This post was originally published on this site

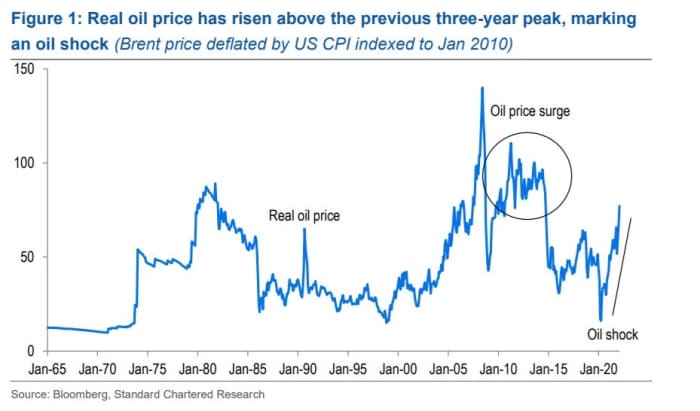

Oil is absolutely exploding higher, thanks to the diminished appetite for Russian-produced oil, even after Western sanctions specifically exempted energy from the menu of restrictions imposed after the Ukraine invasion.

The question is what impact this will have on the global economy. Madhur Jha, senior global economist at Standard Chartered, looked at the 2011 experience when energy prices also soared. “There are some clear similarities between the global conditions that preceded the 2011 surge and the current one — including a nascent economic recovery, supply-chain disruptions, and heightened geopolitical tensions,” she said.

Back then, supply chains were disrupted by the Japanese earthquake and tensions were high due to the Arab Spring. Despite oil surging 30% in real terms, the world escaped recession. She identified three reasons — oil prices weren’t volatile even as they increased, there was falling energy intensity and there was an ample monetary policy cushion. Even so, growth forecasts were lowered and inflation expectations were raised.

Now, however, there are key differences. The scale of Russia’s invasion of Ukraine is what she called a worst-case scenario. “We think the oil market sees the security of Russian energy supplies as significantly compromised,” she said. Concerns about the reliability of Russian energy flows will limit the downside caused by the return of Iranian volumes, rising inventories, slowing demand growth and upside surprises in U.S. supplies.

Another key difference is that the new shock comes with inflation pressures already built up — in fact Eurostat just reported the largest year-over-year surge in eurozone consumer prices as this story was being written. “While central banks would normally tend to look through supply-driven inflation pressures, this is likely to be difficult with headline CPI inflation already at multidecade highs in economies like the U.S. and U.K.,” she said.

The chart

Goldman Sachs

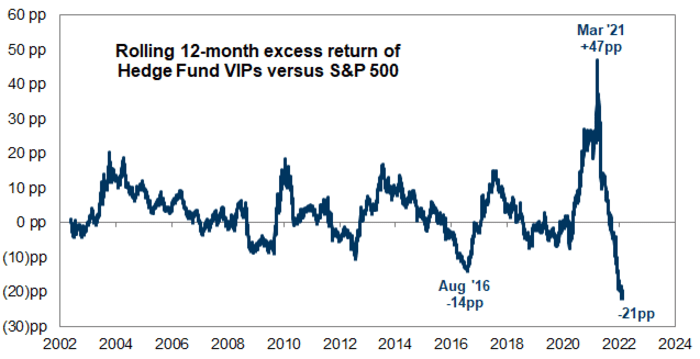

Are hedge funds losing their touch? The most popular hedge fund long positions have suffered their worst 12-month return relative to the S&P 500 on record, according to Goldman Sachs. Some of that underperformance can be explained by the single-day price declines in Facebook parent Meta Platforms

FB,

and Netflix

NFLX,

And despite hedge funds rotating from growth to value, Microsoft

MSFT,

Amazon

AMZN,

Alphabet

GOOGL,

Meta Platforms and Apple

AAPL,

were still the top five hedge fund VIPs this quarter.

The buzz

A convoy of Russian tanks advanced slowly on Ukrainian capital of Kyiv, as they also continued their assault on the ports of Odessa and Mariupol on a seventh day of invasion. A Kremlin spokesman said a Russian delegation will be ready by the evening to resume talks with Ukraine. Russian Foreign Minister Sergei Lavrov on Wednesday said a third world war would be “nuclear and destructive,” according to comments reported by the RIA news agency and translated by Reuters.

President Joe Biden used his first State of the Union address to vow to fight Russian aggression and tame soaring inflation. George P. Bush, the nephew of President George W. Bush, will face Texas Attorney General Ken Paxton in a Republican runoff. The gubernatorial race will be Republican Gov. Greg Abbott versus Democrat Beto O’Rourke, who ran for president in 2020.

Federal Reserve Chair Jerome Powell is set to start two days of Congressional testimony on monetary policy, as the central bank is due to release its Beige Book of economic anecdotes at 2 p.m. Eastern. The ADP report on private-sector payrolls is due at 8:15 a.m. Eastern. How much of a signal the report provides is debatable — last month, the ADP said 301,000 jobs were lost in January, while the Labor Department said 444,000 private-sector jobs were created.

Nordstrom

JWN,

shares vaulted 32% higher in premarket trade, as the retailer topped earnings expectations by reducing promotions, and guided for fiscal earnings that were as much as 175% above consensus estimates. Hewlett Packard Enterprise

HPE,

lifted its profit forecast for the year.

Exxon Mobil

XOM,

became the latest energy giant to exit Russia, saying it is halting its operations at the Sakhalin-1 oil and gas venture.

The market

Back and forth, back and forth — U.S. stock futures

ES00,

NQ00,

were pointing higher Wednesday after the 1.6% tumble in the S&P 500 on Tuesday.

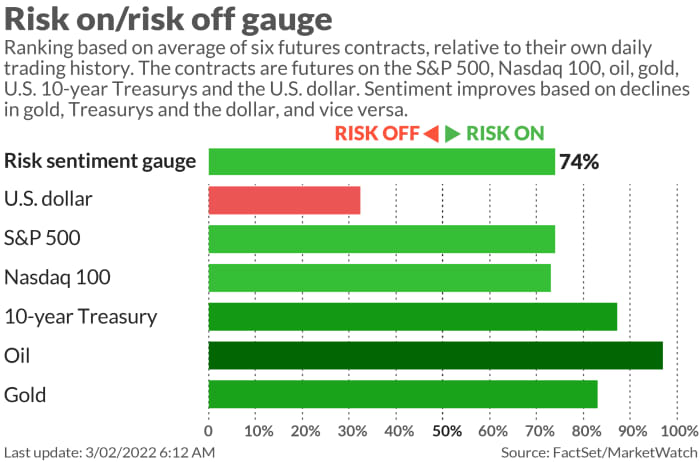

Oil prices

CL.1,

continued to vault higher, rising by some $5 per barrel. Wheat

W00,

prices also were surging. Gold

GC00,

futures fell, and the yield on the 10-year Treasury

TMUBMUSD10Y,

edged up to 1.75%.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

AMC, |

AMC Entertainment |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

SBER, |

Sberbank Rossia |

|

MULN, |

Mullen Automotive |

|

NIO, |

Nio |

|

AAPL, |

Apple |

|

SOFI, |

SoFi Technologies |

|

DWAC, |

Digital World Acquisition Corp. |

|

NVDA, |

Nvidia |

Random reads

A Paris museum had to dismantle the wax figure of Russian President Vladimir Putin because it kept getting defaced.

Credit Suisse has asked investors to destroy documents tied to rich clients’ yachts and jets, according to letters seen by the Financial Times.

The Moon is about to get whacked by three tons of space junk.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.