This post was originally published on this site

While you were sleeping, the yield on the 30-year Treasury yield briefly broke the 5% level earlier on Wednesday. Bond chaos, to be sure, is not through with this market yet.

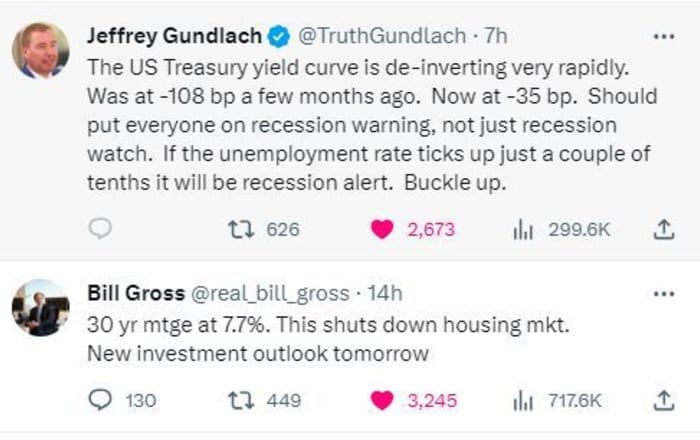

And big investing names are ringing alarm bells:

@TruthGundlach @real_bill_gross

As the stock market goes along for a choppy ride, chartists are keeping close watch on an important level for the S&P 500, the subject of our call of the day.

“The 4,200 mark is crucial,” says Michael Kramer, Mott Capital Management founder. “Not only is it where the 200-day moving average [DMA] resides, but dropping below 4,200 also means the S&P 500 no longer boasts a 20% gain from the October 2022 lows.” The S&P 500

SPX

closed at 4,229.45 on Tuesday, a 1.37% drop.

TradingView/Mott Capital

“It’s worth considering how many investors might grow anxious if the 200-day moving average is breached and the index is no longer in a bull market,” Kramer told clients in a note.

Also read: Stock-market rout puts all eyes on 4,200 level for S&P 500

The 200-DMA is considered a key indicator used by many chartists to determine long-term trends. After Tuesday’s selloff, the S&P 500 is still 21% above its October intraday low. The market would have to fall 20% from its July 31 high to exit its bull market.

“4200 is a big technical level and a very big psychological level, and if that breaks, I would think things get worse. Obviously, if you get weak job data on Friday and rates collapse, stocks will snap back. So suddenly, Friday’s job report just became a whole lot more important,” said Kramer.

A stock market commentator who goes by Heisenberg (@Mr_Derivatives) has been discussing in recent weeks a pivotal moment facing the S&P 500. He’s optimistic., expecting a visit to 4,200 sooner than later, perhaps an “overshoot” to 4,185 to 4,190, and a “decently strong rally” from there out.

@Mr_Derivatives

Read: The S&P 500 is brushing up against ‘the mother of all trend lines.’

Meanwhile, Keith Lerner, co-chief investment officer and chief market strategist at Truist Advisory Services, smells opportunity with the stock market now at its most oversold since autumn 2022 as that 4,200 support level nears. He also thinks a temporary dip below that number is likely, given so many are watching it.

The good news? “The percentage of stocks within the S&P 500 trading above their 50-day moving average is now below the 20% threshold considered oversold and sits at 15% currently,” he tells clients.

“This suggests indiscriminate selling and is a level from which markets tend to bounce, at least in stronger markets,” though that will depend on yields cooling off and coming earnings season, he says. But investors below benchmark equity targets could realize an opportunity to “lean into equities and bring weightings closer toward neutral,” Lerner adds.

The markets

Stocks

SPX

COMP

are modestly higher after weak private-sector employment data, with bond yields pulling back — the 30-year

BX:TMUBMUSD30Y

is down 7 basis points at 4.882% and the 10-year

BX:TMUBMUSD10Y

is down the same at 4.725%. The dollar

DXY

is dropping. Asia was a sea of red ink, with the biggest losses of over 2% for the Nikkei 225 index

JP:NIK

and Korea’s KOSPI

KR:180721.

Oil prices

CL.1,

are down over 2% ahead of supply data. Saudi Arabia said will stick to a production cut of 1 million barrels of oil a day through the end of 2023.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

A lower-than-expected 89,000 private-sector jobs were created in September, data that comes ahead of Friday’s nonfarm payrolls numbers. Factory orders and the Institute for Supply Management’s services index are due at 10 a.m. Fed. Gov. Michelle Bowman will speak at 10:25 a.m., with Chicago Fed President Austan Goolsbee at 10:30 a.m.

Apple stock

AAPL,

is down just under 1% after a downgrade to sector weight from overweight by analysts at KeyBanc Capital, who are worried about valuation and U.S. sales for starters.

General Motors

GM,

has agreed to a $6 billion, 364-day revolving credit agreement with 21 banks led by JPMorgan Chase & Co. as autowork strikes reach the three-week mark.

Cal-Maine Foods

CALM,

shares are down 11% after disappointing results from the egg producer who said the average price for a dozen eggs fell to $1.59 from $2.28 a year ago.

Brooge Energy

BROG,

is up 8% after the energy infrastructure provider got a buyout offer from Dubai-based maritime and shipping group Gulf Navigation.

A tourist bus in Venice fell from an elevated road, killing 21 people and leaving many injured in a fiery crash.

Best of the web

It’s time to ‘buy a T bill and chill,’ says DoubleLine’s Gundlach.

The chart

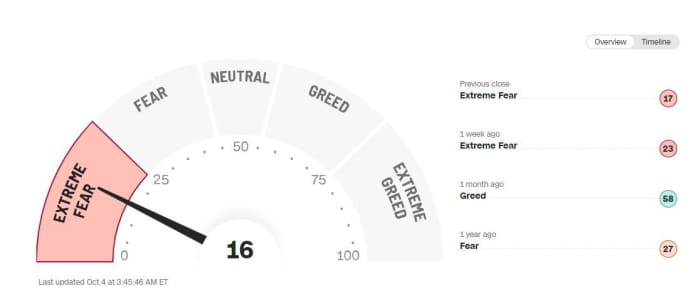

No surprise that fear is driving the stock market, and a lot more of it, according to the latest from CNN’s “Fear and Greed” index.

CNN

The gauge that uses several inputs, including Wall Street’s Cboe Volatility Index

VIX,

or fear gauge, reached an “extreme fear” reading on Sept. 27 for the first time since March 15. It is now at 17, deep in that extreme territory from a reading of 23 a week ago.

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

GME, |

GameStop |

|

NVDA, |

Nvidia |

|

AAPL, |

Apple |

|

NIO, |

NIO |

|

AMZN, |

Amazon.com |

|

PLTR, |

Palantir Technologies |

|

TTOO, |

T2 Biosystems |

|

NKLA, |

Nikola |

Random reads

Climate scientist may be fired for refusing to fly back to Germany from the Solomon Islands.

Materials on an asteroid are like those that may have “triggered the origin of life” on Earth.

Kevin McCarthy’s removal as House speaker was all about the gavel slam.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton.