This post was originally published on this site

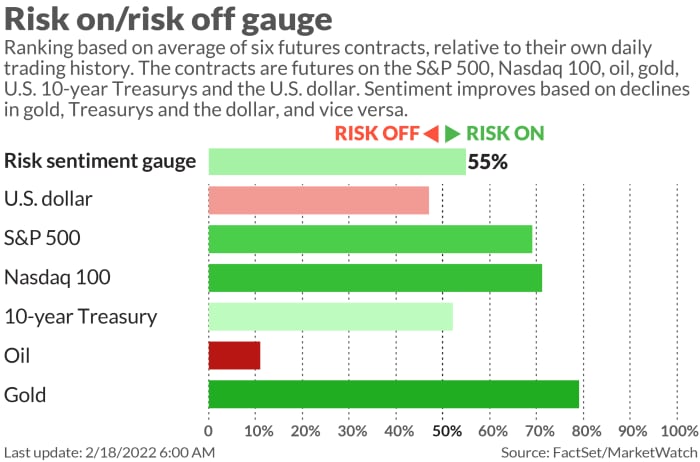

Diplomacy over war optimism where the Russia-Ukraine conflict is concerned was lifting the mood, but headed into a four-day weekend for the U.S., investors have got the jitters.

Our call of the day comes from GMO’s co-head of asset allocation, Ben Inker, who sees investors making costly errors these days. The first, “riding your winners and losing faith in all your losers,” has to do with investors piling into growth and U.S. stocks, and dumping Chinese and emerging equities.

China’s tech-giant crackdown has probably “left plenty of investors feeling as if U.S. large growth was both the lowest risk and highest return version of equities,” Inker wrote in the asset manager’s fourth-quarterly letter to investors.

So those investors have been rethinking those emerging markets, when they should be rebalancing out of their portfolio winners into the losers. That isn’t helped by the fact lots of active managers have been hotly chasing performance by growth names.

“The rising weight of the U.S. in global indexes at a time when its valuation premium

is the highest in decades actually argues for more active reductions in U.S. exposure than simply keeping its weight in line with that of, for example, MSCI ACWI, which currently has weights of 61%/26%/13% in the U.S., EAFE, and emerging regions, respectively,” Inker said.

And while Wall Street has done better than global rivals in most of the past 15 years, a belief that a U.S. bias helps reduce risk doesn’t quite stand up to history, he said.

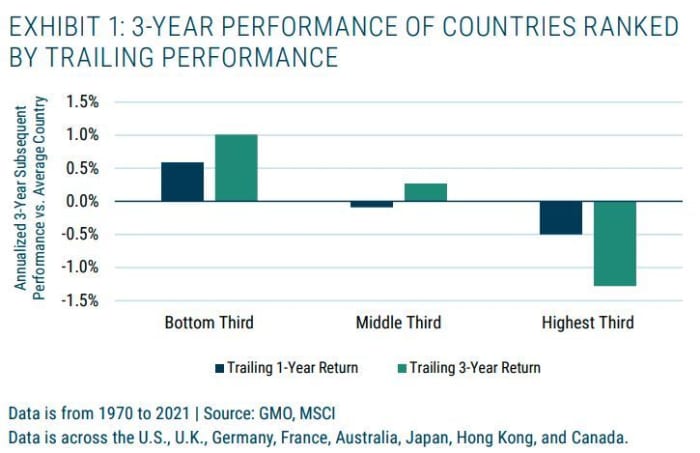

“Whether we are looking at trailing 1- or 3-year performance, the former

laggard countries wind up being the winners, and the previous highfliers underperform,” he said.

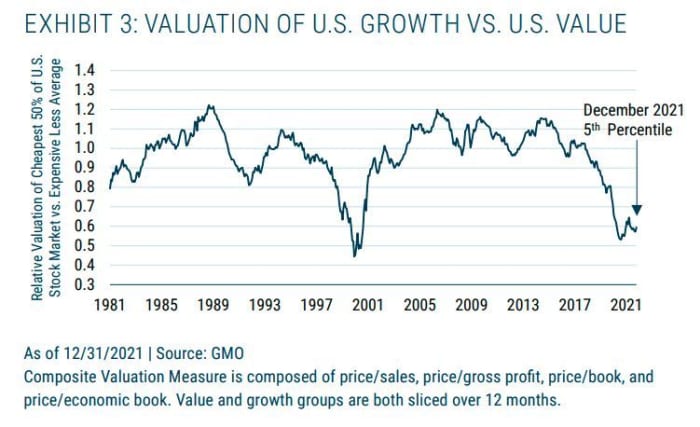

And a growth bias is problematic, given value remains so cheap relative to growth — in the fifth percentage relative to history. “If it were to go to its historical average valuation versus growth, that would entail outperforming growth by approximately 68%,” he said.

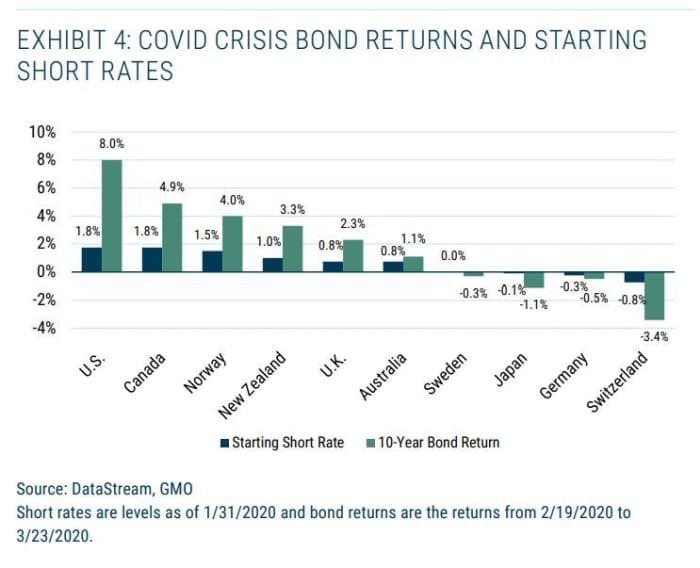

Another investor mistake is assuming assets that powered through the COVID-19 pandemic carry low fundamental risk, as Inker said there is “no single definition of ‘risk’ that one can rely on to tell you how an asset will do in a bear market. An asset might be reasonably resilient to losses driven by economic weakness but very vulnerable to losses from a liquidity shock,” he said.

For example, in the COVID bear market of 2020, U.S. Treasurys performed well, but other high-quality bonds that did well in prior equity bear markets fared poorly.

Another error, Inker said, is harboring unrealistically high expected portfolio returns after three strong years of returns — the three-year annual return for a 60/40 portfolio is an annualized 14.3%.

The biggest driver of those has been rising valuations, which isn’t a sustainable source of returns. That steady source is income and earnings growth that investors receive, and those will deliver less when prices are high relative to earnings, he said.

“Even if you wanted to assume that today’s record profits across most of the world are ‘normal’ and earnings yields correspondingly higher than the normalized versions, those sustainable real returns would only increase to 2.6% for 60/40 and 3.2% for a 75/25 split.” he said. Leaning away from U.S. stocks and non-equity exposure away from long-term bonds could help, but we may also need a severe bear market to get average valuations for bonds and stocks lower, said Inker.

The buzz

Investors have been cheered by the prospect of next week’s talks between Russian foreign minister Sergei Lavrov and Secretary of State Antony Blinken. Ahead of that, Russian President Vladimir Putin will on Saturday monitor a show of the country’s nuclear weaponry, such as practice missile launches.

Deere

DE,

stock is jumping after the tractor maker’s big profit and sales jump. DraftKings

DKNG,

shares tumbled 15% after digital sports entertainment and gaming company reported another, wider quarterly loss.

Roku shares

ROKU,

tanked 20% after the streaming company’s outlook came up short, and Redfin

RDFN,

fell 17% after the real-estate company forecast first-quarter losses would be bigger than those for all of last year.

3M stock

MMM,

is sinking after Morgan Stanley advised investors sell the conglomerate. Intel shares

INTC,

are up slightly, after the chip maker forecast a bullish 2022 outlook.

Cleveland Fed President Loretta Mester said high inflation calls for rate increases more aggressive than during the 2007-09 recession. Chicago Fed President Charles Evans, New York Fed President John Williams and Fed Governor Lael Brainard are also due to give speeches.

On the data front, existing home sales and leading indicators are due at 10 a.m..

Rapper Kanye West announced his new album “Donda 2” will only be available on his Stem Player, not via Apple

AAPL,

Amazon

AMZN,

or Spotify

SPOT,

The markets

Stock futures

ES00,

NQ00,

turned lower, along with bond yields

TMUBMUSD10Y,

while oil prices

CL00,

BRN00,

are tumbling again and headed for hefty weekly losses. Elsewhere, Asian stocks

NIK,

000300,

had a mixed session and European equities

SXXP,

gave up an early slim lead. Gold

GC00,

is trading just under that $1,900 level.

U.S. markets will be closed on Monday for Presidents Day, the day otherwise known as Washington’s Birthday.

The tickers

These were the most searched tickers on MarketWatch as of 6 a.m. Eastern.

Random reads

Apple’s next update will allow for face recognition without taking off your mask.

Storms are bashing the U.K. and Europe. Check out this terrifying ferry ride in Germany, thanks to “Storm Ylenia”:

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.