This post was originally published on this site

Stocks are off to a third-straight losing session as investors weigh up a fresh batch of data.

That follows Wednesday’s session and extremely weak industrial production that sparked fears the economy is losing steam, as the Fed pushes on with interest rate hikes. Or as CNBC commentator Ron Insana put it:

On that front, our call of the day from Jefferies tackles that idea. “Disinflation is a key assumption for our road map for 2023,” says Desh Peramunetilleke, global head of microstrategy, and analyst Mahesh Kedia, in a note to clients on Thursday.

“The 1980s disinflation cycle brought about by higher rates and easing

supply side pressures provide a good template for the current cycle. Broadly, quality growth stocks/sectors did better than value, and small-caps underperformed,” said the pair.

Read: JPMorgan CEO Jamie Dimon sees ‘a lot of underlying inflation,’ rates at 6% in a recession

What did well from April 1980 to February 1983 was the consumer, with business services, staples and consumer services outperforming, while commodities and industrials did less well. Buying quality and avoiding value was also a smart move, they add.

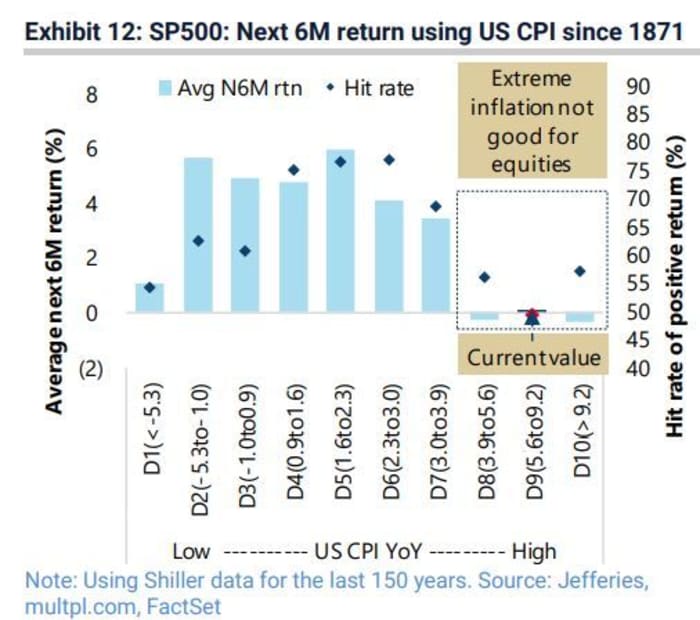

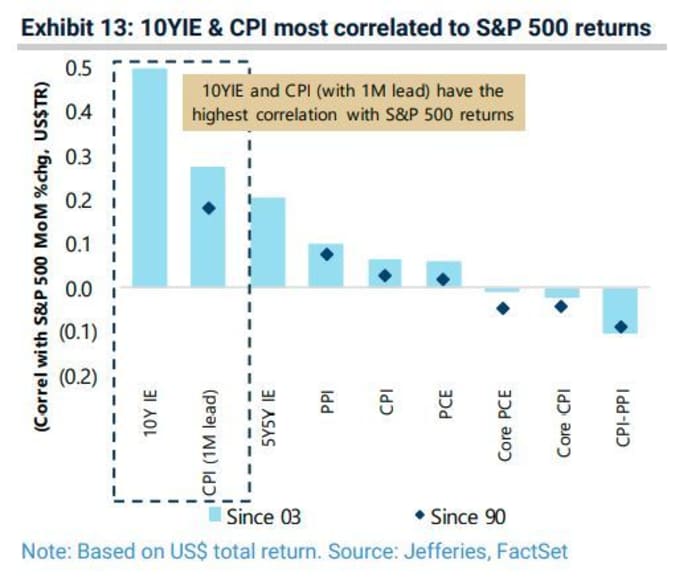

As for here and now, the pair say while extreme inflation is usually not great for stocks, moderate inflation can be a better setup. They note a positive correlation over the past 20 years, between monthly S&P 500 returns and the percentage point change in U.S. 10-year inflation expectations.

Jefferies, FactSet, multpl.com

Jefferies, FactSet

“Based on the sector correlation with the [10-year inflation expectations,] materials, energy, infotech and industrials are sectors to avoid when inflation is falling, while staples, utilities, communication services and healthcare are in focus,” said Peramunetilleke and Kedia. “Style-wise, investors should avoid GARP (growth at a reasonable price), value and reversion and focus on low risk and quality stocks during falling inflation.”

Reversion refers to a view that any asset over time will return to its average price.

As for stock ideas, Jefferies has some top disinflation plays to consider. First up are those negatively correlated to inflation — Procter & Gamble

PG,

Dollar General

DG,

Walmart

WMT,

Church & Dwight

CHD,

McDonald’s

MCD,

Waste Management

WM,

Costco

COST,

Public Storage

PSA,

Waste Connections

WCN,

and Mondelez Intl

MDLZ,

Under quality stocks at a reasonable price, they list Visa

V,

Home Depot

HD,

Broadcom

AVGO,

Cisco Systems

CSCO,

Linde

LIN,

TJX

TJX,

Booking Holding

BKNG,

Altria

MO,

Boston Scientific

BSX,

and Ulta Beauty

ULTA,

Opinion: This perfect storm of megathreats is even more dangerous than the 1970s or the 1930s, Roubini says

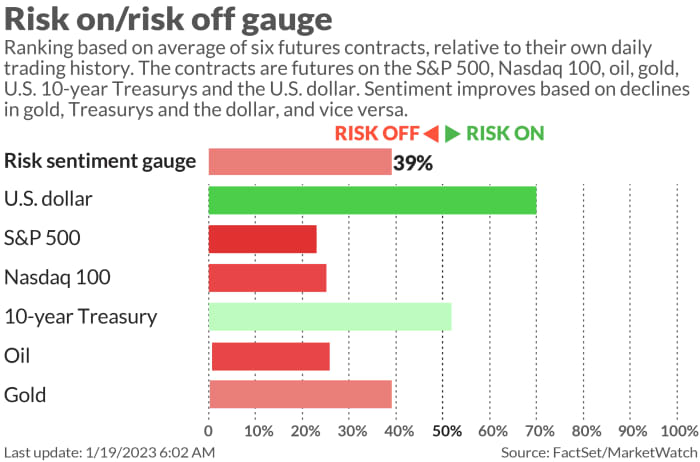

The markets

Stocks

DJIA,

COMP,

have opened in the red, as bond yields

TMUBMUSD10Y,

TMUBMUSD02Y,

hover at four-month lows on those recession worries. The dollar

DXY,

and oil

CL.1,

are down modestly, while gold prices

GC00,

up slightly. European stocks

SXXP,

followed Wall Street lower, and much of Asia

NIK,

was also in the red.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Weekly jobless claims fell 15,000 to 190,000 in the latest week, while housing starts fell 1.4% in December and building permits dropped 1.6%. Elsewhere, the Philadelphia Fed manufacturing index rose to a negative 8.9 in January from -13.7 in the prior month.

Still to come are three Fed speakers, starting with Boston President Susan Collins, then Vice Chair Lael Brainard and New York President John Williams later.

Alcoa shares

AA,

are tumbling in premarket after reporting a second-straight quarterly loss. Procter & Gamble

PG,

stock is also down after profit met forecasts, but sales volume disappointed. Allstate stock

ALL,

is down after the insurer warned of higher catastrophic losses for the fourth quarter, thanks to December storms.

Netflix

NFLX,

and Costco

COST,

will report after the close.

Netflix’s unpredictable finale: With no more subscription guidance, the focus is on financial estimates

KFC and Taco Bell parent Yum Brands!

YUM,

has been hit with a ransomware attack that has forced around 300 U.K. restaurants to close.

Mastercard

MA,

will expanding its partnership with Citizens Financial Group

CFG,

to become the bank’s exclusive payments network, the companies are due to announce Thursday.

Also, the U.S. will hit its debt limit on Thursday, and here’s what that means.

Best of the web

“I no longer have enough in the tank.” A beloved prime minister, who became only the second in the world to give birth while in office, is stepping down.

Banked rainwater is rare benefit of California’s recent deadly and destructive rainstorms.

A 1000-year Tunisian cave village is slowly dying

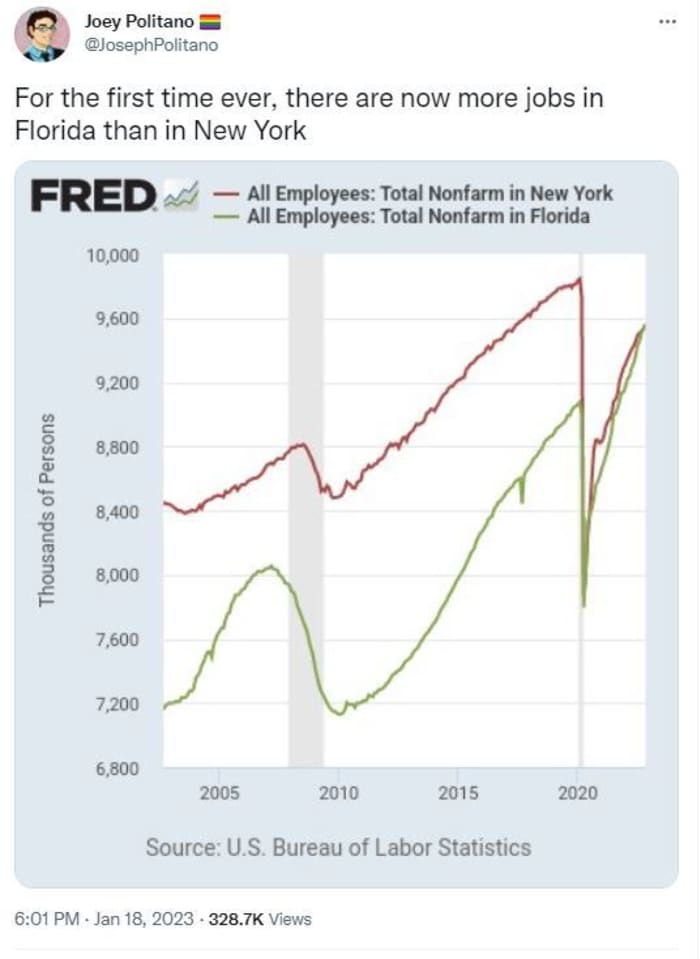

The chart

Where are the jobs? Florida, apparently.

@JosephPolitano

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

BBBY, |

Bed Bath & Beyond |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

AAPL, |

Apple |

|

APE, |

AMC Entertainment preferred shares |

|

NIO, |

NIO |

|

MULN, |

Mullen Automotive |

|

AMZN, |

Amazon |

|

HKD, |

AMTD Digital |

Random reads

Sprinting legend Usain Bolt lost millions to a scam.

King of Pain? The night before layoffs, Microsoft hosted a Sting concert

New York restaurants are calling time on crazy TikTok menu hacks.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.