This post was originally published on this site

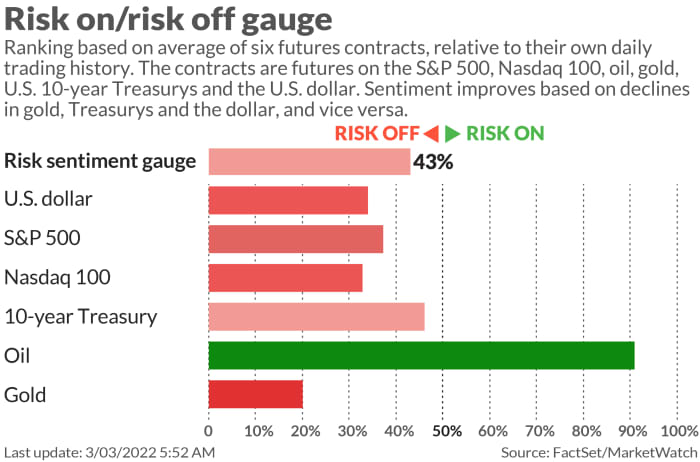

Wall Street is facing a choppy start for Thursday, with commodity prices once again sky high as an intensifying battle for Ukraine hits its eighth day.

“As long as the Russia-Ukraine crisis continues, we will maintain the view that another round of selling could be possible at any time,” said JFD Group’s head of research Charalambos Pissouros, who said Wednesday’s rally for Wall Street, driven in part by comments from Fed Chairman Jerome Powell, was a mere “adjustment bounce.”

The mantra from Wall Street and elsewhere has been that despite the grim here and now of this conflict, history tells us that stocks eventually rebound. Pressing that point home, Citigroup strategists pointed out to clients in a note Thursday that thus far, the pressure has been largely on stocks with direct Russia exposure and select financials.

“We still want to buy the dips, and highlight that global equities have ended 10% to 20% higher after previous geopolitical crisis,” said a team led by Robert Buckland, chief equity strategist.

That brings us to our call of the day, also from Citi, who in the same note lifted U.S. equities and the global information technology sector back to overweight. “Both are growth trades that should benefit, in relative terms at least, from the recent sharp drop in real yields,” said the strategists.

They point out how the outbreak of the Ukraine-Russia conflict has moved rates markets to price in more dovish monetary policy, with bond yields and real yields dropping, despite higher inflation expectations. “Having started the year at -1.10% and risen to -0.42%, U.S. 10-year TIPS yields fell back to -0.95%,” said Citi.

What that sharp drop in nominal yields has done is pressure financials as profitability from that sector needs higher rates. But equity markets have not moved as fast to price in falling real yields, Buckland and the team say.

“We have frequently highlighted that these have been a big driver of the global value/growth trade in recent years. However, this latest drop in 10-year TIPs has yet to drive a similarly sharp reversal in the value rotation trade that has dominated global equity markets [year-to-date],” with other growth trades lagging.

Highlighting “close relationship” between real yields and growth stock valuations, , they note that 83% of the MSCI U.S. 12-month forward price/earnings ratio can be explained by the level of U.S. 10-year real yields. Those are implying that U.S. markets should trade on 12-month forward P/E ratio of 21.5 times, versus the current 19.7 times.

“We had previously been expecting real yields to hit -0.25%, which would have implied the S&P trading at 20 times,” said the Citi team. Meanwhile, the MSCI All Country World IT sector is trading on a P/E ratio of 22.7 times, well below the 24.8 times implied by current 10-year TIPS yields.

“While we don’t’ want to be too slavish to this relationship, the latest plunge in real yields does imply that this year’s derating of growth stocks should stop,” said the Citi team.

The buzz

Fighting continues to rage across multiple parts of Ukraine, with Russian forces closing in on Kyiv, besieging port cities and pummeling Kharkiv. Russian Foreign Minister Sergei Lavrov said Russia is ready for talks, but won’t stop the attacks.

The fallout of that invasion continues, with Russian markets closed again, equity index provider MSCI deeming the country’s stocks “uninvestible,” the London Stock Exchange halting trade in Russia securities, and Fitch and Moody’s cutting the country’s credit rating to junk.

Fed Chairman Powell is back on Capitol Hill for Thursday. Weekly jobless claims, fourth-quarter productivity and unit labor costs are due ahead of the open, followed by the Institute for Supply Management services index and factory orders.

The former boss of fund manager Cathie Wood, whose flagship ARK Innovation Fund has fallen on hard times, said she’s “a boom or bust investor.”

Shares of software group Snowflake

SNOW,

are plunging after disappointing results.

A smattering of retailers have been rolling out results, with Burlington Stores

BURL,

and BJ’s Wholesale

BJ,

both falling short and those shares down.

The markets

Uncredited

Stock futures

ES00,

NQ00,

are tilting south, with oil

CL00,

and other commodity prices

W00,

continuing to climb, bond yields

TMUBMUSD10Y,

steady and gold

GC00,

silver

SI00,

and the dollar

DXY,

getting bid. The Russian ruble

USDRUB,

is down another 15%. European equities

SXXP,

are underwater and Asia had a choppy session. Bitcoin

BTCUSD,

is a little softer following its recent rally.

The tickers

These were the most-active tickers on MarketWatch as of 6 a.m. Eastern Time.

The chart

The energy sector remains solid on a technical standpoint, following a 7-year high for the Energy Select Sector SPDR ETF

XLE,

this week, ssays Larry Tentarelli, editor and publisher of the Blue Chip Daily Trend Report.

“XLE trades at 12.1 x forward earnings, well below the S&P 500 and yields 3.31%, well above the S&P 500,” said Tentarelli, in a blog. And while crude can be a volatile market, the chart has been trending higher. He’s highlights three stock favorites right now — Chevron, Devon Energy and Halliburton, and said he’d be a buyer on any potential pullbacks.

Uncredited

Random reads

German authorities seize the largest yacht in the world (512-foot) belonging to Russian billionaire Alisher Usmanov.

Even kids are getting arrested in Russia.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.