This post was originally published on this site

We’re a day away from what could be the first half-point hike from the Federal Reserve in 22 years. Kicking a busy central bank week was the first rate increase since 2010 from Down Under.

So where next for stocks? In our call of the day, RBC Capital Markets equity analysts Lori Calvasina and Sara Mahaffy map out key levels to watch, and see 3,850 as the next rung down the ladder for the S&P 500

SPX,

if a low from last Friday’s brutal session doesn’t hold.

Even though it dropped below a March 8 closing low last Friday, “daily trading in the index still resembles most of the post-Financial Crisis growth scares that we’ve previously highlighted as being useful reference points for how low U.S. equities could trade in 2022,” the pair explain.

During those “scares” — the 2010 European debt crisis, the 2011 U.S. debt downgrade, the earnings/industrial recession of 2015-16 and the late 2018 China trade war/quantitative tightening selloff — equity declines ranged from 14% to 20%, for an average drop of 17.7%.

RBC

“As of Friday’s close, the S&P 500 was 13.9% below its January 2022 peak, putting it close to the range of a typical growth scare. If a median growth scare drawdown of 17.7% occurs, the S&P 500 would fall to ~3,950 this time around, while a late-2018-type drawdown of -19.8% would take the S&P 500 to ~3,850,” said Calvasina and Mahaffy. That’s even if the economy can avoid recession.

And if they are wrong in their core belief that recession can be avoided, they see much downside ahead, as “recession drawdowns since the 1920s for the S&P 500 have averaged ~32% vs. their prerecession peaks.”

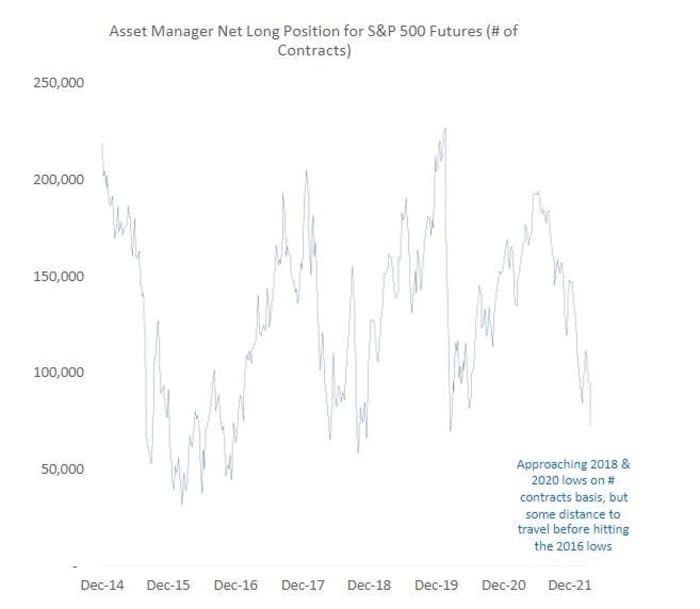

The pair are also keeping a close eye on weekly Commodity Futures Trading Commission data on asset manager positioning in U.S. equity futures. While signs of retail bearishness are everywhere, the institutional side isn’t quite there yet, they note. “And it may simply be that in order for the U.S. equity market to bottom, institutional investor sentiment needs to catch down to retail.”

RBC

“This indicator attempted to put in a bottom in Nasdaq and Russell 2000 contracts in March after hitting levels that had marked important lows/turning points in the past,” but never returned to those lows, meaning institutional capitulation isn’t quite in.

RBC

The buzz

In a massive blow to abortion rights, the U.S. Supreme Court intends to strike down the landmark Roe v. Wade decision, Politico reported, sparking hundreds to gather in DC.

Another busy earnings day is ahead, with DuPont

DD,

Pfizer

PFE,

and Biogen

BIIB,

reporting ahead of the open, followed by Advanced Micro Devices

AMD,

Starbucks,

SBUX,

and Caesars

CZR,

to name a few. DuPont shares were weaker after its outlook fell short of Wall Street expectations.

Russia plans to annex large parts of Eastern Ukraine, a U.S. official has warned. And the EU is reportedly looking to Africa to help wean off Russian natural gas.

As the Fed meeting kicks off Tuesday, Australia hiked rates by a bigger-than-forecast 25 basis points. U.S. data on tap includes job openings, factory orders and core capital goods orders after the market open.

The markets

Stock futures

YM00,

NQ00,

are steady, as bond yields

TMUBMUSD10Y,

TMUBMUSD02Y,

inch up . Oil prices

CL00,

are softer, along with gold

GC00,

Non-holidaying Asia markets were weaker, while Europe equities

SXXP,

are higher, and the yield on the 10-year German bund

TMBMKDE-10Y,

rising above 1% for the first time in seven years.

Opinion: Here’s why European value stocks could top U.S. growth plays over the next decade

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern Time:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameSteop |

|

AMC, |

AMC Entertainment |

|

NIO, |

NIO |

|

AMZN, |

Amazon |

|

AAPL, |

Apple |

|

BABA, |

Alibaba |

|

FB, |

Meta Platforms |

|

NVDA, |

NVIDIA |

|

AMD, |

Advanced Micro Devices |

The chart

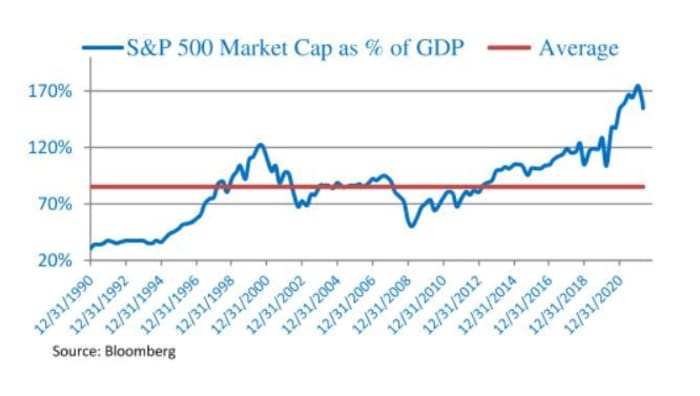

“Relative to the U.S. economy, the S&P 500 is still 28% more expense then it was at its 2000 bubble peak,” writes JonesTrading’s O’Rourke, who provides the below chart:

Bloomberg/JonesTrading

Just because stocks have dipped, prices are lower and the valuation is less than it was at the start of the year doesn’t mean the equity market is “inexpensive or attractively valued,” said O’Rourke, who is advising clients against “bottom fishing or dip buying.”

Random reads

Ukraine’s folksy hip-hop group Kalush Orchestra has high hopes for this year’s Eurovision contest.

Rare, centuries old, ‘wicked’ Bible discovered in New Zealand

Kim Kardashian strutted the Met Gala in Marilyn Monroe’s “Happy Birthday Mr. President” dress

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.