This post was originally published on this site

Is the Federal Reserve loosening or tightening policy right now?

That seems like a silly question. Interest rates are still barely above zero, and this month, the Fed is still planning to buy $20 billion of Treasury securities and another $10 billion in mortgage-backed securities.

But that isn’t how markets are behaving. And economists at Deutsche Bank say there’s some validity to the idea that the Fed is actually tightening right now, before it makes its first interest-rate hike.

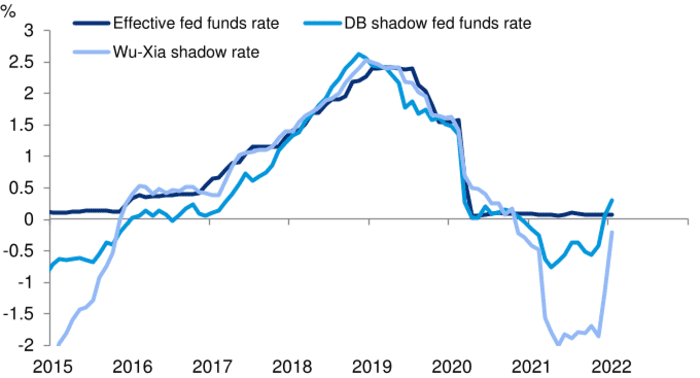

Their shadow rate — a model first introduced in 2019 that maps the signals from the yield curve into a fed funds equivalent rate — has risen 85 basis points over the past three months. That would rank in the top 5% of historical moves, say the Deutsche Bank economists.

“The recent rise moved the shadow rate into positive territory for the first time since the onset of the pandemic. This movement can be interpreted as the yield curve’s signal about how the monetary policy stance has adjusted in recent months,” say economists led by Matthew Luzzetti, chief U.S. economist.

A more widely followed “shadow rate,” called the Wu-Xia shadow rate, has climbed 1.5 percentage points since October, the sharpest three-month rise since 1994, though that measure is still not in positive territory.

“The upshot is that while a lot of work remains to be done in tightening financial conditions through a more restrictive monetary stance, through its recent pivot the Fed has been able to already kick-start that process,” say the Deutsche Bank economists.

The chart

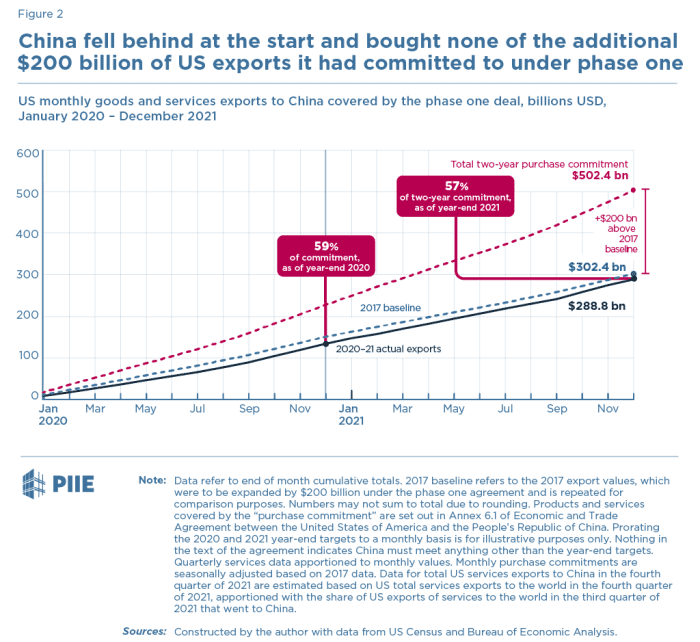

Nada. Zip. Zilch. China bought none of the extra $200 billion of U.S. exports it promised in the deal it signed with the Trump administration, according to Chad Bown of the Peterson Institute for International Economics. Bown did allow that the deal wasn’t a total washout, as it halted the spiraling trade war, and China did remove technical barriers to U.S. farm exports and pledged to respect intellectual property and open up its financial services sector.

The buzz

Coming in hotter than forecast, U.S. consumer price growth stayed at 0.6% in January, the Labor Department reported on Thursday. Core price growth stayed at 0.6%. Over the last 12 months, prices have gained 7.5%.

U.S. stock futures

ES00,

NQ00,

slumped after the hotter-than-forecast CPI reading, and the yield on the 10-year Treasury

TMUBMUSD10Y,

climbed to 1.97%.

Jobless claims meanwhile fell to 223,000 from 239,000.

Russia and Belarus started a joint military drill, as the world fears an invasion of neighboring Ukraine.

Walt Disney Co.

DIS,

jumped 8% in preopen trade, after it reported much stronger-than-expected earnings, helped by a jump in theme-park revenue as Disney+ subscription numbers also came in ahead of estimates.

Twilio

TWLO,

shares leapt 19%, after the communications software company beat on earning expectations and forecast it will be profitable next year. Uber Technologies

UBER,

also is seen rising after reporting revenue ahead of estimates, with gross bookings toward the high end of its projected range.

Twitter

TWTR,

rose 5% as the social-media company announced a $4 billion stock buyback and in-line fourth-quarter results.

Beverage makers Coca-Cola

KO,

and PepsiCo

PEP,

both edged higher after their fourth-quarter results.

Video-sharing platform Vimeo

VMEO,

dropped 20% after forecasting slower revenue growth this year.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

TSLA, |

Tesla |

|

FB, |

Meta Platforms |

|

NIO, |

NIO |

|

DIS, |

Walt Disney |

|

AAPL, |

Apple |

|

NVDA, |

Nvidia |

|

AMZN, |

Amazon.com |

|

BABA, |

Alibaba |

Random reads

Millennials just aren’t into wine, and U.S. producers are panicking.

A painting insured for about $1 million was vandalized by a bored security guard.

Does ice fishing lead to…prostitution? That’s the view of one Ohio mayor.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.