This post was originally published on this site

It’s nearly two weeks since Russia launched an invasion of Ukraine and sparked the biggest European ground war since World War II.

As the tragedy and devastation keep unfolding, the volatility for global financial markets has been bewildering for investors, fearful of making the wrong move.

But our call of the day from the president of macroeconomic research firm Lamoureux & Co., Yves Lamoureux, says it’s time to buy stocks again, as he sees a bull market stretching from here to 2025.

“ “We can’t stay in a state of panic.” ”

The 58-year-old forecaster is basing his new call on proprietary behavioral models that have been showing “extreme” readings in fear, which in the past have corresponded to a bottom for equities, he said.

“I’m saying we’re at the bottom or very close to the bottom because this type of high reading, high emotion, high panic, high fear, that’s not sustainable. We can’t stay in a state of panic,” said Lamoureux, in a Tuesday interview with MarketWatch.

What he sees at work is a capitulation bottom, which happens when sellers capitulate and sell out, leading to sellers exhaustion. “So there’s no more damage because the sellers have been taken out of the equation. That’s what we’re starting to see today,” he said.

Lamoureux said both retail and institutional investors have joined in the bearish selling. And the war-driven selloff has now completed the trilogy of rolling bear markets he first predicted in March 2020 — the second wave was in September 2020, with a third now complete, he said.

That final bear leg was due sometime in 2022, but the Russia-Ukraine war “brought it forward faster,” he said. But isn’t it risky to call a bull market with so much uncertainty, one might ask?

Lamoureux said lots of good stocks are selling for cheap right now. “I’m not looking at the short term, and sooner or later, there’s got to be an end to the war,” he said, adding that if the ultimate nuclear weapon threat comes to fruition, nothing will matter anyway.

Read: The end of the world may be nigh. Buy stocks, this firm says.

“In investments, where it’s important to invest is at the maximum uncertainty point, and this is part of my models,” he said, adding that in this case, that point is represented by an inability to guess when the war will end. “So as soon as we start to have clues that we’re going to see a light at the end of the tunnel, the market is going to start to raise up.”

Investors who can capture the turn in markets, he said, can make money “for now all the way to 2025,” though he warned that will come with a lot of ups and downs. Lamoureux expects that by 2024 or 2025, rates on the 10-year Treasury note will” normalize” at 4%, and at some point will go so high they break the market.

So what should investors be buying? Lamoureux spoke last month of opportunity among damaged technology and high growth stocks. “Because we’re very bearish on interest rates, people should look at strong technology stocks that have really been destroyed. That’s the area that I think is going to be rewarding,” he said.

One theme he keeps returning to is quantum computing, which leads him to his stock pick — Rigetti Computing

RGTI,

which went public via a special-purpose acquisition deal last week, albeit a modest initial public offering given the timing and geopolitical uncertainty. A so-called pioneer in hybrid quantum-classical computing, Rigetti is classic disruptive technology, said Lamoureux.

“Once we have the super powerful quantum computers, most cybersecurity systems go out the window and the digital world is at risk,” he said. “We call this the Quantum Threat and it should arrive around 2025-2030.”

More on Lamoureux: Forecaster who called bitcoin’s ‘skyscraper’ top says this company remains the smartest digital/fintech play

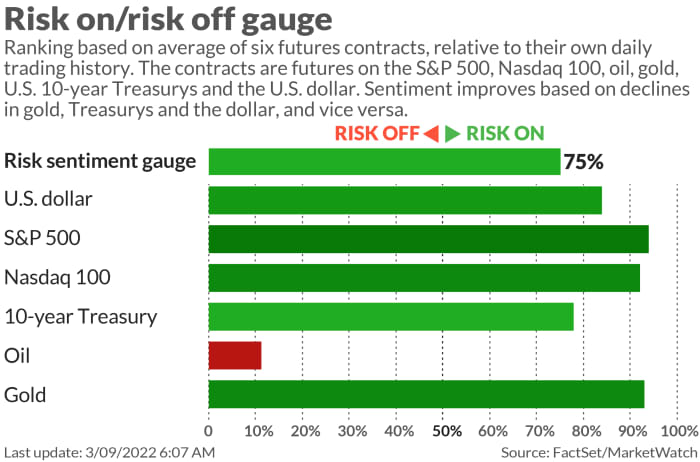

That bullish call comes as a rally is under way for risk assets on Wednesday, though gains could be gone by the time this column reaches the internet.

The buzz

Sparking market gains, Ukraine President Volodymyr Zelensky said he is no longer pushing for NATO membership, ahead of negotiations in Turkey by foreign ministers from both sides. But Russian forces continue to pummel the country and the humanitarian crisis grows.

Read: Why the U.S. ban on Russian oil imports differs from the 1970s embargo for markets

Fitch Ratings cut Russian debt six notches further into junk and warned default was “imminent.” And McDonald’s

MCD,

Starbucks

SBUX,

Coca-Cola

KO,

PepsiCo

PEP,

and General Electric

GE,

are the latest to suspend operations in Russia.

Read: Yale professor keeps tabs on companies still operating in Russia

In a retaliatory move to the U.S. ban on Russian energy exports and a U.K. move to phase them out, Russia is planning a commodity export ban of its own. Meanwhile, the London Metal Exchange says nickel trading won’t resume until Friday at the earliest, after Tuesday’s drama.

President Joe Biden is expected to sign an executive order that requires federal agencies to review of their policies related to cryptocurrencies. Bitcoin

BTCUSD,

meanwhile, is rallying.

Job openings are ahead, with one day to go until key consumer price inflation data.

The markets

Uncredited

Stock futures

ES00,

NQ00,

are solidly in the green, with European stocks

SXXP,

also rallying hard, and oil prices

CL00,

BRN00,

pulling back from 2008 highs. Gold

GC00,

continues to push higher, while the dollar

DXY,

is also lower.

The tickers

These were the most-searched company tickers on MarketWatch as of 6 a.m. Eastern Time.

Random reads

“Whose door should I knock on to get my child back?” Russian soldiers’ mothers are looking for them.

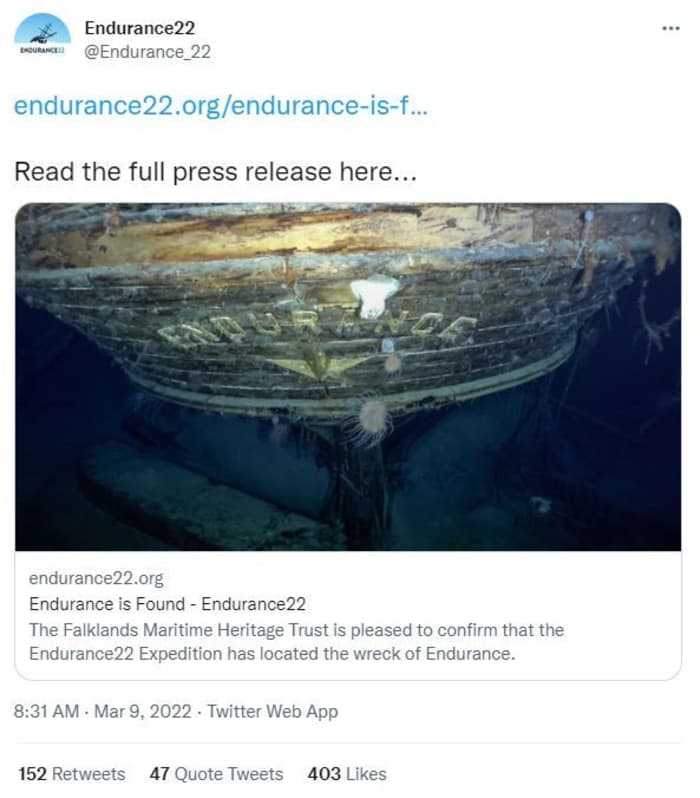

Not seen since it sank in 1915, the wreck of explorer Ernest Shackleton’s ship Endurance has been located off the coast of Antarctica.

Scotland has officially apologized to thousands of witches.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.