This post was originally published on this site

Is the global economy steering toward a Bretton Woods for the digital-currency age?

Sunday marks the 50th anniversary of what has been described as the dropping of a “monetary bombshell” on the world financial system, when President Richard Nixon announced that the dollar would no longer be pegged to gold, effectively yanking America out of an international currency regime established by the Bretton Woods agreement.

The international monetary system was forged in the 1940s amid political turmoil, the fight against fascism and global economic instability, economists and historians have said. The primary aim of the Bretton Woods agreement was to create a currency system less rigid than the gold standard while providing stability. As part of the effort, the conference laid the foundations for the International Monetary Fund and the World Bank.

Now, five decades later, the monetary regime in the wake of the dissolution of Bretton Woods on Aug. 15, 1971 isn’t that much different than what it was prior. The dollar still serves as the reserve currency of the world. But in an era of bitcoin

BTCUSD,

and crypto and an apparent rise of stable coins, pegged to fiat currencies, and central bank digital currencies, aka CBDCs, a new global regime could be at hand.

“The case for an international currency is as strong today as it was then, but remains difficult to implement,” wrote Ousmène Jacques Mandeng, director of advisory boutique Economics Advisory Ltd, in a guest column in the Financial Times published Monday (paywall). Mandeng described the depegging of gold from the dollar as “a monetary bombshell.”

There are a few similarities between the period of Nixon and 2021. Inflation picked up steam in the 1960s and reached nearly 6% in 1970, and world dollar reserves rose sharply. Inflation was running at around 5.4% over the past 12 months from 1.4% in 2020, according to the Bureau of Labor Statistics.

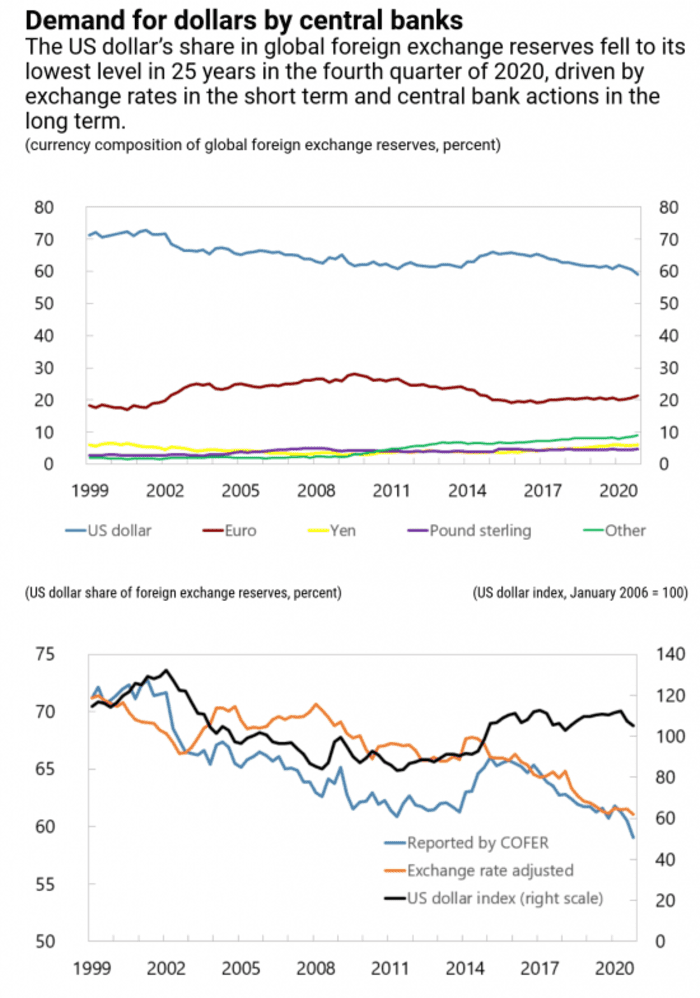

However, the share of U.S. dollars held in global foreign exchange reserves is around the lowest levels in 25 years, during the fourth quarter of 2020, the most recently available data, according to the IMF’s Currency Composition of Official Foreign Exchange Reserves survey.

IMF

Meanwhile, the supply of stable coins, like Tether

USDTUSD,

and Circle-backed USDC digital currencies usually backed by a fiat currency or some other asset to keep values fixed, has climbed by 900% to over $100 billion from a year ago, the Block reported in late May.

Cryptocurrencies like bitcoin haven’t become widely used as a means of payment, in part because their values are so volatile relative to the U.S. dollar

DXY,

or other government-backed currencies. Because stablecoins are pegged to the dollar, many crypto enthusiasts see them as essential for promoting the use of digital currencies for everyday purchases. Meanwhile, advocates of a so-called central bank digital currency have argued that a CBDC could function similarly to a stablecoin, but with reduced risk.

It seems a movement toward a digital regime is already under way.

Treasury Secretary Janet Yellen already convened a meeting of regulators, including Securities and Exchange Commission head Gary Gensler, to discuss stablecoins, in light of the rapid proliferation of the digital assets and concerns about segments of the digital-currency market.

Critics of stablecoins say they pose significant risks to financial stability, especially after it was revealed that some of these dollar-pegged tokens aren’t 100% backed by actual U.S. dollars, but a combination of riskier assets.

Kenneth Rogoff, a professor of economics and public policy at Harvard University, told MarketWatch in a phone interview that he can understand why stablecoin supply, in particular, has exploded.

“A lot of it is the unease, not just the Chinese but the Europeans, have with the U.S. controlling the rails of the global [monetary] system because the dollar is so dominant,” Rogoff said.

That said, the former chief economist of the IMF from 2001 to 2003 said that he thinks that there is still a lot to do before any CBDC meets the requirements for use by central banks. Rogoff said that CBDCs need to have the same level of transparency and speed and ease of use that the U.S. Federal Reserve currently enjoys with the existing system.

“The game-changer would be if CBDCs were interoperable,” writes Barry Eichengreen, professor of economics at the University of California, Berkeley, and a former senior policy adviser at the International Monetary Fund, in a column for Project Syndicate published Tuesday.

For his part, Rogoff views crypto more broadly as not a solution looking for a problem but “a problem.”

“Ransomware, tax evasion, crime. It is the Wild West,” he said of digital assets.

What’s on deck next week?

After the S&P 500 index

SPX,

and the Dow Jones Industrial Average

DJIA,

on Friday booked four tandem record closes for the first time since 2017 (the Nasdaq Composite Index COMP finished less 0.5% from its Aug. 5 closing record), investors will be focused ahead mainly on retail sales for July at 8:30 a.m. ET Tuesday and minutes from the Federal Open Market Committee due at 2 p.m. on Wednesday to glean further clues about the health of the economy and the central bank’s monetary policy plans.

Wednesday also brings reports on housing starts and building permits at 8:30 a.m. that likely will be followed for insights on the bubblicious home market, which is showing signs of cooling.

Investors may also watch a reading of manufacturing in the New York state area for August, Empire State manufacturing index at 8:30 a.m. on Monday, a similar report for the Fed’s Philadelphia region on Thursday, as well as the usual weekly jobless claims report at 8:30 a.m.

Next week, markets are retail heavy, with giants like Walmart Inc.

WMT,

Home Depot Inc.

HD,

set to report on Tuesday. Target Corp., home-improvement company Lowe’s Cos.

LOW,

and TJ Maxx parent TJX Cos.

TJX,

set to report on Wednesday. Semiconductor company Nvidia NVDA also reports Wednesday.

Coach parent Tapestry

TPR,

Estee Lauder Cos.

EL,

Ross Stores

ROST,

and Macy’s Inc.

M,

report on Thursday.