This post was originally published on this site

It was quite the Manic Monday, with not just the S&P 500 suffering its worst single-day performance in nearly two weeks, but retail favorites such as meme stocks GameStop and AMC Entertainment getting battered.

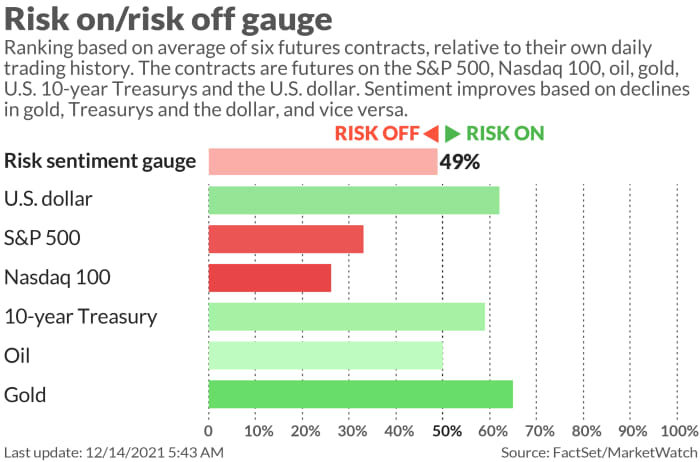

Thomas Lee of Fundstrat made three points. No investor wants to go risk-on into the Federal Open Market Committee meeting, equities reached an all-time high just last week, and the U.K. pushing COVID-19 vaccines is a reminder the U.S. still has to get through the omicron variant wave.

The 2022 outlooks are still pouring in, and a relatively optimistic outlook comes from the equities and derivatives strategy team at BNP Paribas, whose 5,100 call for the S&P 500

SPX,

next year matches Goldman Sachs, though it isn’t the highest on Wall Street. The team says valuations are “rationally exuberant.” The S&P 500 forward earnings yield premium to the U.S. 10-year Treasury

TMUBMUSD10Y,

is in line with the five-year average, even if the Shiller price-to-earnings ratio is at a 99th percentile reading. And valuations, it notes, “have almost never been the sole cause of a market correction.”

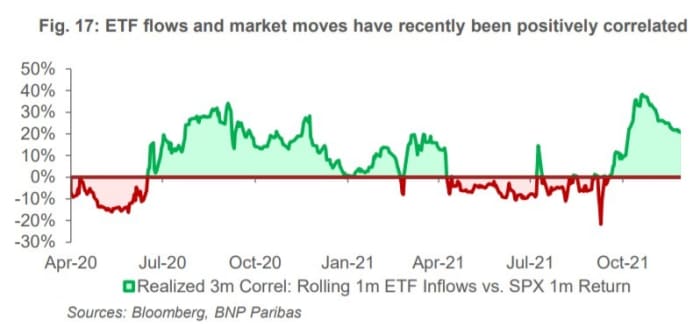

BNP also details the exuberance elsewhere, such as in options. Call option volumes exploded at different times in 2021, and recently exchange-traded fund flows and market moves have been positively correlated, which it says is “consistent with a more momentum-driven regime, in which investors are chasing rallies rather than buying dips.”

From meme stocks to mega caps, there have been several instances of large dislocations and abnormal price moves. It expects more of these dislocations next year, but still of the “episodic and idiosyncratic” variety. While margin debt is at an all-time high, household balance sheets are also in excellent shape, and the labor market remains strong. “It could take either a significant economic or market downturn to change this behavior, neither of which we anticipate in 2022,” BNP says.

As for institutional investors, there’s a high bar to decrease allocations to equities while real returns for many assets are low or negative, the so-called there-is-no-alternative, or TINA, trade.

What about a Fed tightening cycle? Historically, the team says, it’s the end of the tightening cycle, not the start, that has been problematic for stocks. That isn’t to say there won’t be speed bumps, but BNP says there could be a rally afterward.

It is more worried about another topic du jour, supply chains, though it assumes disruptions will start to ease next year. Backlogs as measured by Institute of Supply Management polls of purchasing managers have already started to peak, and a gradual shift back into services demand from goods would also ease inflationary bottlenecks. But if these disruptions don’t ease, or get worse, there’s the risk of the Fed hiking into a weaker growth outlook, which could unwind the elevated valuations.

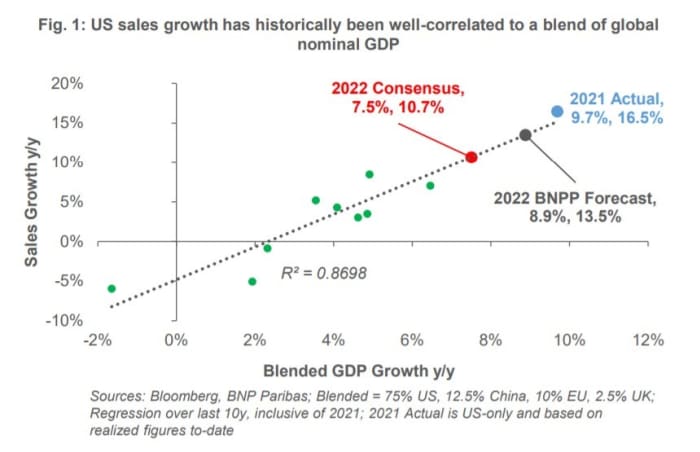

But the team is optimistic about corporate earnings. Historically, U.S. sales growth has been correlated to global nominal gross domestic product growth (that is, real growth plus inflation). BNP’s estimate of 4.8% real GDP growth, and 4.1% consumer-price index growth, translates into earnings per share growth of 12.4%, 5 percentage points above the consensus.

The buzz

The Fed’s two-day meeting starts Tuesday, with the announcement and press conference coming on Wednesday. There’s also a report due on producer prices.

California imposed a month-long mask mandate for indoor public places, as Philadelphia will require vaccine proof for bars, restaurants and indoor sporting events. Two doses of the vaccine made by Pfizer

PFE,

and BioNTech

BNTX,

offer 70% protection against hospitalization from the omicron variant, though just 33% protection against infection, according to a South African study. Pfizer separately said its oral antiviral offers 89% protection against hospitalization or death.

3M

MMM,

is merging its food safety business in a $9 billion deal with Neogen

NEOG,

Rentokil Initial

RTO,

struck a $7 billion deal to buy Terminix Global Holdings

TMX,

boosting its U.S. presence in pest control.

U.S.-listed Chinese social media provider Weibo

WB,

was fined by China’s internet regulator for violating a cybersecurity law.

Tesla

TSLA,

CEO Elon Musk continued his sale of shares while exercising options, taking the total stock sales to about $12 billion. The cryptocurrency Dogecoin

DOGEUSD,

jumped in value after Musk tweeted Tesla will start allowing merchandise purchases with it.

An initial examination by the U.K. Competition and Markets Authority found a “vice-like” grip by Apple

AAPL,

and Alphabet

GOOGL,

unit Google over mobile device ecosystems, ahead of a final report in June.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

The market

U.S. stock futures

ES00,

NQ00,

pointed to a second day of declines, particularly for the interest-rate sensitive technology sector.

Other assets weren’t faring as badly, with crude-oil futures

CL.1,

inching higher.

Top tickers

Here are the most active tickers on MarketWatch, as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

DXY, |

U.S. dollar index |

|

TMUBMUSD10Y, |

U.S. 10-year Treasury note |

|

DJIA, |

Dow Jones Industrial Average |

|

AAPL, |

Apple |

|

NIO, |

NIO |

|

ES00, |

E-mini S&P 500 futures |

|

NVDA, |

Nvidia |

Random reads

There’s a comet that if you don’t see this month, you never will.

This $6 hat with a picture of a bass is popular even among non-fishers.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.