This post was originally published on this site

It now expects vaccine sales of $18 billion to $19 billion this year compared to a prior forecast of $21 billion due to delays at its contract manufacturing partner.

Demand for original coronavirus vaccines too has taken a hit in international markets as countries complete primary vaccine campaigns, while the roll out of updated Omicron-tailored boosters has been slow in the United States and Europe.

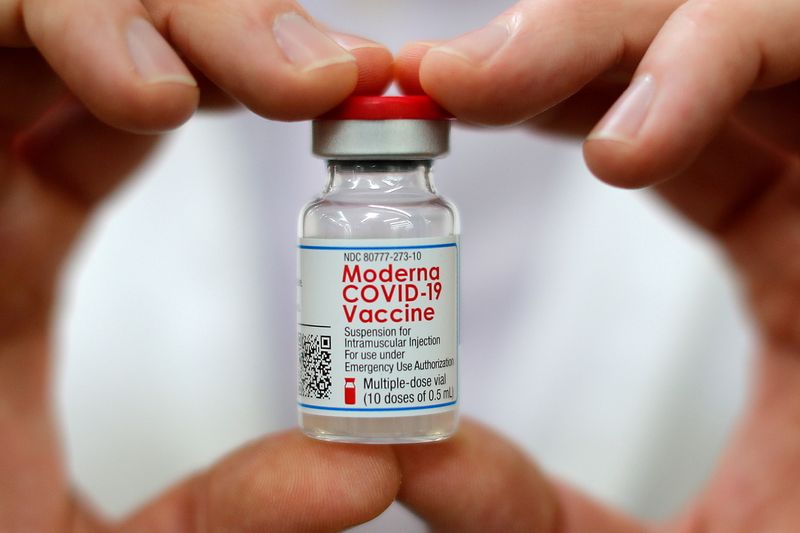

Some U.S. pharmacies in September had reported that government supply of Moderna (NASDAQ:MRNA)’s updated shot remains limited, causing appointments for the product to vary across the country.

Moderna’s weak forecast comes just two days after rival Pfizer Inc (NYSE:PFE)’s quarterly sales of its COVID-19 vaccine exceeded market expectations and the drugmaker raised the full-year sales view for its shots.

Jefferies analyst Michael Yee said Wall Street’s expectations for the shot were too high and Moderna’s forecast was “a stretch”.

Its sales of $3.36 billion in the third quarter missed Wall Street estimates of $3.53 billion. The company said the lower sales was due to the timing of market authorization for bivalent booster shots and the related manufacturing ramp-up.

It also reported a $333 million charge on vaccines that had expired or were about to expire before being used and $209 million in expenses for unutilized manufacturing capacity.

Moderna expects $4.5 billion to $5.5 billion in sales from signed contracts for its COVID-19 shots in 2023.

The biotech company’s shares were trading lower at $131.83.