This post was originally published on this site

Less than 10% of the flood risk to single-family homes in America is actually insured by the national program designed to offer such protection, with communities of color and lower-income areas disproportionately less likely to be covered.

That analysis, described as “a toxin sitting in the residential real estate market that will only worsen with climate change,” is from a new report from risQ, a Boston-based provider of climate-change analytics for the municipal-bond market.

The report, Economic and Racial Inequality in FEMA SFHA Flood Zone Designations, addresses the National Flood Insurance Program, which is administered by the Federal Emergency Management Agency.

The NFIP offers insurance policies for homeowners in areas prone to flooding. In most cases, there is no private market alternative for flood insurance, and such coverage is required for all mortgages with backing from government entities like Fannie Mae and Freddie Mac. The NFIP policies are heavily subsidized by taxpayers.

FEMA relies on what’s called a “Special Flood Hazard Assessment” to develop “Special Flood Hazard Areas,” which determine where the National Flood Insurance Program is active. But risQ’s analysis found that about three-quarters of the flood risk across the US lies outside the SFHA zones — meaning there is no requirement for homeowners there to be insured, nor access to the NFIP insurance.

Earlier coverage: More than half of Houston’s flood-prone properties aren’t in areas that require insurance: CoreLogic

Only 14% of the 3 million households hit by Irma have flood insurance

What’s more, many homeowners who are required to buy flood insurance don’t: risQ’s analysis suggests only 25% actually do. “Putting all of these numbers together suggests that less than 10% of the nation’s total single family residential flood risk is actually insured by the NFIP,” the report says.

Perhaps more strikingly, the report also finds that “the less white a community is, the less access it has to FEMA’s NFIP flood insurance.”

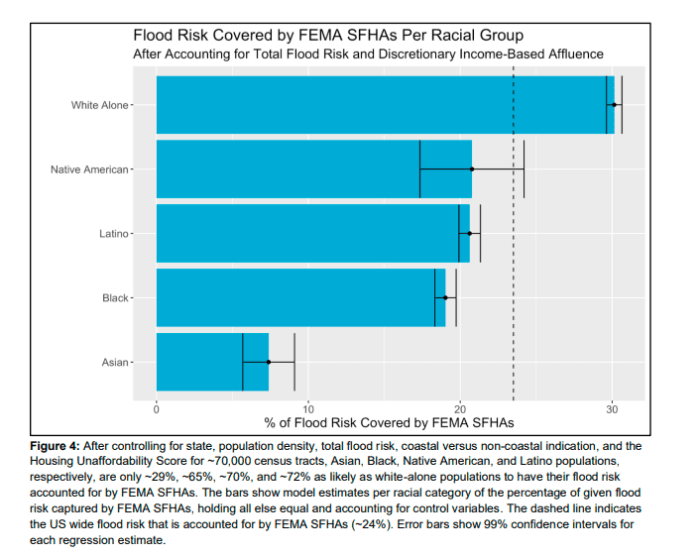

Source: risQ

As shown in the chart above, Latino communities are 72% as likely to have their flood risk jibe with the FEMA SFHA as white-only communities are. That figure drops to 70%, 65%, and 29% for Native American, Black, and Asian communities, respectively.

risQ also maps how well FEMA’s SFHAs correlate to income levels, using a ratio of housing costs relative to the incomes in a community. As that metric increases and housing becomes less affordable, SFHA coverage decreases “significantly and consistently across different levels of flood risk,” the report notes. “Communities with the least affordable housing and least discretionary income are systemically predisposed to being less insured.”

It’s worth noting that FEMA is aware of the NFIP’s drawbacks and is working to enhance the risk methodology it uses.

But that approach falls short, risQ argues, since it doesn’t redefine the SFHA zones. “As such it will still leave disproportionately non-white and income-stressed communities further behind,” the report concludes.

“To build a more equitable and sustainable program, FEMA should also focus on restorative investment, both in terms of immediate action on floodplain modeling in historically disadvantaged areas, thereby making flood insurance much more accessible, in particular to these communities that have been left behind.

Read next: Climate risk is hitting home for state and local governments