This post was originally published on this site

The colorful blogger Wolf Richter of the Wolf Street blog says the Federal Reserve engaged in a bit of deception with its purchases of Treasury-inflation protected securities as part of its quantitative-easing program.

“Since March 2020, the Fed’s proportionally huge purchases dominated the relatively small TIPS market and pushed the TIPS yields into the negative,” he says. “Manipulating the TIPS yield to show that ‘market-based inflation expectations’ were ‘well-anchored,’ though inflation had already begun to rage, was one of the cleverest monetary sleights of hand.”

But that game is over as quantitative easing has ended, as the era of quantitative tightening looms. The yield on 10-year TIPS briefly turned positive this week, from -1.1% in January.

Still, global stocks have weathered the storm surprisingly well. Over the past month, the MSCI all-country world index has been flat, even as real yields stormed 70 basis points higher. The S&P 500

SPX,

has dropped 3% over the past month.

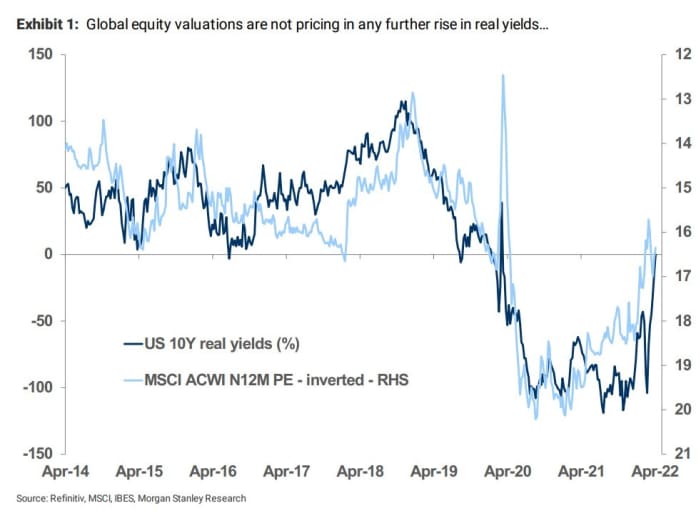

Graham Secker, chief European equity strategist at Morgan Stanley, says investors shouldn’t take too much comfort. “First, there’s a plausible argument that equity valuations had already derated in advance of this move and that the rise in real yields has simply recoupled the two series back together. Hence, if real yields move higher from here, equities will need to derate further,” he says.

And there’s reason to think real yields will indeed continue higher. Real yields tend to rise for the duration of Fed hiking cycles, and not just as investor expectations change.

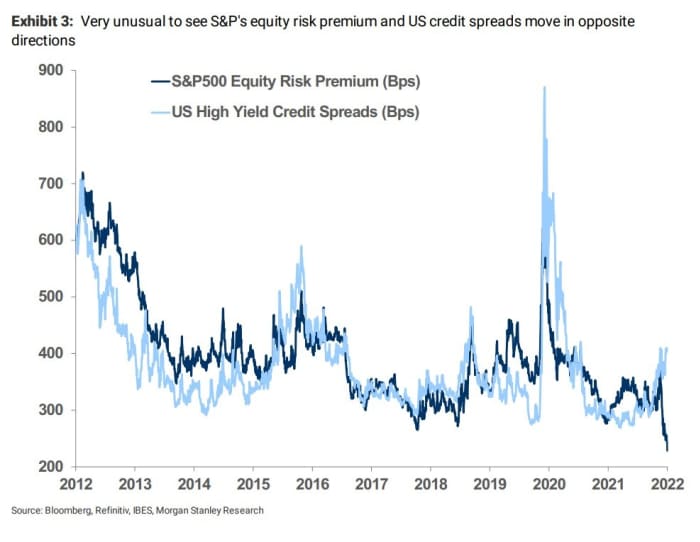

Secker also points to an unusual disconnect between the U.S. equity risk premium and credit spreads. The equity risk premium refers to the return earned by an investor for investing in stocks rather than risk-free assets.

And a further observation he makes is that the rotation to value hasn’t kept up with the rise in bond yields (using an average of U.S. and German securities). He says there’s potential for a resumption of value outperformance — and quality stock underperformance — if yields move higher, or if investors current concerns about the economy ebb.

The buzz

Gap Inc.

GPS,

shares skidded after the company warned that sales at its Old Navy brand would be worse than forecast, as the chief executive of the unit will depart. Social-media service Snap

SNAP,

reported a narrower-than-forecast loss on 38% sales growth, as it flagged inflation and geopolitical risks.

Cathie Wood’s ARK Invest sold nearly $100 million worth of Tesla

TSLA,

shares after the electric-vehicle maker’s well-received first-quarter results. Tesla is still the top holding in the three funds which sold the auto maker shares. The Tuttle Capital Short Innovation ETF

SARK,

which is designed to inversely track Wood’s flagship fund, closed above the Ark Innovation ETF

ARKK,

on Thursday.

Elon Musk is in talks with private-equity firm Thoma Bravo about joining a bid for Twitter

TWTR,

the New York Post reported, citing sources close to the situation.

The economics calendar is on the quiet side, though investors will still be focusing on Fed Chair Jerome Powell’s comments delivered at an International Monetary Fund panel on Thursday, when he said the rate-setting board will be considering a 50-basis-point rate hike. Flash manufacturing and services data are due for release.

Philadelphia ended a short-lived reinstatement of its indoor mask mandate.

The market

U.S. stock futures

ES00,

NQ00,

edged lower, after the 368-point slide in the Dow Jones Industrial Average

DJIA,

on Thursday. The 10-year yield moved up to 2.95%.

The pound

GBPUSD,

dropped after disappointing U.K. retail sales and consumer confidence numbers. German bund yields

TMBMKDE-02Y,

continue to rise on speculation over European Central Bank rate hikes.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

NFLX, |

Netflix |

|

NIO, |

Nio |

|

SNAP, |

Snap |

|

NVDA, |

Nvidia |

|

FB, |

Meta Platforms |

|

MULN, |

Mullen Automotive |

|

AAPL, |

Apple |

The chart

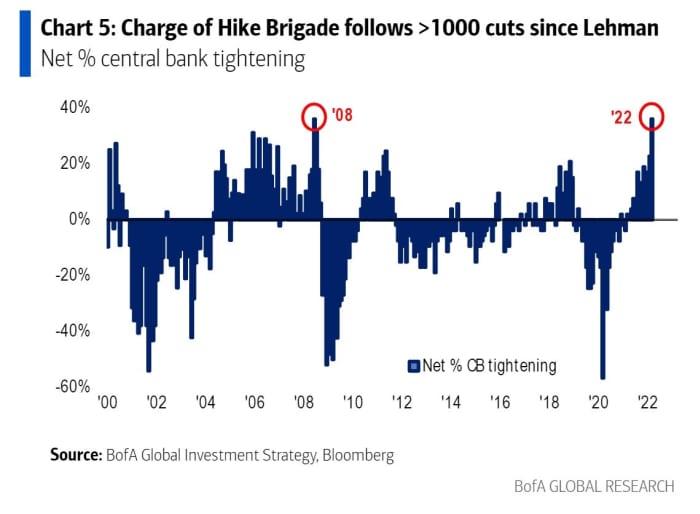

Call it the “charge of the hike brigade,” says Bank of America strategist Michael Hartnett. With 75 rate increases globally this year, there’s the highest percentage of central banks hiking since 2008. It follows, however, 1,000 rate cuts since the collapse of Lehman Brothers, and some $23 trillion of quantitative easing.

Random reads

Is the optimal workweek two days in the office?

Killer alien jellyfish may be lurking — on a moon of Jupiter.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.