This post was originally published on this site

This earnings season has been all about supply-chain disruptions — what they mean for supply, obviously, but also demand. According to FactSet, 107 companies in the S&P 500 have mentioned the phrase “supply chain” in their earnings calls over the past month, which to put in perspective compares to the 129 companies using the all-important word “revenue.”

But the view at the Federal Reserve, and elsewhere, is that these supply disruptions will eventually ease. Spencer Hill, an economist at Goldman Sachs, laid out the road map how in an interesting note.

Uncredited

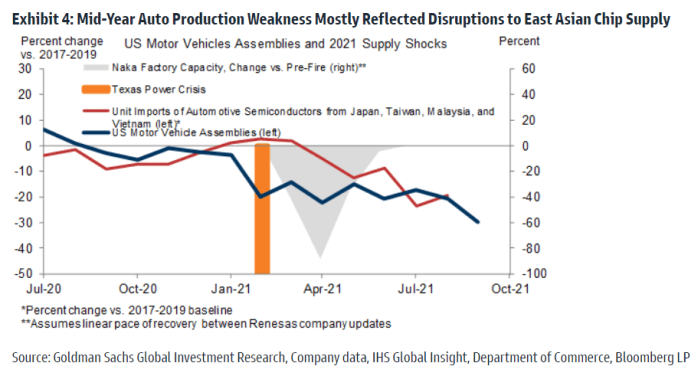

The first channel would be a rebound in microchip production in Southeast Asia. Hill pointed out the import of key semiconductor inputs from Malaysia and Vietnam dropped 36% in August, owing to COVID-19 lockdowns. Rapid vaccination and a relaxation of lockdowns in Southeast Asia should help boost automotive chip supply, and U.S. vehicle production, in the fourth quarter, but it will take longer to build out chip production capacity required to sustain above-normal production. Auto dealer inventories may remain very low through the middle of next year, Hill said.

Uncredited

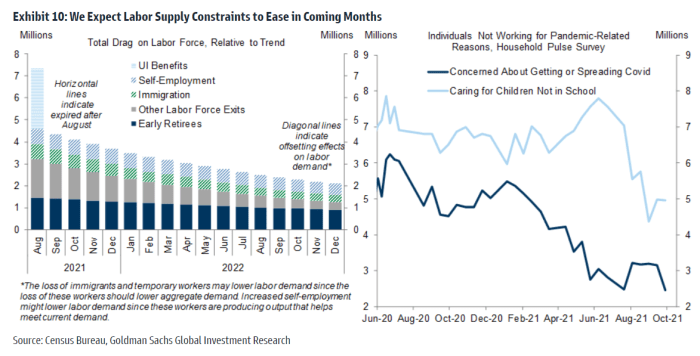

Rising labor supply in the U.S. should also alleviate disruptions. Hill said the expiration in September of emergency unemployment insurance benefits will boost fourth-quarter job growth by about one million, and as many as three million individuals staying away from the workplace due to health concerns will return by the middle of next year.

The third channel to ease supply constraints will be reducing port congestion after the busy U.S. holiday and pre-Lunar New Year shipping windows. Demand bottoms out in February after the Lunar New Year, when it’s typically 15% to 20% below August levels, so if port throughput maintains the August pace, the backlog could be cleared. Also, U.S. import volumes may normalize due to waning stimulus and a consumer rotation back toward services consumption.

Putting it altogether, and Hill said inflation will be stickier than the investment bank previously estimated, now seeing core personal consumption expenditure inflation of 4.3% at the end of the year, vs. 4.25% previously, and 2.15% in December 2022, vs. 2% previously. “While we expect inflation to be on a sharp downward trajectory at that point and to continue falling through the end of the year, this higher-for-longer path increases the risk of an earlier hike in 2022,” said Hill.

The buzz

Alphabet parent Google

GOOG,

was steady in the early hours after reporting forecast-beating earnings and revenue. Another tech giant, Microsoft

MSFT,

also beat earnings and revenue estimates, driven by cloud revenue as well as a surprisingly strong showing from personal computer software.

Microchip maker Advanced Micro Devices

AMD,

raised guidance after topping earnings estimates for the third quarter. Twitter

TWTR,

shares rose after-hours after the microblogging service said the impact from Apple’s

AAPL,

iOS privacy settings was modest, even as the company recorded a surprise loss. Twitter had $3.47 billion in cash and equivalents at the end of the third quarter, which appears to be somewhat in conflict with CEO Jack Dorsey’s professed view that hyperinflation is coming.

Visa

V,

the payments company, topped earnings estimates but issued a cautious outlook on revenue for next year. Robinhood Markets

HOOD,

missed expectations as crypto revenue tumbled.

Boeing

BA,

Coca-Cola

KO,

General Motors

GM,

and McDonald’s

MCD,

are among the companies set to report results before the open.

The economics calendar features durable-goods orders and preliminary trade data, the latter used to help estimate gross domestic product, which is due for release on Thursday.

The Federal Communications Commission ordered the expulsion of China Telecom from the U.S. market on national security concerns.

Listen to the Best New Ideas In Money podcast.

The market

After the ninth gain in 10 days and 57th record close for the S&P 500

SPX,

U.S. stock futures

ES00,

NQ00,

pointed to a more cautious start.

The yield on the 10-year Treasury

TMUBMUSD10Y,

fell below 1.60%, and bitcoin

BTCUSD,

traded below $60,000.

Random reads

The first public flight from Israel to Saudi Arabia has landed.

SpaceX has encountered a very mundane issue — a broken toilet.

Alibaba

BABA,

co-founder Jack Ma is no longer China’s richest person — it’s this water tycoon.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers