This post was originally published on this site

In this article, we would like to mention several reasons which led us to increase our long exposure in NYMEX Henry Hub futures Tuesday. We will briefly outline key themes impacting the U.S. natural gas market right now. Large charts gallery from our exclusive reports is attached below, so scroll down to see more.

Let us jump straight to the point.

Why We Increased Our Long Exposure?

Reason 1 – Technicals

1.700 proved to be a strong support, as June contract re-tested this level for the third time Tuesday morning (in as many days) and failed to confidently break below it. Thus, June contract continued to trade within the ascending wedge, targeting 1.800 and 1.850 in extension.

Reason 2 – Production and Other Market Variables

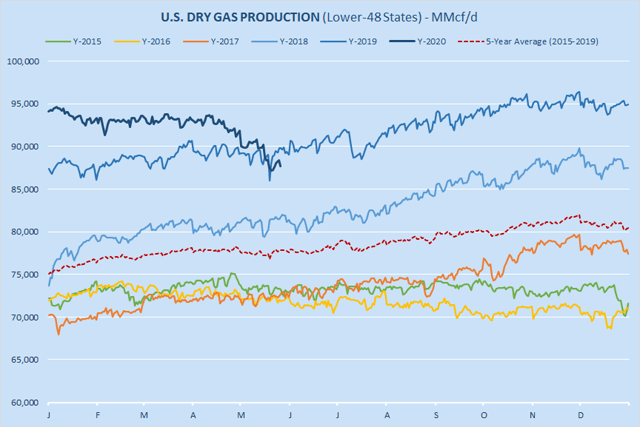

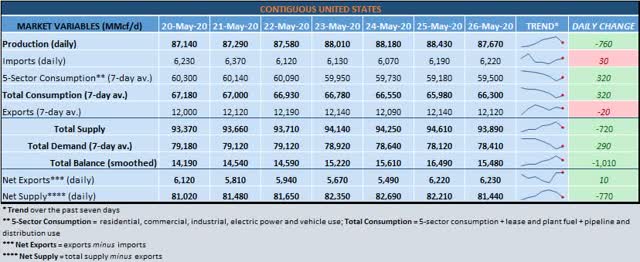

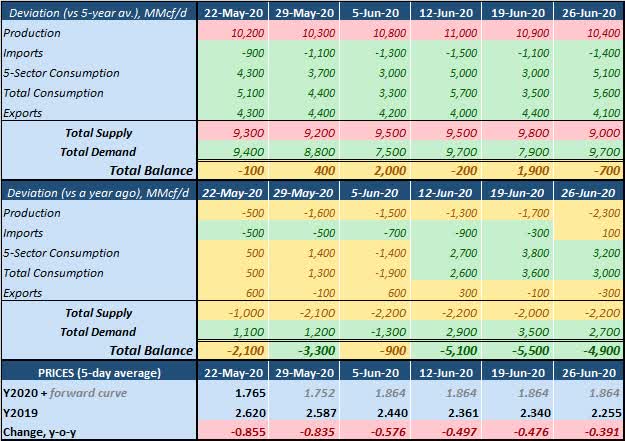

U.S. natural gas production growth potential has been severely damaged. Daily production rate is not expected to set a new all-time high for several years. Indeed, EIA expects dry gas production to continue falling until March 2021. Tuesday, early morning pipeline nominations lost more than 500 MMcf/d (vs. Monday’s results), which is a bullish signal (with all other things being equal).

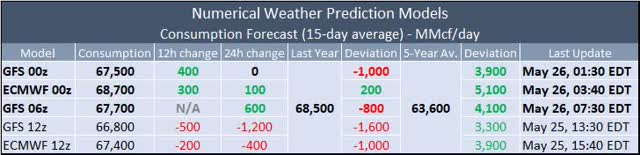

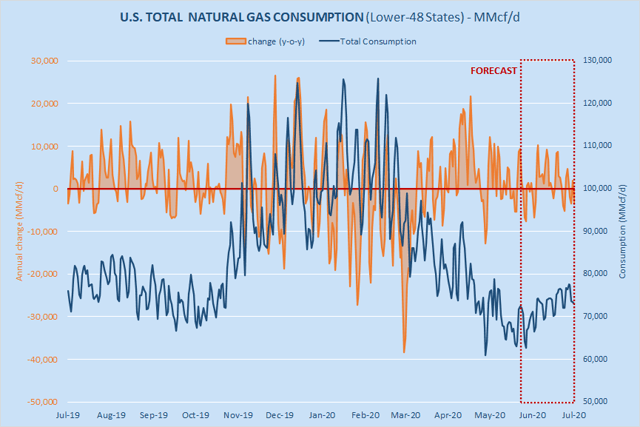

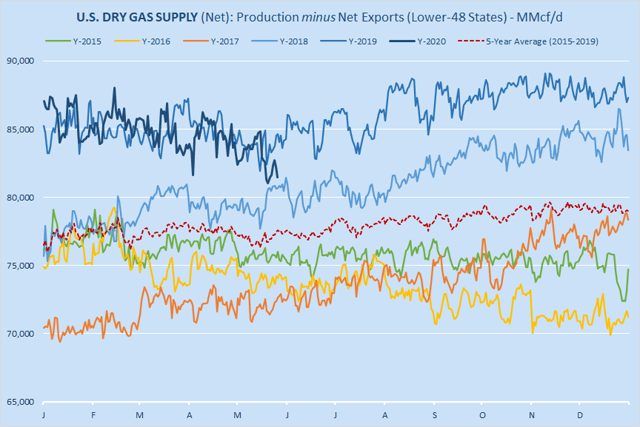

Furthermore, other market variables – particularly, consumption and net exports – have bottomed out and began growing again. In fact, daily total balance lost more than 1 bcf/d compared to Monday’s results (see the table below).

Consumption is increasing partly due to seasonal factors and partly due to the diminishing impact on COVID-19. We estimate that the percentage of the U.S. population under lockdown has decreased to 54% (from the peak of 96% observed in April).

Source: Bluegold Research estimates and calculations

Source: Bluegold Research estimates and calculations

Reason 3 – The Weather Factor

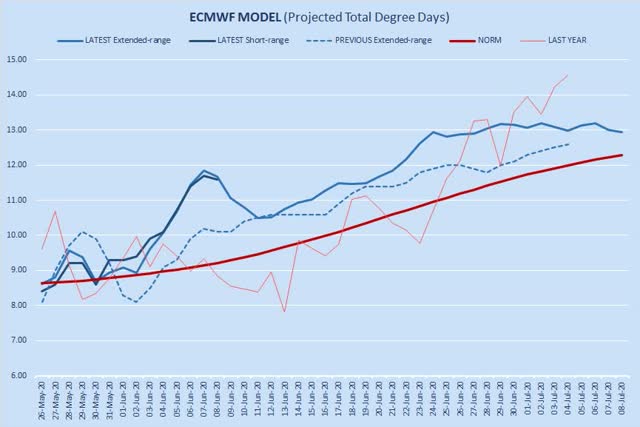

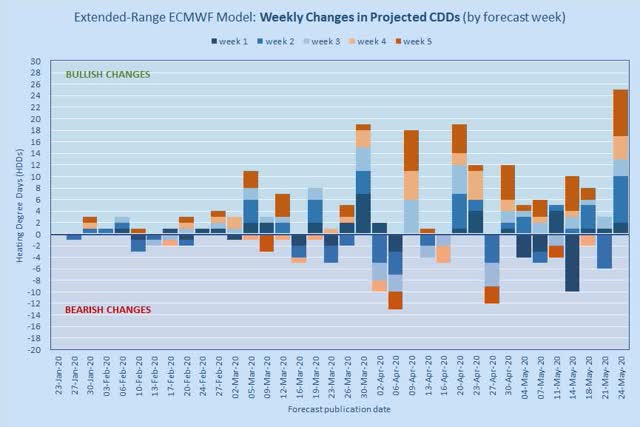

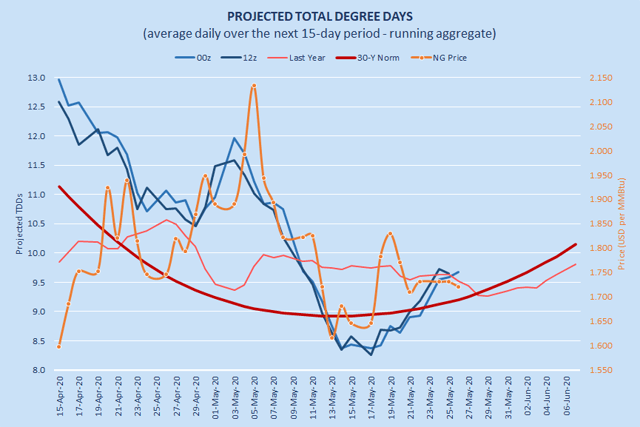

The latest extended-range ECMWF model showed more CDDs in all five forecast weeks (see the chart below). Consumption-wise, the model was bullish vs. previous update (issued on May 21). The net impact on our long-term storage level outlook is bullish.

Source: Bluegold Research estimates and calculations

Indeed, in terms of weekly changes, Monday’s update of the extended-range ECMWF model was the most bullish so far this injection season.

Source: Bluegold Research estimates and calculations

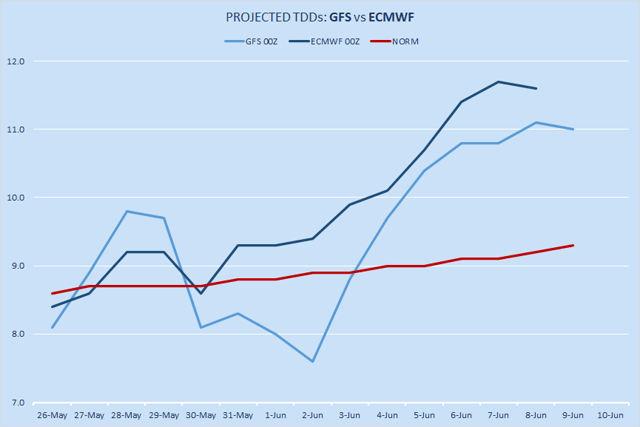

In addition, Tuesday’s short-range weather models were bullish vs. Monday’s 12z results. Overall, the weather factor has significantly improved our consumption outlook and led us to revise lower our storage level projections, which leads us to Reason 4.

Source: Bluegold Research estimates and calculations

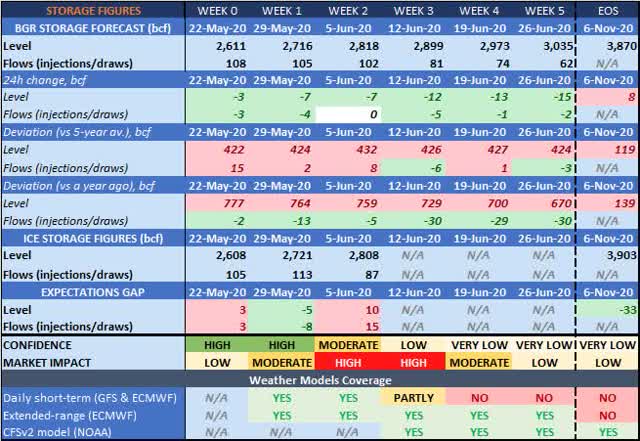

Reason 4 – Storage Projections

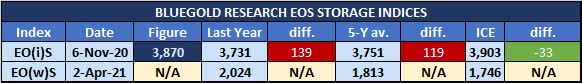

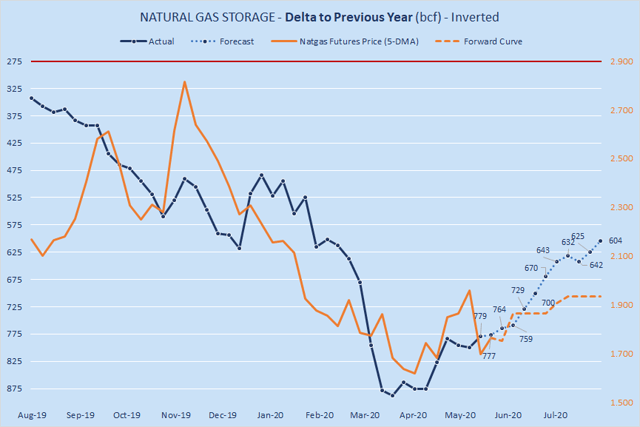

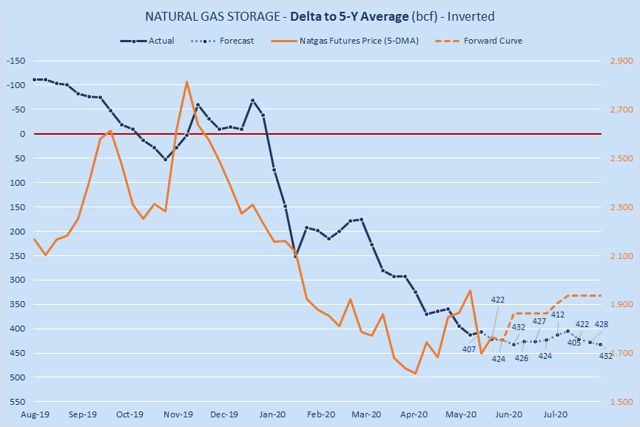

In the near term, storage injections were revised lower (which is a bullish signal), but EOS storage index is relatively flat (vs. Monday’s results). Currently, EOS storage index is at 3,870 bcf (33 bcf below market expectations). Annual storage “surplus” is projected to shrink by -109 bcf by June 26. However, storage “surplus” vs. 5-year average is actually projected to expand (by +17 bcf over the same period).

Source: Bluegold Research estimates and calculations

So, as of Tuesday, we are 100% LONG (no short positions in progress); gross exposure is 23.0% of available equity (30% is the maximum permissible exposure). We prefer to buy the dips – but only carefully. It seems reasonable to take some profit if the July contract price rises into the $1.900-2.000 area. Ideally, however, we would like to see if the July contract can break above the $2.000 mark.

Charts Gallery (from our exclusive daily reports)

SD Balance

Forecast (weekly)

Weather

Projected TDDs: GFS vs. ECMWF

Projected TDDs (hybrid; running aggregate)

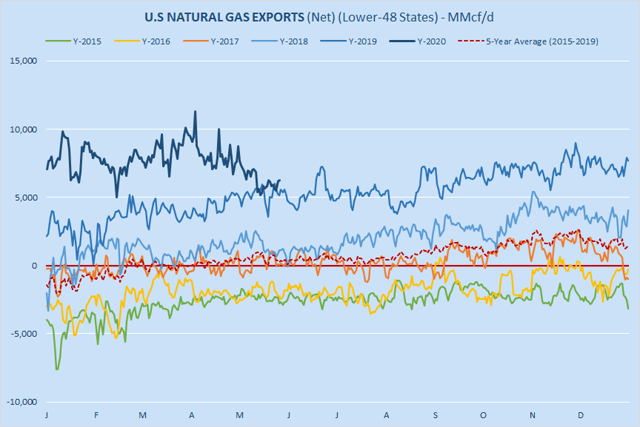

Net Exports

Production

Net Supply

Storage Level Deviations

Source: Bluegold Research estimates and calculations

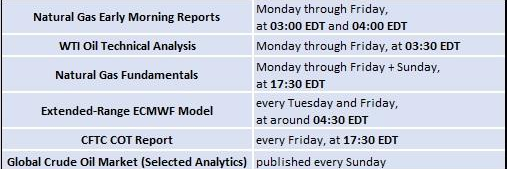

Thank you for reading this article. We also write daily and weekly reports, covering key variables in U.S. natural gas market (supply, demand, storage, prices and more). We provide the following to subscribers:

We are offering a two-week free trial, and we will soon begin to cover the global LNG market. Come and join us.

Disclosure: I am/we are long NG1:COM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.