This post was originally published on this site

U.S. stocks were mostly higher Monday as investors welcomed waning signs of banking sector stress, but remained wary of the potential for further problems as well as the threat of a potential credit crunch.

How stocks are trading

-

The Dow Jones Industrial Average

DJIA,

+0.60%

rose was up 150 points, or 0.5%, at 32,388. -

The S&P 500

SPX,

+0.15%

was up 10 points, or 0.2%, at 3,981. -

The Nasdaq Composite

COMP,

-0.61%

edged down 2 points, or less than 0.1%, to 11,822.

The Dow on Friday ended a back-to-back run of weekly declines, while the S&P 500 and Nasdaq Composite both saw weekly advances.

What’s driving markets

An agreement by First Citizens Banchshares Inc.

FCNCA,

to buy the deposits and loans of failed Silicon Valley Bank helped underpin sentiment as shares of European banks steadied. Shares of First Republic Bank

FRC,

were up 12.7% and led a swath of regional lenders higher, with the SPDR S&P Regional Banking exchange-traded fund

KRE,

up 1.1%.

“Anxiety is going to remain until we have a few weeks of calm and despite the small frenzy on Friday, I think we can say that the first of those is now behind us,” said Craig Erlam, senior market analyst at Oanda, in a note.

“That isn’t to say that I think the storm has passed, just that the panic of the last few weeks may subside and allow for a more rational market to re-emerge. Or perhaps I’m being too hopeful for a Monday,” he wrote.

U.S. equities have been particularly choppy in recent weeks as traders have expressed anxiety about banking sector stress while welcoming the lower bond yields those concerns have delivered.

See: Why the worst banking mess since 2008 isn’t freaking out stock-market investors — yet

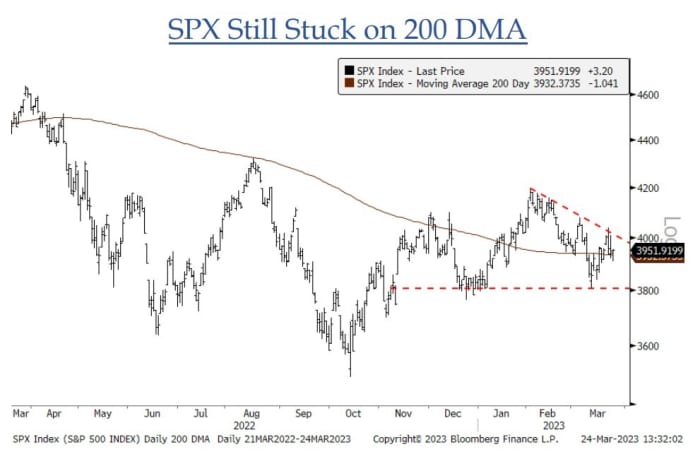

This has left the S&P 500 stuck near the middle of the 3800-4200 range it has held for four months, and leaves the Wall Street barometer “stuck on either side of its 200-day moving average,” said Jonathan Krinsky, chief technical strategist at BTIG.

Source BTIG.

There are no notable U.S. economic updates set for release on Monday, but there will be some Federal Reserve commentary when Gov. Philip Jefferson is due to deliver comments at 5 p.m. Eastern.

Companies in focus

-

BioNTech SE

BNTX,

-0.39%

American depositary receipts fell 4.2%. The German vaccine maker reported profit and sales ahead of forecasts, but estimated €5 billion ($5.4 billion) of COVID-19 vaccine revenue this year, down from €17.2 billion in 2022. -

Carnival Corp.

CCL,

-2.60%

shares fell 1.6%, after the cruise operator reported better-than-expected fiscal first-quarter results, amid record bookings, but provided a downbeat second-quarter outlook.