This post was originally published on this site

China was the worst-performing of the major markets in the first quarter — with the Shanghai Composite

SHCOMP,

dropping by 14% — but value-minded investors such as Charlie Munger are tempted. After all, China is still growing fast, and authorities have begun to temper their regulatory zeal. What could go wrong?

In a note to clients, Bank of America strategist Winnie Wu said it’s still too early for Chinese stocks.

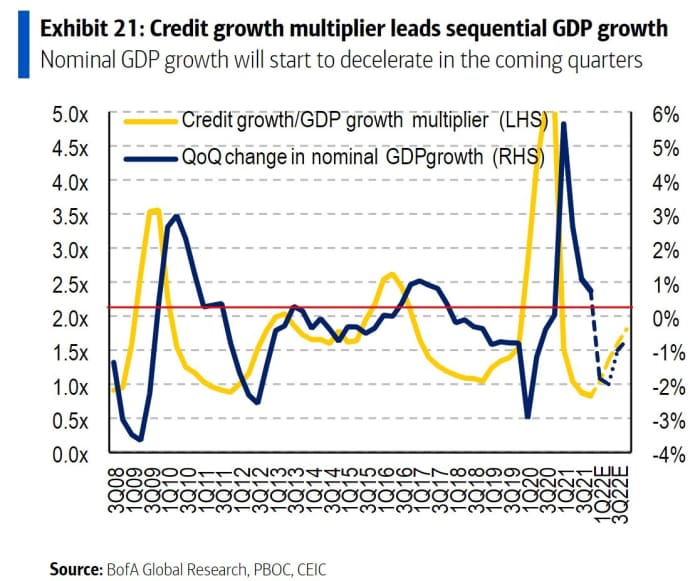

“While valuation has become more attractive, earnings forecasts will probably continue to be revised down,” she said. China’s credit cycle typically leads the gross domestic product cycle by 12 to 18 months, and corporate earnings trend broadly in line with nominal GDP growth. Credit growth has only just bottomed, meaning GDP, and therefore earnings growth, won’t turn around until the first half of 2023.

And while China isn’t tightening the screws on companies further, it hasn’t been loosening them, either.

“Policy noises is lower compared to 2H21, but there are no coordinated, strong easing measures either,” she said.

“Geopolitical risks remain, with uncertainty on the ADR delisting situation. More recently, the rise in COVID cases and the sharply tightened lockdown measures in Shanghai and other parts of China, will probably take a toll on the economy in 2Q22 and undermine market confidence.”

The note was written in advance of NIO saying lockdowns would affect production.

“We are cautious on the sectors that could be more vulnerable to the lockdown measures, ie real estate, consumer discretionary (auto, hotels, apparels), and transportation infrastructure. We have also become more negative on insurance and media sectors, for their weak earnings momentum,” said Wu. What the bank does like are tech hardware and semiconductor, healthcare, diversified financials and chemicals.

The buzz

Twitter

TWTR,

shares slumped after Elon Musk, the chief executive of Tesla, abruptly reversed his decision to join the social-media service company’s board after becoming its top shareholder. Twitter CEO Parag Agrawal said the decision was Musk’s, but also noted that his joining the board was subject to a background check and “formal acceptance.”

Lithium plays fell in Shanghai after Musk tweeted Tesla

TSLA,

might have to join the lithium mining and refining business due to surging prices.

NIO

NIO,

slumped, after saying it will have to suspend production due to COVID-19 restrictions disrupting its supply chain.

Shopify

SHOP,

announced a 10-for-1 stock split.

SailPoint Technologies

SAIL,

announced it was being bought by Thomas Bravo for $6.9 billion, or $65.25 per share.

French President Emmanuel Macron will take on far-right challenger Marine Le Pen for the second straight election, as various polling groups show a tight race, with Macron in the lead.

Russia was downgraded to selective default by S&P, as European companies Société Générale

GLE,

Nokia

TYRES,

and Ericsson

ERIC,

each announced plans to leave the country.

The markets

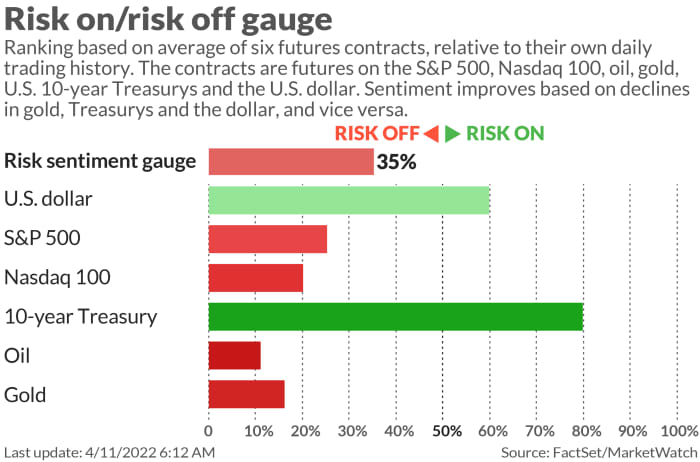

U.S. stock futures

ES00,

NQ00,

continued to feel the pressure on Monday as bond yields soared to new highs.

The yield on the 10-year Treasury

TMUBMUSD10Y,

was 2.75% ahead of inflation data due on Tuesday.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

NIO, |

Nio |

|

MULN, |

Mullen Automotive |

|

DWAC, |

Digital World Acquisition Company |

|

TWTR, |

|

|

ATER, |

Aterian |

|

NVDA, |

Nvidia |

|

BABA, |

Alibaba |

Random reads

Here’s an interesting if terrifying interview with a longtime Russian presidential adviser on the invasion of Ukraine.

Julian Lennon sang his father’s song “Imagine” for the first time ever in a fundraiser for Ukrainian refugees.

Cloud formations in Alaska prompt UFO talk.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.