This post was originally published on this site

Earnings season is kicking off to incredible expectations. Analysts are expecting 64% growth in earnings per share from S&P 500 companies in the second quarter, according to data from FactSet.

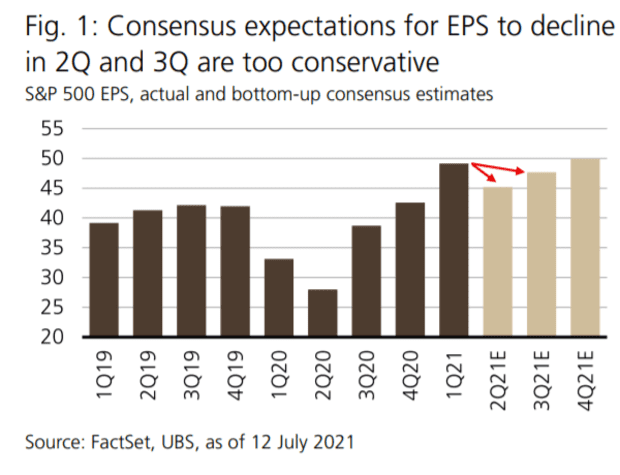

To strategists at UBS, those lofty expectations still aren’t high enough. The bank said earnings may grow 80%. “The ebbing of the pandemic and the massive government response to it are the primary drivers of the profit surge,” said strategists led by David Lefkowitz, and they said it is illogical to expect results to decline sequentially from the first quarter.

“Many consumers are itching for a sense of normalcy and household balance sheets are flush with cash suggesting spending has been — and will continue to be — solid,” said the UBS strategists. And while costs are clearly rising, they said, robust revenue is more than compensating. “Net profit margins should hit a new all-time high. Typically, margins take their cue from revenue growth. When revenue growth is strong, margins rise, even if costs are also rising,” they said.

The strategists lifted their S&P 500

SPX,

view for the end of the year to 4,500 from 4,400, and their June 2022 view to 4,650 from 4,550. The S&P 500 ended Monday at 4,384.63. “Our price targets assume a forward P/E of 20.5x — slightly below today’s 21.6x P/E. While valuations are high and remain above historical averages, they are reasonable in the context of very low interest rates. Valuations typically only contract when investors fear a pronounced growth slowdown is in the cards or central banks are making a policy error. Our outlook for healthy ISM [Institute for Supply Management] readings over the next year also suggests further upside for stocks,” they said.

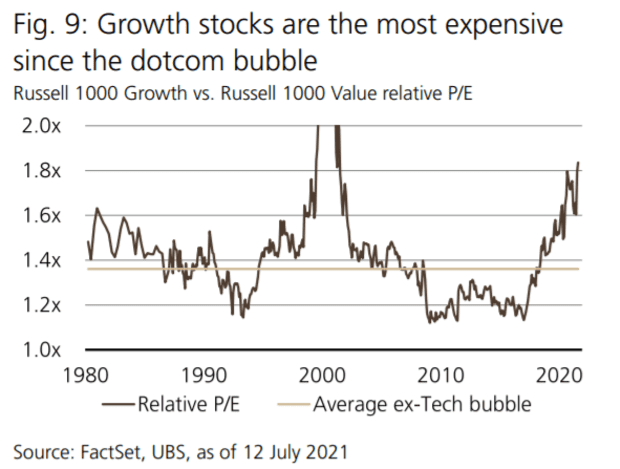

In terms of positioning, they continue to recommend a cyclical tilt. “We have a moderately preferred view on consumer discretionary, energy, financials, and industrials and a less preferred view on consumer staples and utilities. In our view, value stocks look more attractive than growth stocks,” they said. Growth stocks, they added, are at the largest premium to value since the dot-com bubble.

Here come the earnings

JPMorgan Chase

JPM,

and snacking giant PepsiCo

PEP,

beat expectations on second-quarter earnings, as Goldman Sachs

GS,

readies its results.

U.S. consumer price data is due at 8:30 a.m. Eastern, with expectations for a slight cooling in June to 0.5% monthly growth both at the headline and core level. “We think that the reopening effects continued to ease in June after a step in that direction in May,” said Rubeela Farooqi, chief U.S. economist at High Frequency Economics.

China’s export growth surged in June, rising 32% year-over-year, in a positive sign for world economic demand.

The price of lumber futures

LB00,

— the posterchild for runaway inflation as economies reopened — actually turned negative year-over-year on Monday.

St. Louis Federal Reserve President James Bullard told The Wall Street Journal that the time is right to end the Fed’s stimulus efforts, just a day after New York Fed President John Williams said such activity should continue.

The markets

U.S. stock futures

ES00,

NQ00,

were steady after the 39th record high of the year for the S&P 500

SPX,

The yield on the 10-year Treasury has crept up to 1.36%. Oil

CL.1,

was trading just under $75 a barrel.

Random reads

Gyms in Seoul are being forced to ban fast music, on the grounds that intense workouts could exacerbate the spread of coronavirus.

The odd story of 1,100-year-old silver coins minted in France that have ended up in a cornfield in Poland.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.