’s throw in China doubling down on its zero-COVID policy, which doesn’t exactly lend confidence in the world’s number-two economy.

But Thursday’s 3.6% nosedive in the S&P 500

SPX,

to the second-lowest close of the year, had two major culprits: the Federal Reserve, and weirdly, investors themselves.

Krishna Guha, the vice chairman of Evercore ISI and previously a top aide to former New York Fed President Bill Dudley, says that, more or less, stocks fell because they rose too much the day before, when the S&P 500 rose 3% on Wednesday.

“Powell’s mistake was to strike a tone that prematurely invited the easing of financial conditions in the first place, the market’s mistake to rally hard without sufficient new information to warrant this in conditions in which such a rally could not possibly be sustained,” says Guha.

The reason for Wednesday’s gain was the Powell removing the likelihood of a 75-basis-point hike at its next meeting, as he also said the U.S. could achieve a soft landing and didn’t take a firm stance on whether the Fed would have to lift rates beyond the fuzzy notion of neutral.

“By the standards of the current debate, this was optimistic-bullish into a market where positioning was all bearish, setting up a violent rally,” said Guha.

Even if Powell is right on the economic outlook, it’s self-defeating to be optimistic this early, because it loosens financial conditions that need to tighten to achieve the Fed’s goal of stamping out inflation.

“No big risk rally can be sustained until inflation and the drivers of inflation — including demand and labor market pressures — have much more decisively turned towards tolerable levels, which we see as at least sub-3 per cent on core PCE, for the very simple reason that if it does not reverse of its own accord the Fed would have to rein it in,” he said.

Joseph Carson, the director of global economic research at Alliance Bernstein, points out policymakers have had to raise official rates above peak inflation each time there was inflation above 4%.

He says even an inflation gauge that removes some particularly hot items — CPI excluding food, energy, shelter and used car and truck prices — is surging by 5.8% year-over-year, matching the fastest pace in 40 years. “So even if this is the inflation rate the Fed needs to target to reverse the inflation cycle, it still calls for a fed funds rate of 6% or more than twice the peak rate shown in policymakers’ official rate projections made in March,” says Carson.

But before the Fed could take rates to 6%, he says, “something else would break to stop the Fed.” That could be an abrupt drop in financial markets, or a cessation in the flow of credit.

“Given the current market environment, none of those conditions are present, so the risk, for now, is that Fed tightening course could look a lot like those of the past until something else breaks. Investors forewarned,” he said.

The buzz

The nonfarm payrolls report is due at 8:30 a.m. Eastern, with expectations the U.S. economy added 400,000 jobs in April as the unemployment rate fell to 3.5%. New York Fed President John Williams is due to speak at 9:15 a.m.

Zillow Group

Z,

ZG,

warned “consumer transaction value growth trends are softening and experts have disparate views of what will happen next,” which took the shine off better-than-forecast revenue in the first quarter from the real-estate services group.

Block

SQ,

shares rallied after the financial services payment firm gave upbeat signals about its Cash App business.

Bausch + Lomb priced its initial public offering that’s due to start trading on Friday below its expected range, at $18 per share.

The Food and Drug Administration said it will limit availability of Johnson & Johnson’s

JNJ,

coronavirus vaccine due to the risks of blood clots.

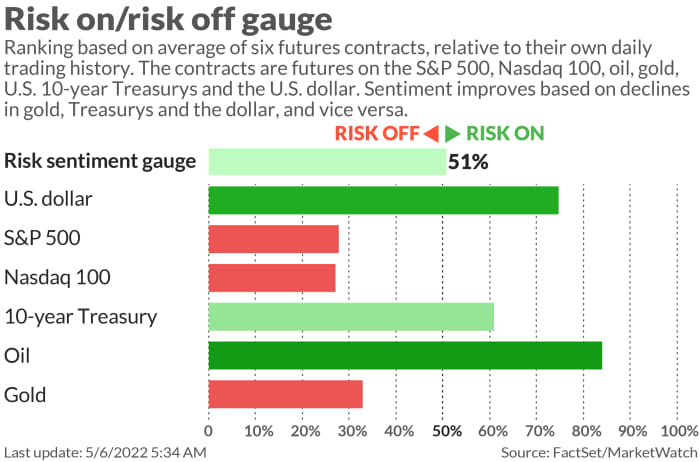

The markets

After a 1,063-point fall in the Dow Jones Industrial Average

DJIA,

— it hurts just typing that — U.S. stock futures

ES00,

NQ00,

edged lower.

Crude oil futures

CL.1,

were trading above $110 per barrel, and the yield on the 10-year Treasury

TMUBMUSD10Y,

was 3.07%.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern on MarketWatch.

The chart

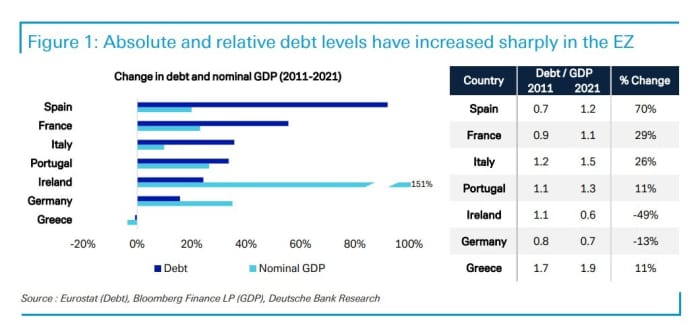

A decade after the eurozone financial crisis, are we on a precipice of another one? Deutsche Bank strategist Maximilian Uleer notes that both absolute and relative amounts of government debt haven’t improved much. This could lead to trouble as interest rates rise.

Random reads

A week off social media reduces depress and anxiety, research finds.

Inside a container of coffee bean bags destined for Nestle was over 500 kilograms of cocaine.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.