This post was originally published on this site

U.S. stock-index futures ticked lower on Wednesday after strong back-to-back gains as benchmark Treasury yields moved further above 4%.

How are stock-index futures trading

-

S&P 500 futures

ES00,

-0.62%

were down 11.50 points, or 0.3%, at 3,721.25. -

Dow Jones Industrial Average futures

YM00,

-0.48%

were off 82 points, or 0.3%, at 30,494. -

Nasdaq-100 futures

NQ00,

-0.58%

fell 32.25 points, or 0.3%, to 11,168.50.

On Tuesday, the Dow

DJIA,

rose 551 points, or 1.9%, to 30186, the S&P 500

SPX,

rpse 2.7% and the Nasdaq Composite

COMP,

gained 3.4%. The S&P 500 is up 4% from its 2022 closing low but remains down 22% for the year to date.

What’s driving markets

Stocks were struggling after those back-to-back gains on Monday and Tuesday as worries about stubbornly high inflation counteracted good news on company earnings.

U.S. equity futures had been higher in the early hours after a well-received update from Netflix Inc.

NFLX,

cemented the impression that the third-quarter earnings season would support the market. Netflix shares were up 12% in premarket trade.

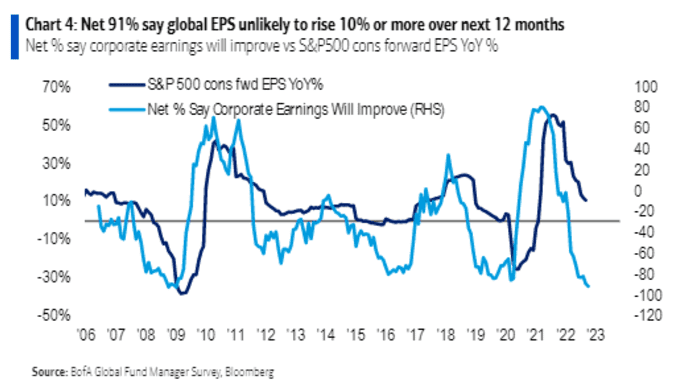

With 45 members of the S&P 500 index having reported, 69% have beaten profit expectations, according to Refinitiv. The high proportion of beats comes as investors are the most pessimistic since the great financial crisis of 2008 about future profit growth, according to a fund manager survey by Bank of America.

Source: Bank of America

Netflix’s positive surprise would help boost sentiment on Wall Street, said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, “following yesterday’s gains boosted by other resilient corporate earnings from the likes of Goldman Sachs and Johnson and Johnson”.

Earnings highlights on Wednesday include Procter & Gamble Co.

PG,

and after the close, Tesla Inc.

TSLA,

and International Business Machines Corp.

IBM,

Read: It’s the 35th anniversary of the 1987 stock-market crash: What investors need to know

However, news that U.K. inflation was back at a 40-year high of 10.1% reminded traders that central banks’ determination to battle such price pressures meant yet tighter monetary policy.

This has helped push the U.S. 10-year Treasury yield

TMUBMUSD10Y,

further above the significant 4% mark, up another 5 basis points to 4.061% as the equivalent duration U.K. gilt

TMBMKGB-10Y,

rose 4.9 basis points to 3.997%.

“As has been the case of late, any disturbance in global fixed-income markets immediately hemorrhages into risk,” said Stephen Innes managing partner at SPI Asset Management.

In U.S. economic data, US housing starts fell 8.1% in September, after a revised 13.7% rise in August. U.S. building permits rose 1.4% in September.

Investors are also expecting the Federal Reserve’s Beige Book of anecdotes to be released at 2 p.m. Eastern.

Minneapolis Fed President Neel Kashkari is due to speak at 1 p.m. and Chicago Fed President Charles Evans will deliver comments at 6:30 p.m.

Companies in focus

-

Procter & Gamble

PG,

+0.81%

shares were up 2% after the consumer packaged goods company reported fiscal first-quarter profit and sales that rose above expectations, as higher pricing provided a boost, but lowered its full-year sales outlook. -

United Airlines Holdings Inc.

UAL,

+3.19%

stock rallied 5.4% in premarket trading Wednesday after the airline said Tuesday it expected the travel rebound to weather a shakier economy in the months ahead and reported third-quarter results that beat expectations. -

Hair-care company Olaplex Holdings Inc.

OLPX,

+1.98%

shares dived 43.5% Wednesday after its management team dramatically reduced its financial outlook for the full year in the face of competitive and economic pressures. -

Shares of Walt Disney Co.

DIS,

+1.18%

advanced 1.6% as a strong earnings report from fellow streaming video provider Netflix Inc. NFLX, -1.73% likely provided a boost. -

Ally Financial Inc.

ALLY,

-4.65%

shares fell 5.9% in premarket trades on Wednesday after the mortgage, car loan and banking provider’s adjusted earnings per share and revenue fell short of analyst targets. -

Adobe Inc.

ADBE,

-0.18%

shares rose 1.4% in premarket trading Wednesday after the software company did what many tech companies have not this earnings season: Stick to its forecast. -

Abbott Laboratories

ABT,

+1.41%

shares tanked 3.8% Wednesday after the company said it had earnings of $1.4 billion in the third quarter of 2022, compared with $2.1 billion in the same quarter a year ago. The company reported that sales fell 4.7% to $10.4 billion in the third quarter, partly due to shortages of baby formula since the start of the year, and falling sales of COVID-19 tests.