This post was originally published on this site

Shares of Microsoft Corp. rose Tuesday to buck the selloff in the broader stock market, as the software behemoth is expected to announce another dividend increase as soon as this week.

The stock

MSFT,

rose 0.9% in afternoon trading, and was best performer of the only two of 30 components of the Dow Jones Industrial Average

DJIA,

that were gaining ground. Meanwhile, the Dow dropped 308 points, or 0.9%.

For the past 11 years, Microsoft has announced in mid-September an increase to its quarterly dividend, with all of the announcements coming between Sept. 15 and Sept. 21.

Morgan Stanley analyst Keith Weiss pointed out that in the past several years, the percentage increase in the dividend has hovered around the “high-single digit/low-double digit range,” regardless of operating income growth.

So even though Microsoft reported in late July operating income growth of 32.0% in the 12 months through June 30, Weiss said he “conservatively estimates” a roughly 10% increase in the quarterly dividend, to 62 cents a share from 56 cents a share.

That said, given another year that operating income grew by more than 20%, Weiss said he sees “capacity for a larger dividend increase.”

If the dividend is increased to 62 cents a share, the new annual dividend rate would imply a dividend yield of 0.83%, based on current stock prices. That would be below the implied yield for the S&P 500 index

SPX,

of 1.36%, according to FactSet, but above the yield for the SPDR Technology Sector Select Sector exchange-traded fund

XLK,

of 0.69%.

Of the five U.S. companies with market capitalizations above $1 trillion, Microsoft’s is the highest, as Apple Inc.’s

AAPL,

current dividend yield is 0.60%, while Alphabet Inc.

GOOGL,

GOOG,

Amazon.com Inc.

AMZN,

and Facebook Inc.

FB,

do not pay a dividend.

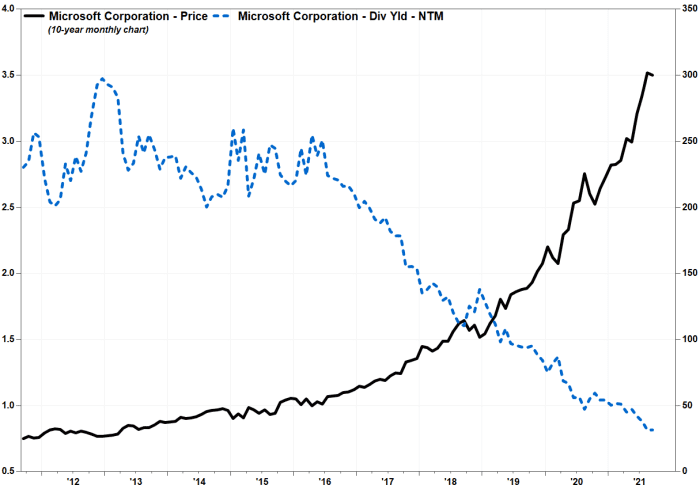

Meanwhile, Microsoft’s dividend yield has been trending lower for nearly the past decade, and has fallen to the lowest level in 17 years, as the pace of increases has lagged behind the pace of stock price increases, especially recently.

FactSet, MarketWatch

The stock has rallied an average of 37.5% in each of the past five years, including this year, and has climbed an average 28.6% over the past 10 years, while the dividend increase has averaged 9.2% the past five years and 13.5% the past 10.

Microsoft’s stock, which was just 1.6% below the Aug. 23, 2021 record close of $304.65, has soared 45.9% over the past 12 months, while the SPDR technology ETF has advanced 35.6% and the Dow has climbed 23.5% over the past year.