This post was originally published on this site

Stocks are pointing south as investors mull that hefty jobs rise and any implications for Fed hikes, as consumer price data looms for later this week.

And while much of the U.S. thaws out from last week’s brutal winter storm, a little ice appears to be melting around digital currencies. Bitcoin

BTCUSD,

dropped all the way to $34,000 in January, sparking fears of a crypto winter, but has this morning charged back up to top $42,000. Even meme coin Shiba Inu is up about 20% to $0.000027.

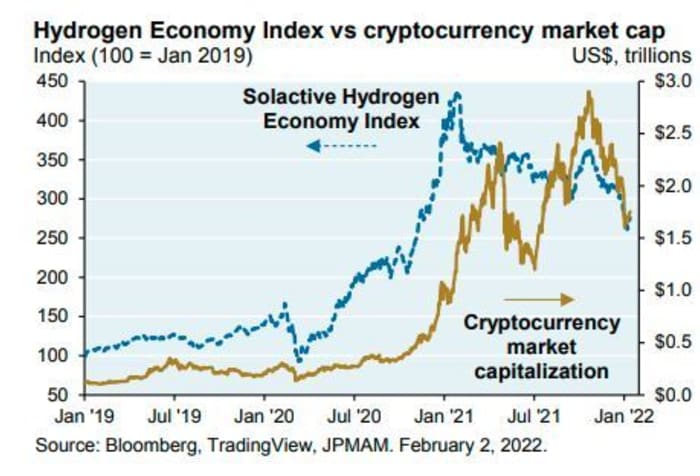

Be wary, says our call of the day from J.P. Morgan Asset Management’s chairman of market and investment strategy Michael Cembalest, who tackled a few problems that he sees in the digital currency’s appeal as an investment. He compares it to hydrogen projects and green energy, asking really, what will the scale of bitcoin be ultimately.

“Which companies will actually make money and how many will go to zero? Are some valuations way ahead of themselves, setting investors up for disappointment?” he said.

Uncredited

“Some hydrogen use cases make sense, but energy investors are pricing in a lot more than that, and that’s how I feel about crypto valuations too. Some crypto use cases will endure, but valuations assume broader and faster adoption,” said Cembalest.

Those crypto uses that may stick around? Remittances and permissioned, private blockchain with little to no cryptocurrency impact is all that he sees surviving for now, he said.

And bitcoin as medium of exchange is a few niche cases and nothing else. “The declining number of bitcoin transactions per day and the spikes in execution costs bear no resemblance to any functioning fiat currency,” said Cembalest.

He points to a forthcoming article in Quantitative Finance, by NYU’s Nassim Taleb, who notes It’s been 12 years since bitcoin was created. Yet the few prices fixed in the crypto amount to “the 3 bitcoin cost of a permanent residence in El Salvador.” Taleb also argues bitcoin transactions “can be more expensive to execute than those done using African mobile phones.”

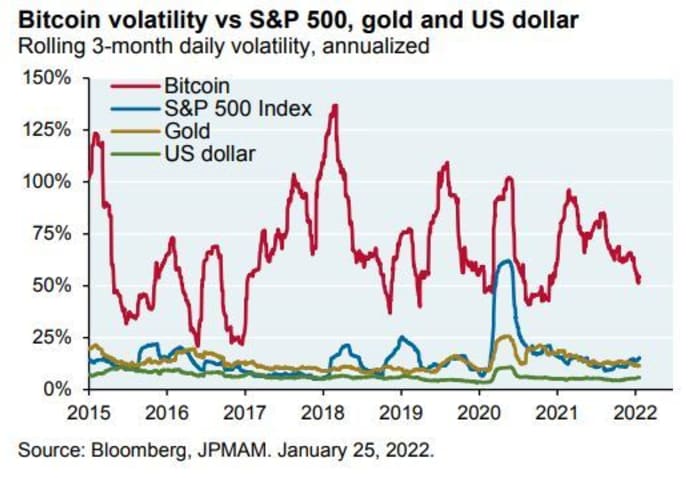

Cembalest tackled bitcoin’s use as a store of value, arguable given a world awash in debt. He wants to see more proof of wider adoption and for volatility around the crypto settle down into a “range consistent with store-of-value investing.” Bitcoin needs to either go up or remain stable when systemic risks or inflation are rising to compete with gold.

“I’m temped by the store of value thesis given the degradation of money, but have no crypto valuation tools to time my investment, and its volatility and market concentration are hard to manage,” he writes.

Bitcoin volatility, meanwhile, “continues to be ridiculously high,” tracking action in equity markets.

Uncredited

In short, he says this: “I won’t be buying [bitcoin] even though part of me wants to, regardless of consequences, since that’s what some crypto holders have been

counting on from the beginning. I would take another look if crypto valuations and the companies linked to them plummeted to deeply distressed values. But until then, the most widely discussed use cases and the valuations at which they’re trading are still the ‘stuff that dreams are made of.’”

That’s one opinion. The bitcoin faithful of course, may beg to differ.

The buzz

Spirit Airlines

SAVE,

and Frontier Group

ULCC,

are merging in a $6.6 billion cash-and-stock deal.

Google parent Alphabet

GOOGL,

said co-founder Larry Page sold more than $80 million worth of shares, days after a surge in shares following strong earnings and a stock-split announcement.

Peloton shares

PTON,

are surging after The Wall Street Journal reported that Amazon

AMZN,

and other potential acquirers are circling the exercise-equipment maker.

Tyson Foods

TSN,

Hasbro, Loews will report ahead of the open, with Take-Two Interactive coming after the close. Pfizer

PFE,

Chipotle

CMG,

Disney

DIS,

and Twitter

TWTR,

earnings are also due this week.

This week’s big data to watch is Thursday’s CPI report, expected to come in again at 7.2%, the highest since 1982. Consumer credit is due Monday after the open.

Ottawa’s mayor has declared a state of emergency over the “freedom truck convoy” protesting COVID-19 restrictions that has paralyzed the city’s downtown.

French President Emmanuel Macron will hold talks Monday in Moscow with President Vladimir Putin to help ratchet down tensions over Ukraine.

Meanwhile on the Olympics beat, 15-year old Russian figure skater Kamila Valieva earned gold for being the first woman to land a quadruple quad.

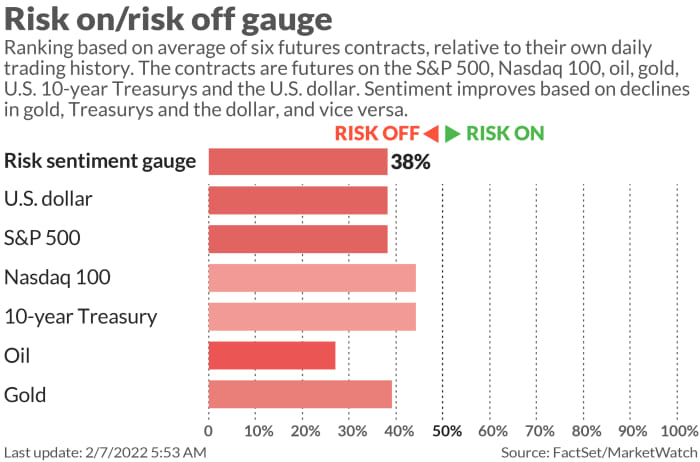

The markets

Uncredited

Stock futures

ES00,

NQ00,

are tilting lower, while bond yields

TMUBMUSD10Y,

are drifting lower. China stocks

SHCOMP,

climbed on the first day back from a weeklong holiday. Oil prices

CL00,

are taking a hefty step lower.

Gold

GC00,

is on the rise, while bitcoin

BTCUSD,

has pushed further past the $42,000 level.

And: Junk bond flows dropped by most since early days of pandemic

The chart

Here’s UBS’s weekly roundup of the top over and underowned stocks. Microsoft

MSFT,

is at the top of the overweight, while Apple

AAPL,

is high on the underweights list.

Uncredited

The tickers

These were the top tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

FB, |

Meta Platforms |

|

NIO, |

NIO |

|

AMZN, |

Amazon |

|

AAPL, |

Apple |

|

SNAP, |

Snap |

|

BABA, |

Alibaba |

|

NVDA, |

Nvidia |

Random reads

Hundreds of Dutch residents plan to pelt Jeff Bezo’s superyacht with rotten eggs if a historic bridge gets dismantled.

The vast and growing fast-fashion graveyard.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.