This post was originally published on this site

A band of merry retail investors has been spicing up the normally dull days of August.

Wednesday’s meteoric rise in Robinhood

HOOD,

shares caught much of Wall Street off guard, and left some in the retail space baffled as the no-fee trading app appeared to fast-track itself into a coveted meme space.

Read: Robinhood’s big day proves it’s the first meta–‘meme stock’

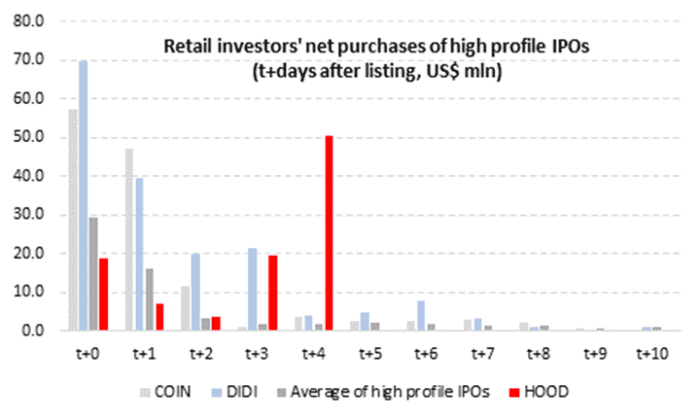

Our call of the day from VandaTrack, a tracker of individual investor purchases, offers a glimpse at just how far that push might go for Robinhood, which just a week ago suffered a disastrous debut. Note, the stock is down Thursday after the company said shareholders will sell 98 million shares.

“Robinhood has only seen US$100 million in retail purchases this week. If retail investors start withdrawing money from tired meme stocks to buy HOOD, there is still room for the move to continue,” said senior strategist Ben Onatibia and analyst Giancomo Pierantoni in a note on Thursday. VandaTrack provides daily data on retail investors’ net purchases of US single stocks and ETFs.

In January short squeeze, retail investors spent $352 million on net purchases of GameStop

GME,

while AMC Entertainment’s

AMC,

subsequent bubble drew $600 million at its peak.

VandaTrack

VandaTrack data also shows HOOD was the third-most purchased stock — $50.5 million — on retail platforms Wednesday. A total of $467 million buys and sells for that stock placed it fourth in volume behind a mega S&P ETF

SPY,

chip stock AMD

AMD,

and COVID-19 mMRA vaccine maker Moderna

MRNA,

on the day.

In a separate note, Onatibia and Pierantoni observed that retail buying of U.S. equities is at its lowest since May, which is partly due to summer vacations and a lack of sector-specific stories to get excited about. Tech is one category that has seen flows improving, at the expense of cyclical stocks.

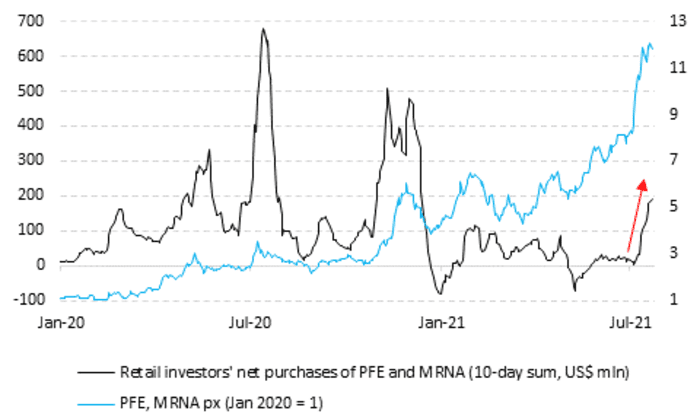

Vaccine manufacturers such as Moderna and Pfizer have also seen a jump in retail buying, they noted.

“Over the past 10 days, they have seen combined net inflows of US$180 mln, the largest amount since the results of the clinical trials were published in November. The rise in global cases of the delta variant, the imminent FDA approval and the rise in vaccine prices have all coalesced to turbocharge the rally,” said the pair.

VandaTrack

Shares of Moderna, which just reported a big profit beat and 199 million doses of its COVID-19 vaccine sold, have climbed over 300% this year, though mMRA rival BioNTech

BNTX,

has jumped 400%, while Pfizer

PFE,

is up 22%.

Read: These 20 tech stocks boosted sales by up to 152% while also expanding profit margins

Weekly jobless claims and an EV-auto pledge

Earnings are rolling in from Cigna

CI,

Cardinal Health

CAH,

Duke Energy

DUK,

Marathon Oil

MRO,

and Kellogg

K,

with Expedia

EXPE,

and American International Group

AIG,

due after the close.

Uber shares

UBER,

are sinking after the ride-share group reported a revenue surge, but also an adusted loss. Electronic Arts

EA,

is climbing after the videogame maker’s results topped forecasts. Roku

ROKU,

also reported upbeat results, but the streaming device maker’s shares are down on slow account growth. Online marketplace Etsy

ETSY,

is taking a hit post-earnings as it reported fewer active buyers.

China gaming stocks — Tencent

700,

XD

2400,

and NetEase

NTES,

— fell in Asia after an opinion column in the government backed Securities Times called for a stop on tax breaks for the sector. It’s the second China media swipe this week to hit the group.

Shares of GM

GM,

and Ford

F,

are rising after the White House announced an industry pledge that 40% to 50% of all sales will be for electric vehicles by 2030.

A day ahead of nonfarm payrolls, the latest weekly jobless claims are ahead, along with the June trade balance.

The markets

Goldman Sachs hiked its S&P 500

SPX,

target, which may be helping to lift U.S. stock futures

ES00,

NQ00,

European equities

SXXP,

are climbing, while Asian stocks finished in the red, with pressure on tech stocks in China

000300,

and Hong Kong

HSI,

The chart

Random reads

Spanish engineers make water out of nothing at all.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.