This post was originally published on this site

Wariness that set in at the end of Monday’s session is morphing into full-on anxiety for Tuesday, as bond yields surge and stock futures drop, led by a hefty fall for Nasdaq-100 futures.

Some of that may be down to a U.S. government shutdown threat amid Republican/Democrat brinkmanship over a debt ceiling. But it’s also down to an awakening over an energy crunch in Europe and elsewhere that may not leave U.S. investors alone, say analysts.

“I think yesterday was the first sign in quite some time where we got a glimpse of what an energy crunch, and more important, high interest rates mean for equities,” said Peter Garnry, head of equity strategy at Saxo Bank, in a podcast on Tuesday.

Energy prices are surging in Europe this morning, including natural gas, and one of the region’s big competitors is China. That global powerhouse has been suffering electricity shortages that have closed factories, which could worsen COVID-19 pandemic-fueled problems such as a semiconductor shortages. And the scramble for natural gas comes as countries have been trying to reach for cleaner energy.

Read: Blame surging Europe energy prices on a shortfall of Asian coal, says strategist

With oil prices also pushing higher — Brent is on the doorstop of $80 this morning — our call of the day from Saxo Bank’s Garnry says investors may be herded back toward some unloved sectors soon.

“I think at one point, the mining and energy sector will be too attractive in terms of cash flow, that I think more investors will just put the ESG focus on standby and go all in on the energy and mining sector,” he said.

ESG refers to investments that take into account environmental, social, and governance concerns, a sector that’s been thrust into the spotlight amid climate change warnings.

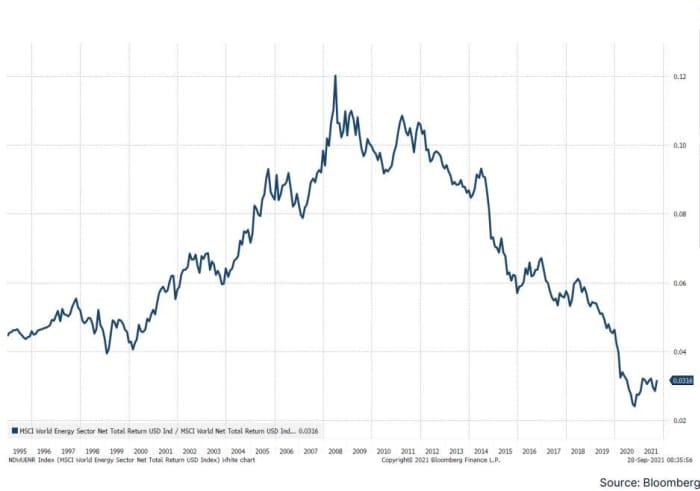

Garnry points to the below slide that shows the ratio between the MSCI World Energy Sector net total returns in dollars versus MSCI World.

Saxo Bank/Bloomberg

“As you can see, as in 1995, we are still at very, very low relative levels. I think there is so much room and potential for the energy sector here,” said Garnry. “You are trading at something that looks like a 60% to 70% discount on forward valuations and the dividend yield is more than twice as high for the energy sector as it is for the MSCI World.”

Saxo Bank/Bloomberg

Powell at the podium

Federal Reserve Chair Jerome Powell will testify to Congress over the pandemic response on Tuesday, alongside Treasury Secretary Janet Yellen. He’s expected to warn that inflation will stay elevated in coming months before cooling off.

Dallas Federal Reserve President Rob Kaplan will step down amid a controversy over trading individual securities, which has also led to the departure of Boston Fed President Eric Rosengren.

Democrats are vowing to try again to get a bill pushed through to stop a looming government shutdown, after Republicans blocked it late Monday.

Read: What happens if the U.S. defaults on its debt?

Drug company Merck

MRK,

is reportedly nearing a deal for Acceleron Pharma

XLRN,

a rare-disease drug company.

Amid Facebook’s

FB,

former chief security officer Alex Stamos warning against young teens being active on social media, the company said it would pause its Instagram Kids project.

Europe’s energy crisis is going from bad to worse, with prices for Dutch gas, German power and carbon permits hitting fresh records.

The data calendar includes the August trade in goods report and consumer confidence.

The markets

Stock futures

ES00,

YM00,

are down in premarket, with Nasdaq-100 futures bearing the brunt of losses as bond yields climb

TMUBMUSD10Y,

TMUBMUSD30Y,

and the dollar rises.

Also climbing are oil prices, with Brent oil

BRN00,

almost on top of the $80 a barrel level, while gold prices

GC00,

were falling. European stocks

SXXP,

are down and Asian equities were mixed.

Random reads

Anderson Cooper says he won’t leave an inheritance to his son, Wyatt. Cooper’s mother, Gloria Vanderbilt, did leave Cooper a $1.5 million inheritance, despite telling her broadcaster son she wasn’t going to.

The secrets of Neanderthal life could be in this cave nook that’s been sealed off for 40,000 years.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.