This post was originally published on this site

A choppy October thus far is pointing north for stocks on Thursday. Less pressure over the debt ceiling and falling natural-gas prices after Wednesday’s mayhem and Russia’s offer to help Europe, may be helping.

Some aren’t too worried.

But the list of what could ail this market seems to get longer by the day. Strategists at global investment research provider TS Lombard have whittled down the list to a few very big things that require close attention from investors.

“The kind of market action we are seeing these days — slower gains and more two-way action — should be the norm during this phase. But somehow it feels different this time round, and we think there are three main reasons for this,” write head of strategy Andrea Cicione and economist Krzysztof Halladin. Their list:

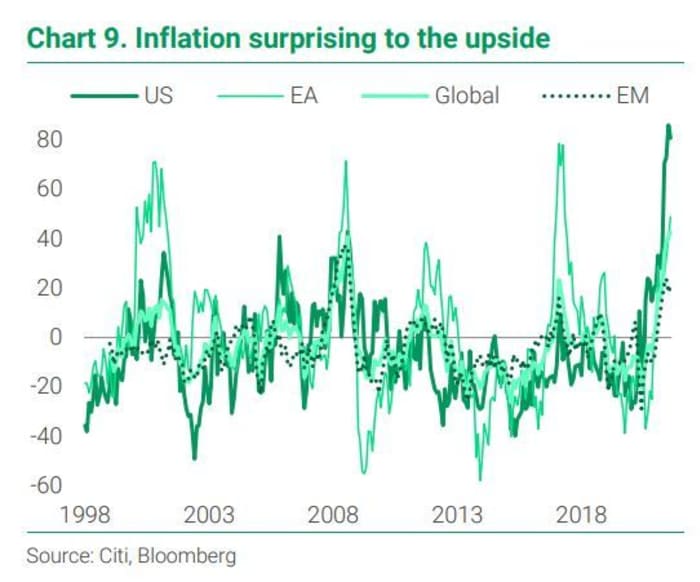

- Stagflation risk — the chances of pro-cyclical inflation turning countercyclical are growing and raise the specter of the ‘s’ word.

- A bursting Chinese property bubble — Evergrande’s downfall may not be a Lehman moment but China growth will take a hit.

- Tighter monetary policy — Lifting assets since March 2020, its absence will prove a headwind for both stocks and bonds.

Each of those, or more likely a combination, would tip their constructive balance on stocks toward a more cautious one, say Cicione and Halladin.

The biggest risk to portfolios is stagflation (Already here, says Bank of America) as a counter-cyclical turn in prices can trigger a derating of corporate profits, which then weighs on equities. Bonds also fall as fixed-income investors need more compensation and push up yields. So diversification benefits from that classic 60/40 portfolio are lost because bonds are adding to risk rather that hedging for it.

TS Lombard advises watching for surging energy prices that could dampen recovery, labor market wage growth, continued supply-chain disruptions, corporate margins that are already close to records (gauge company guidance rather than actual levels), and waning consumer confidence. Gold can offer some protection, but not full against stagflation, the research provider says.

How to play it? A short Treasury position, such as the iShares 7-10 Year Treasury Bond ETF

IEF,

or for stocks, a long position on iShares Edge MSCI USA Quality Factor

QUAL,

and short on SPDR S&P 500 ETF Trust

SPY,

are a couple of Cicione’s suggestions.

As for China’s Evergrande crisis, the pair notes that almost every country that has gone through a credit bubble has suffered slower gross domestic product in the five years to follow. The strategists see this as highly likely in China, given so much wealth is tied to real estate and often land is used as loan collateral, and they say falling real estate and land prices would spread, with global repercussions.

TS Lombard

Monitor property sales, developer new funding, property prices — paying close attention to Tier 3 cities — iron ore and industrial metals prices for domestic investment guidance, and shipping rates for export sector health. The strategists note China’s credit impulse leads global purchasing manager indexes by 10 months. One suggestion to protect against a China meltdown — a long U.S. dollar/Chinese yuan

USDCNY,

position.

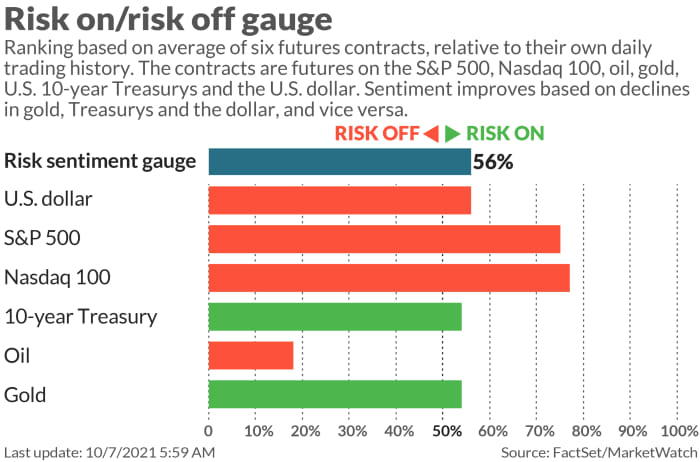

Finally, the fact that several global central banks are closing in on first rate hikes is not itself a reason to turn equity bear, they say.

TS Lombard

Apart from the usual suspects that keep central bankers up at night, they advise keeping an eye on signs of rising wage expectations. One way to play this — veer toward defensive stocks — quality and staples, says the TS Lombard team.

The buzz

Brinkmanship over the debt ceiling may be over for now, after Democratic senators said they were open to a Republican offer of an emergency extension into December.

U.S. President Joe Biden and Chinese leader Xi Jinping are reportedly set to meet virtually before the end of the year.

Levi

LEVI,

stock is jumping, after the denim giant beat on earnings and hiked its full-year outlook.

Rocket Lab shares

RKLB,

are climbing, after the aerospace and satellite service provider announced a NASA deal.

Weekly jobless claims are ahead, a prelude to Friday’s closely watched September payroll data that are expected to show a gain of about 500,000 jobs.

In the first blow to the most restrictive abortion law in the U.S., a federal judge has ordered Texas to suspend Senate Bill 8.

Listen to The Best New Ideas In Money podcast.

The markets

U.S. stock futures

YM00,

NQ00,

are moving higher and the yield on the 10-year Treasury note

TMUBMUSD10Y,

is steady at 1.525%. Hong Kong’s Hang Seng Index

HSI,

jumped 2.8%, with a rally for Chinese Estates

127,

— formerly a big shareholder of troubled China Evergrande

3333,

— after an offer to go private.

Oil prices

CL00,

BRN00,

are easing, along with natural-gas prices

NGX21,

following Tuesday’s Russia-driven big drop.

Bitcoin’s

BTCUSD,

is hovering just under $55,000 as a recent run of strength continues.

The chart

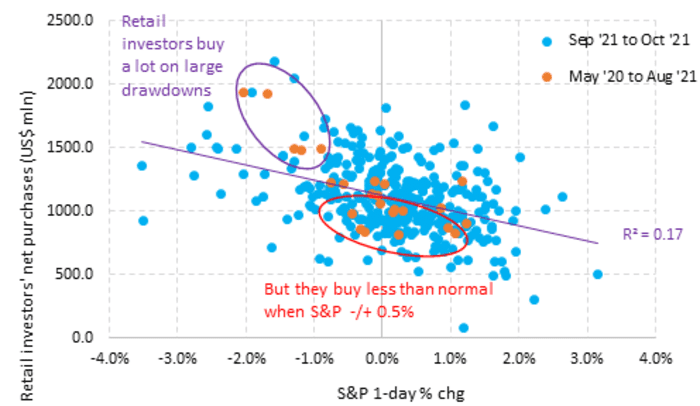

Buy the dip is alive and well — to a point, say senior strategist Ben Onatibia and analyst Giacomo Pierantoni at VandaTrack, a tracker of individual investor purchases.

Retail investors have continued to buy market downturns this week, but continue to get price sensitive. “They buy large quantities when the S&P sells off by more than 1%, but they buy very little when stocks fluctuate between -1% and 1% (chart below). That’s another way of saying that institutional selling faces little resistance from retail investors, unless the selloff reaches dramatic proportions,” says the team.

Vanda Research

Random reads

Meet Otis, Alaska’s three-time fattest bear champ.

Facing a shortage of key workers, fast-food chain Raising Cane sent its corporate staff to the front lines.

Welcome back, Carnegie Hall.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.