This post was originally published on this site

Monday was a manic one, in which the Dow Jones Industrial Average

DJIA,

surged over 500 points in a day in which volatility

VIX,

actually rose, as did the yield on inflation-protected securities. Tuesday’s CPI data may determine whether the stock market was early or just wrong.

As 2022 wraps up, one of the few assets that for a while was generating a positive return is now stuck with stocks and bonds in negative territory. Crude oil futures

CL.1,

which reached over $130 in March, are now around $74. For the year, the front-month contract is down 2%, though that’s better than the 10% retreat for the S&P U.S. government bond index and the 16% decline in the S&P 500

SPX,

Ever the contrarian, Kevin Muir of The Macro Tourist wonders if there’s an opportunity here. The former institutional equity trader said the fundamentals really haven’t changed very much. “Many of the bullish fundamental arguments are equally valid today as they were back in March, but the main difference is that market participants had previously pushed prices to levels where much of that good news was built into the price, whereas now, little is incorporated. Back then, we needed everything to go right (or wrong depending on how you look at it) for oil prices to rise. Today, we need much less,” says Muir.

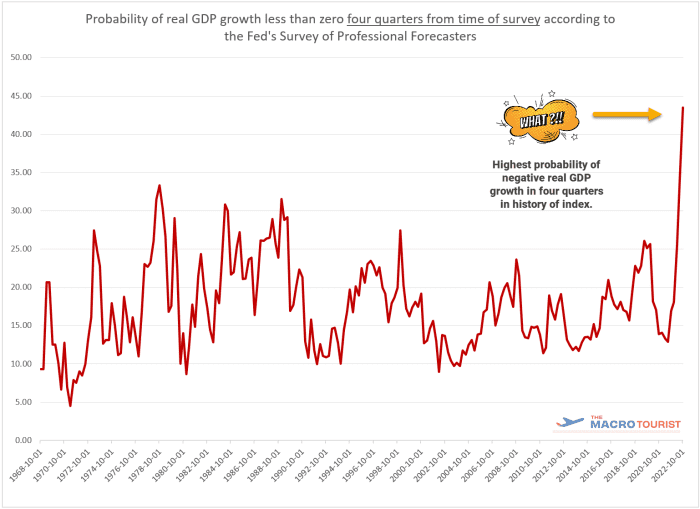

Macro Tourist/Philadelphia Fed

Look at some of the reasons.

- The Strategic Petroleum Reserve, a seller through 2022, is now poised to become a buyer, to refill reserves.

-

The U.S. dollar

DXY,

-0.27%

seems to have turned over. “It is doubtful that the USD will prove as much of a headwind to crude oil performance in 2023 as it was in 2022,” says Muir. - Interest rates also are not likely to climb as aggressively as in 2022.

- The Fed’s survey of professional forecasters finds the highest probability that there will be negative growth over the next four quarters in the history of the index. “I like trades where there is a fair amount of pessimism baked-in. Often, they have a way of surprising to the upside,” he says.

But the main element of his oil thesis revolves around China. He says that oil demand there plummeted because of the country’s strict zero-COVID policies. He says the sooner China gets through a hard winter COVID-wise, the quicker things will get back to normal. “Although others view the China COVID situation as crude oil negative, I think they are looking too closely at the short-term picture and failing to realize the long-term positives. Come spring, the Chinese economy might be ready to take off and experience growth the likes we haven’t seen since pre-COVID,” says Muir.

He does specify that he does not want to buy the front-month contract. “I have no desire to be exposed to the vagaries of OPEC meetings, China COVID developments or the further unwind of overloaded speculators. No, I want to bet on the long-term positives reasserting themselves in the next year,” says Muir.

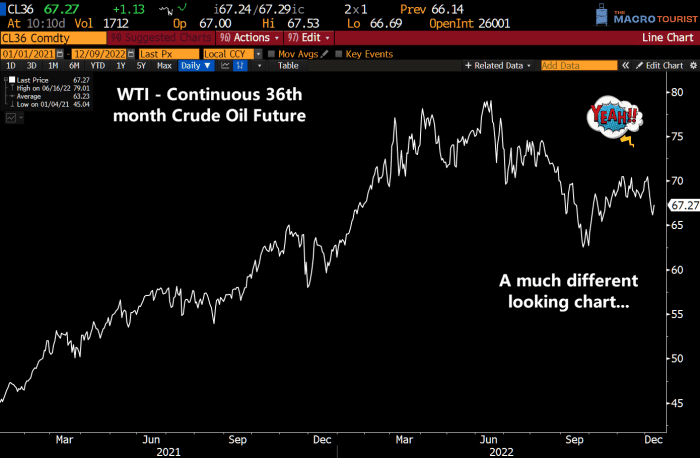

Macro Tourist/Bloomberg

Crude futures contracts 36 months out look like a “bull market that has paused, and is simply correcting.” He said he’s started a long position in the Dec. 2024 West Texas Intermediate contract

CLZ24,

The market

U.S. stock futures

ES00,

NQ00,

advanced ahead of the inflation data, while the dollar

DXY,

fell. The yield on the 10-year Treasury

TMUBMUSD10Y,

was 3.59%.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

The consumer price index data is set for release at 8:30 a.m. Eastern, with expectations for 0.3% monthly gains at both the headline and the core. Economists at TD Securities say used vehicle prices and contractions in apparel and household goods will weigh on the core.

FTX founder Sam Bankman-Fried was arrested in the Bahamas at the request of the U.S. government, just a day before he was due to appear before the House Financial Services Committee, which is still holding a hearing on the cryptocurrency exchange’s collapse. The Securities and Exchange Commission said he defrauded 90 U.S.-based investors in the exchange.

Database software giant Oracle

ORCL,

posted stronger-than-forecast results.

Police have now conducted 20 raids as they probe European Parliament corruption.

Best of the web

A look at Bankman-Fried’s parents, who were in the middle of FTX’s collapse.

Why a Saudi bank says it invested $1.5 billion in Credit Suisse

CS,

Energy Sec. Jennifer Granholm is due to announce a major scientific breakthrough in the quest to harness fusion, but observers say it will take at least a decade for commercialization.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

NIO, |

Nio |

|

BBBY, |

Bed Bath & Beyond |

|

AAPL, |

Apple |

|

AMZN, |

Amazon.com |

|

APE, |

AMC Entertainment preferreds |

|

NVDA, |

Nvidia |

|

MULN, |

Mullen Automotive |

Random reads

Players from World Cup semifinalist Argentina are downing a bitter herbal infusion called Yerba mate.

England’s World Cup team didn’t bring home a trophy, but have brought back a cat.

The Dead Sea is dying, leaving behind exquisite salt formations but also condemned parking lots.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.