This post was originally published on this site

U.S. stock index futures fell back from recent highs early Wednesday as bulls held their fire ahead of the release of the minutes of the Federal Reserve’s last policy meeting later in the session while digesting July retail sales data.

How are stock-index futures trading

-

S&P 500 futures ES00

ES00,

-0.70%

dipped 38.8 points, or 0.9% to 4,272 -

Dow Jones Industrial Average futures

YM00,

-0.50%

fell 216 points, or 1% to 33,889 -

Nasdaq 100 futures

NQ00,

-1.02%

eased 139 points, or 1% to 13,519

On Tuesday, the Dow Jones Industrial Average

DJIA,

rose 240 points, or 0.71%, to 34152, the S&P 500

SPX,

increased 8 points, or 0.19%, to 4305, and the Nasdaq Composite

COMP,

dropped 26 points, or 0.19%, to 13103. The Nasdaq Composite is up 23.1% from its mid-June low but remains down 16.3% for the year-to-date.

What’s driving markets?

The appetite for additional risky bets was waning as investors took time out to assess the strong summer surge that powered the stock market to three-month highs, and awaited the latest monetary policy update via the minutes of the latest Fed meeting.

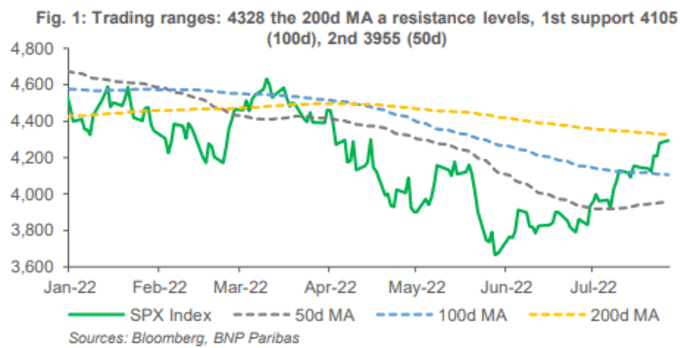

Hopes that inflation may have peaked and that the Fed thus may be able to avoid delivering a hard economic landing has pushed the S&P 500 up 17.4% from its mid-June low, and left the benchmark challenging its 200-day moving average for the first time since April.

“The index traded above its 200-DMA twice this year, once in early February, then late March, but couldn’t hold on to the gains and rapidly sold off,” noted Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

“We will see if the third time is a charm; earnings and the FOMC minutes will be decisive for the short-term direction,” she added.

Source: BNP Paribas

The Federal Reserve is due to release the text from its late July rate-setting meeting at 2 p.m. Eastern and traders will be keen to see whether the discussion matches current market expectations for the pace of rate hikes.

Earlier investors received more clues as to the health of the U.S consumer. Following better-than-expected results on Tuesday from Walmart

WMT,

and Home Depot

HD,

it was the turn of retailing peers Target

TGT,

and Lowe’s

LOW,

to deliver earnings. Target’s numbers disappointed, after higher markdowns led to lower margins, but Lowe’s figures were well-received.

In economic data, U.S. retail sales were unchanged overall in July, though largely due to falling gasoline prices and fewer purchases of new cars and trucks. Economists polled by Dow Jones Newswires and The Wall Street Journal forecasted a 0.1% growth.

Retail sales minus autos rose 0.4% in July, while retail sales excluding autos and gas climbed 0.7% in July.

Potentially contributing to the market’s caution on Wednesday are concerns that the rally may be looking overstretched on a short-term basis.

The S&P 500 future’s 14-day relative strength index, a closely-watched momentum gauge, was 78 in early morning action, according to CMC Markets. Technical analysts consider a figure above 70 to be in ‘overbought’ territory.

“With [the] market looking overbought and having rallied more than 15% from June lows, the recent move is, in our view, starting to look over done. The growth outlook is going to remain challenging to navigate,” said Greg Boutle, U.S. head of equity and derivatives strategy at BNP Paribas.

S&P 500 (SPX) valuations are also no longer compelling, Boutle noted. “SPX 2023 price/earnings multiple at 18x is right at the top end of the 30-year range for 1-year forward earnings (ex. bubble periods, late 90s and the post lockdown recovery). In the middle of a downgrade cycle this could make it challenging for the recent pace of recovery to persist.”

Source: BNP Paribas

Companies in focus

-

Shares of Target Corp.

TGT,

-2.12%

slumped 2.1% in premarket trading Wednesday, after the discount retailer reported fiscal second-quarter profit that fell well short of expectations, as higher markdown rates led to lower gross margins, but revenue that topped forecasts. -

Shares of Walmart Inc.

WMT,

+2.05%

dipped 0.3% in premarket trading Wednesday after climbing to a three-month high Tuesday, after the discount retail behemoth reported fiscal second-quarter profit and revenue that beat recently lowered expectations, and raised its full-year earnings outlook. -

Shares of TJX Companies

TJX,

+0.40%

fell 1.4% in premarket trading Wednesday, after the off-price apparel and home fashions retailer reported fiscal second-quarter profit that rose above expectations, while same-store sales fell more than forecast as “historically high inflation” hurt consumer spending, particularly for home goods.

How are other assets faring

-

Oil futures were a touch softer, with U.S. WTI crude

CL.1,

+0.54%

losing 0.1% to $86.45 a barrel, following hopes an Iran nuclear deal may help the country increase exports. -

The 10-year Treasury yield

TMUBMUSD10Y,

2.887%

rose 8.1 basis points to 2.893% as traders awaited the Fed minutes. -

The ICE Dollar index

DXY,

+0.23%

inched up 0.2% to 106.68, and this pressured gold

GC00,

-0.40% ,

off 0.4% to $1783.4 an ounce. -

Bitcoin

BTCUSD,

-2.46%

fell 1% to $23,723. -

Asia markets were broadly firmer after Wall Street moved to a fresh three-month high overnight. Japan’s Nikkei 225

NIK,

+1.23%

added 1.2% and Hong Kong’s Hang Seng

HSI,

+0.46%

climbed 0.5%. In Europe the mood was more mixed, reflecting the dip in U.S. futures on Wednesday, and the Stoxx 600

SXXP,

-0.73%

fell 0.4%.