This post was originally published on this site

Last year’s winners haven’t been doing so hot. On Monday, the ARK Innovation ETF

ARKK,

which surged 153% in 2020, closed higher for only the second time in 14 sessions, and has dropped 24% this year. “We believe you should invest based on what you see, and what you see is high multiple, unprofitable tech get slaughtered with the selling starting to seep into other areas,” says Matthew Tuttle, the chief executive and chief investment officer at Tuttle Capital Management.

Michael Darda, chief economist and market strategist at MKM Partners, has a similar warning, but first he wanted to give a reality check. After the Powell Pivot and the signal the head of the Federal Reserve likely supports faster tapering, he says some investors are worried the central bank may tighten too much. “There is virtually no evidence that the Fed is getting in front of the curve in a destabilizing way,” replies Darda. “Bond market inflation expectations pulling back from ‘too high’ levels to ‘still elevated’ levels relative to an average 2% per annum path for inflation do not represent a material tightening in monetary policy.”

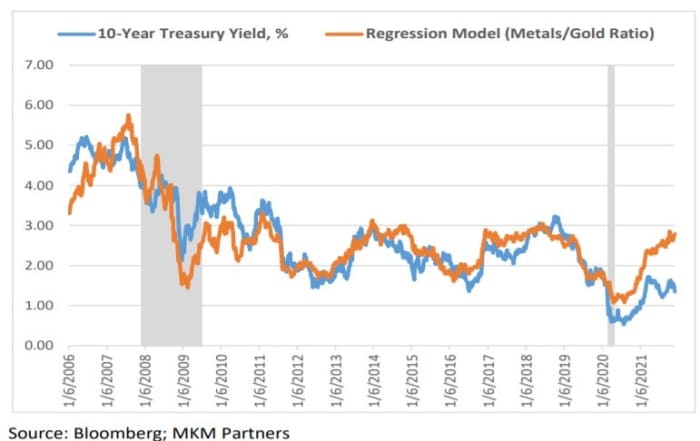

The last time the labor market was near current levels of utilization, real interest rates were 2 percentage points higher, he notes. The breakdown in the relationship between metals and gold, and the 10-year Treasury yield, is more evidence of distortions in the bond market, he adds. “If the bottom were suddenly falling out of global and/or domestic industrial demand, the resilience of metals to gold would be highly unlikely,” he says.

Despite monetary policy that is as loose as a goose, Darda still warns that assets that are priced for perfection against record profits and liquidity could falter for any number of reasons, which already is happening for the highest valued names in the Nasdaq-100.

“We continue to take an upbeat view on the reopening stocks which have been crushed and also small cap value,” says Darda. “We remain bearish on hyper-valued growth. Back in the old days, high valuations used to mean lower expected future returns. Blinded by liquidity and false expectations of the proverbial Fed put, we fear that some investors are chasing momentum into the graveyard.”

The buzz

Intel

INTC,

is planning to list shares of its self-driving-car unit, Mobileye.

MongoDB

MDB,

surged 18% in after-hours trade, as the database software company reported a narrow-than-forecast loss on higher revenue than expected.

The Securities and Exchange Commission has opened an investigation into a whistleblower’s complaint against Tesla’s

TSLA,

SolarCity business. Elon Musk, the chief executive of Tesla, which made $1.6 billion from selling regulatory credits last year, said he’s against federal legislation that would provide tax credits for union-made electric vehicles.

Digital World Acquisition Company

DWAC,

rose 5% in premarket trade, after Rep. Devin Nunes, who unsuccessfully sued an online parody cow, announced he was retiring from Congress to head Trump Media & Technology Company, which the SPAC is planning to merge with.

Craig Wright won a court case over control of $50 billion of bitcoin

BTCUSD,

though it isn’t yet clear he’s the inventor of the cryptocurrency.

Data on the trade deficit, productivity and consumer credit are set for release.

The markets

It’s looking like a second day of gains are in store for Wall Street, with futures on the Dow Jones Industrial Average

YM00,

up over 300 points.

Crude-oil futures

CL.1,

also were strong for a second day, rising past $71 per barrel.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Top tickers

As of 6 a.m. Eastern, here are the most active tickers on MarketWatch.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

GME, |

GameStop |

|

NIO, |

NIO |

|

DXY, |

U.S. dollar index |

|

TMUBMUSD10Y, |

10-year Treasury note |

|

ES00, |

E-mini S&P 500 futures contract |

|

DJIA, |

Dow Jones Industrial Average |

|

BABA, |

Alibaba Group |

|

AAPL, |

Apple |

Random reads

Someone paid $450,000 to be rapper Snoop Dogg’s neighbor — in the metaverse.

Kansas City police on Sunday chased an elusive suspect — a camel.

Here’s what one photographer calls the clearest photos of the Sun.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.