This post was originally published on this site

U.S. stocks finished sharply higher on Wednesday, booking their largest daily percentage gain in three weeks, as investors digested better-than-expected earnings reports and data showing a rise in U.S. consumer confidence.

How stocks traded

-

The Dow Jones Industrial Average

DJIA,

+1.60%

was up 526.74 points, or 1.6%, to finish at 33,376.48. -

The S&P 500

SPX,

+1.49%

rose 56.82 points, or 1.5%, ending at 3,878.44. -

The Nasdaq Composite

COMP,

+1.54%

advanced 162.26 points, or 1.5%, to end at 10,709.37.

On Tuesday, the S&P 500, Dow industrials, and Nasdaq Composite posted modest gains, snapping a four-day string of losses.

What drove markets

The Conference Board said Wednesday that U.S. consumer confidence “bounced back in December,” after back-to-back monthly drops. Its consumer confidence index jumped to an eight-month high of 108.3 in December, exceeding forecasts from economists polled by The Wall Street Journal.

In other economic data, U.S. existing-home sales fell 7.7% to a seasonally adjusted annual rate of 4.09 million in November, worse than the consensus estimate for a 5.2% decline, the National Association of Realtors said Wednesday. The level of sales activity was down 35.4% year-over-year to around where it was in 2010.

See: Nike’s shares surge as analysts applaud a return to growth in China

Meanwhile, investors were cheered by the strong earnings from Nike Inc.

NKE,

and FedEx Corporation

FDX,

with hopes that corporate earnings may be better than feared even during a potential economic downturn. The sporting-goods retailer reported quarterly earnings and sales which were solidly higher than Wall Street expected, supported by a rebound of business in China and improving inventory levels due to strong consumer demand.

Nike shares finished 12.2% higher, leading Dow gainers and booking its largest one-day percentage increase since June 25, 2021, when it rose 15.53%, according to Dow Jones Market Data.

Steve Sosnick, Interactive Brokers’ chief strategist thinks the stock-market rally indicates that investors have finally digested the Federal Reserve’s message from last week. The “triple-whammy” of better-than-expected earnings from FedEx and Nike and the positive consumer sentiment offer “substantive reasons” to be hopeful.

But Matt Lloyd, chief investment strategist at Advisors Asset Management, expressed caution over the stock market’s sharp move higher Wednesday.

“These moves that you see today are just head fakes,” Lloyd said in a phone interview. “There’s less volume” in trading heading into the end of the year, leading to exaggerated moves in the market, he said.

“The problem is the economy really is fundamentally much weaker,” and earnings may have to drop “a lot more,” said Lloyd, adding that he’s expecting a recession in 2023.

Markets have also brushed aside a surprise monetary shift by the Bank of Japan on Tuesday, when it raised the yield at which it allows the country’s 10-year government bond to trade. The move has been viewed by some investors as a first step toward the bank ending its era of ultra easy monetary policy, though BOJ Gov. Haruhiko Kuroda described the measure as neither a tightening nor a move toward the exit.

Read: Why the Bank of Japan’s surprise policy twist rattled global financial markets

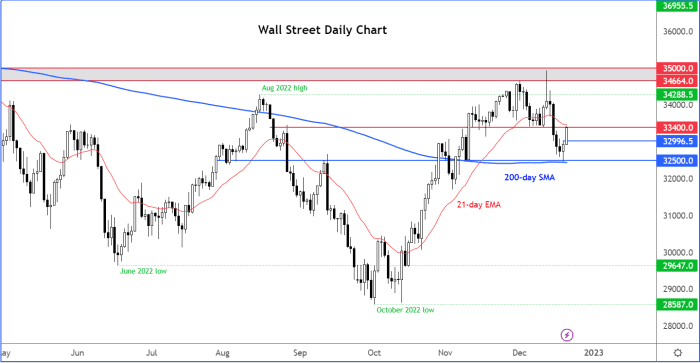

The Dow, meanwhile, was pressing up against an important resistance level on its price chart, said Fawad Razaqzada, market analyst at City Index and Forex.com, in a note.

Forex.com

“At the time of writing, the Dow was testing key resistance around 33,400 area,” which had served as the last major support level on the chart before the Dow broke down last week, he wrote (see chart above). “Once support, could it now turn into strong resistance leading to a big selloff?”

If resistance holds, the chart watcher said he would expect to see a drop back to the high of Tuesday’s range around 33,000. “And if that level fails to offer support, then there is a possibility we will see a revisit of the week’s low, which at 32,500 happens to be where the 200-day average comes into play,” he said. “However, if resistance at 33,400 breaks convincingly, then that would end the renewed bearish bias.”

Companies in focus

-

Shares of Six Flags Entertainment Corporation

SIX,

+11.76%

finished 11.8% higher after The Wall Street Journal reported that activist shareholder Land & Buildings Investment Management has taken an approximate 3% stake in the theme-park operator and is seeking to monetize its real estate. -

Rite Aid Corporation

RAD,

-17.23%

shares dropped 17.2% after the pharmacy operator reported a smaller quarterly loss than expected and lowered its full-year financial guidance citing seasonal markdowns among other issues. -

Electric-vehicle maker Tesla Inc.

TSLA,

-0.17%

is planning another round of layoffs for the first quarter and is instituting a hiring freeze, Electrek reported on Wednesday, citing a person familiar with the matter. Tesla shares ended 0.2% lower.

In One Chart: Possible Tesla bounce good for a trade, but not an investment, says technical analyst

— Barbara Kollmeyer contributed to this article