This post was originally published on this site

U.S. stock futures rose on Monday as investors continued to shrug off the prospects for faster Fed tightening amid hopes a strong labor market signals the U.S. economy remains healthy.

What’s happening

-

S&P 500 futures

ES00,

+0.64%

rose 26.75 points, or 0.6%, to 4,173. -

Dow Jones Industrial Average futures

YM00,

+0.51%

were up 170 points, or 0.5%, at 32,927. -

Nasdaq 100 futures

NQ00,

+0.80%

climbed 105 points or 0.8%, at 13,333.75.

The Dow

DJIA,

fell 0.1% last week, while the S&P 500

SPX,

ticked up 0.4%, and the Nasdaq Composite

COMP,

advanced 2.2%. The S&P 500 is up for three consecutive weeks but remains down 13% for the year to date.

What’s driving markets

Firmer equity index futures point to Wall Street challenging its highest levels in more than two months. Since hitting its 2022 low in mid June, the S&P 500 is up 13% after investors made bets that pessimism over corporate prospects, in the wake of surging inflation and tighter central bank monetary policy, was overdone.

Read: A surging stock market is on the verge of signaling a ‘huge’ move — but there’s a catch

Stocks initially sold off on Friday in the wake of a much stronger than expected U.S. jobs report for July, when investors fretted that the data gave the Federal Reserve more leeway to quicken the pace of interest rate hikes in order to damp inflation.

But risk appetite has returned, with traders hoping that a robust labor market challenges recent evidence of a slowing U.S. economy and as a generally well-received second-quarter company earnings season comes to a close. Investors are also absorbing news that the U.S. Senate over the weekend approved Democrat’s big healthcare, climate and tax package.

“While it was all too easy for some to mock efforts to downplay the first half ‘recession,’ Friday’s payrolls print put the shoe on the other foot,” said analysts at Jefferies in a weekend note.

“As of the end of July, the U.S. workforce is officially larger than it was in Feb ’20. Calling the current economy strongest ever in the face of negative GDP just got a little less absurd. So in this context, the fact that the SPX bounced off Friday’s low to not totally kill off the torrid run we’ve observed since mid-July makes sense,” the Jefferies analysts added.

See: Suddenly, stock-market investors are wrestling with ‘boomflation’ after hot July jobs report

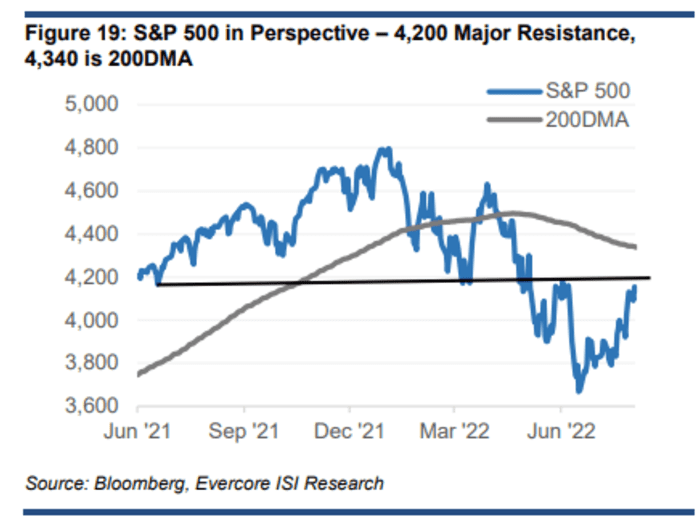

The market rally now faces some technical challenges, argued some observers. The S&P 500 surge of late has left its 14-day relative strength index, a closely-watched momentum gauge, at 71.6 and in “overbought” territory.

And the benchmark index now is also eyeing resistance at the 4,200 level, and if that is breached then the 200-day moving average looms into view.

Source: Evercore ISI

“Economic and policy uncertainty translating into continued trade in the S&P 500 below 4,200 and 4,340 leaves open the possibility of lower lows,” said analysts at Evercore ISI.

Investors were assessing the implications of a massive healthcare, climate and tax package that passed the Senate Sunday on a party-line vote, handing President Joe Biden a political victory. The package is expected to win approval in the Democratic-controlled House.

It includes an extension of a tax credit for the purchase of electric vehicles. Shares of Tesla Inc.

TSLA,

were up 2% in premarket action.

Earnings season, which has so far been characterized as not as bad as feared, is moving into the home stretch. Some 435 members of the S&P 500 had reported second-quarter results as of Friday morning, and year-over-year growth in the blended estimate for earnings per share, which includes reported results and estimates of still-to-be-reported results, stands 6.8%, according to FactSet. That’s up from an estimate of 5.6% as of March 31.

Also read: 5 things we’ve learned from earnings season so far: How big an impact is inflation having?

Supporting the market mood is a calmer tone in sovereign bonds, with the U.S. 10-year Treasury yield

TMUBMUSD10Y,

which had jumped on Friday following the jobs data, easing 3 basis points to 2.802%.

Also helping underpin the market’s risk appetite on Monday is a continued slide in energy costs, which should assist in reducing inflation in the coming months. The WTI crude oil future

CL.1,

was down 0.2% to $89.40 a barrel, near its cheapest since Russia’s invasion of Ukraine in February.

Companies in focus

-

Shares of Warren Buffett’s Berkshire Hathaway Inc.

BRK.A,

-0.59% BRKB,

-1.13%

were down 1.2% in premarket trade after reporting a $43.76 billion loss in the second quarter as the paper value of its investments plummeted. Berkshire’s operating earnings, which exclude some investment results, rose to $9.3 billion from $6.7 billion a year earlier. Buffett has said operating earnings are his preferred gauge for measuring performance. -

Palantir Technologies Inc.

PLTR,

+1.15%

shares were down 14% after the software company posted a surprise adjusted loss on a per-share basis and delivered revenue guidance that fell short of the consensus view.

How are other assets faring

-

The ICE Dollar index

DXY,

-0.29%

fell 0.2%. -

Bitcoin

BTCUSD,

+3.46%

advanced 2.6% to $23,866. -

Asia markets were mixed after another COVID-19 lockdown in a part of China impacted sentiment. Hong Kong’s Hang Seng

HSI,

-0.77%

fell 0.8% and Japan’s Nikkei 225

NIK,

+0.26%

rose 0.3%. In Europe, the Stoxx 600

SXXP,

+0.94%

rose 0.5%.