This post was originally published on this site

U.S. stock futures are sliding on Monday amid fears the recent rally was based on false optimism about a less hawkish Federal Reserve.

How are stock index futures trading

-

S&P 500 futures

ES00,

-1.13%

dipped 48 points, or 1.1%, to 4183 -

Dow Jones Industrial Average futures

YM00,

-0.90%

fell 298 points, or 0.9%, to 33408 -

Nasdaq 100 futures

NQ00,

-1.53%

eased 205 points, or 1.5%, to 13064

On Friday, the Dow Jones Industrial Average

DJIA,

fell 292 points, or 0.86%, to 33707, the S&P 500

SPX,

declined 55 points, or 1.29%, to 4228, and the Nasdaq Composite

COMP,

dropped 260 points, or 2.01%, to 12705. The Nasdaq Composite is up 19.3% from its mid-June low but remains down 18.8% for the year to date.

What’s driving markets

Wall Street was on course for a consecutive day of chunky declines as investors expressed wariness over a series of monetary, technical and seasonal factors.

The benchmark S&P 500 had rallied sharply off its mid-June low, partly on hopes that indications of peak inflation would allow the Fed to slow the pace of interest rate rises and even pivot to a dovish trajectory next year.

However, that assumption has been challenged over the past several days by a succession of Fed officials who, to the market’s mind at least. seemed to be making a concerted effort to disabuse traders of the less hawkish narrative.

“Fed speakers continued to reiterate a ‘whatever it takes’ narrative to curb inflation,” noted Julian Emanuel, analyst at Evercore ISI, adding that the Fed is likely to maintain its “resolutely hawkish tone” at the Jackson Hole Symposium that begins later this week.

Falling bond yields had helped equities in their recent rally. But after dropping below 2.6% at the start of August, the 10-year yield

TMUBMUSD10Y,

is nearing 3% again.

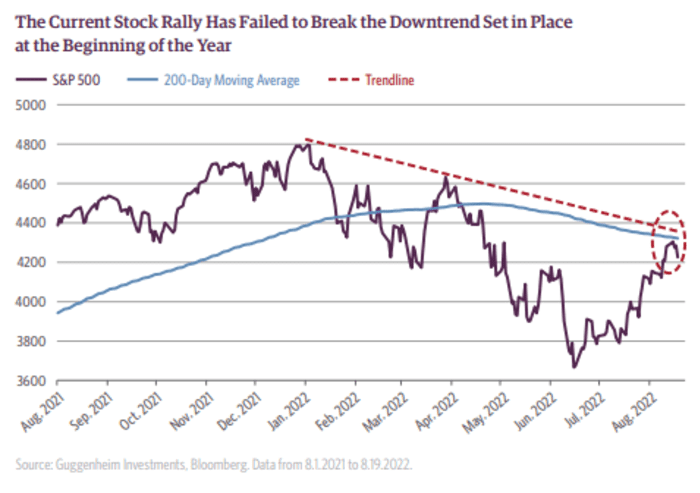

Another issue worrying the bulls is the S&P 500’s failure to break through a key technical level, raising fears the market remains in a downtrend.

Source: Guggenheim

“Stocks have seen a strong rally since the Federal Open Market Committee meeting in mid-June, but the S&P 500 has struggled to close above its 200-day moving average in the past week,” said analysts at Guggenheim in a note.

“Based on the history of previous bear markets, this level (currently 4,320) is an important one to watch. A failure to break the 200-day moving average could portend much deeper losses for equities in the months ahead.”

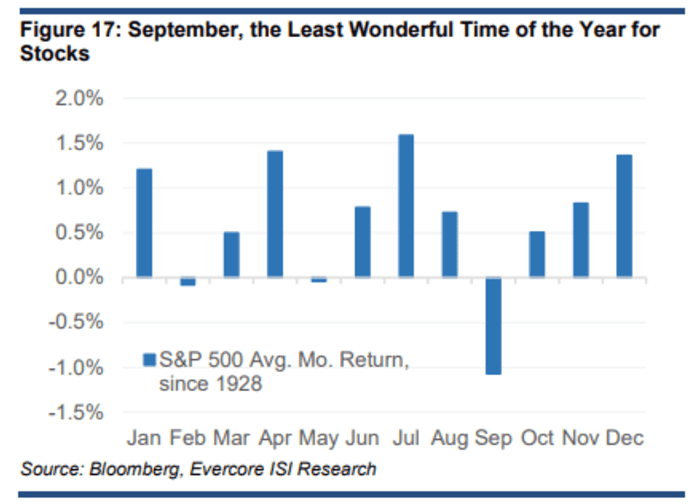

In addition, traders are aware that the market is entering a period of traditional weakness, with September often a negative month for stocks, notes Evercore’s Emanuel.

Source: Evercore ISI

Finally, the dollar index

DXY,

is back to 20-year highs as worries about the European economy amid surging energy prices pull the euro

EURUSD,

to parity with the buck. A strong dollar is associated with weaker stocks, since it erodes foreign earnings of American multinationals by making them worth less in U.S. dollar terms.

Still, Lori Calvasina, equity analyst at RBC Capital Markets, noted that some investors thought “the summer rally in the S&P 500 has left stocks looking expensive again” but she was more sanguine about the market’s prospects.

“S&P 500 P/E’s have moved slightly above average on bottom-up consensus EPS forecasts, and look even more elevated on our own EPS forecasts of $214 (2022) and $212 (2023),” she accepted.

“But even when we substitute in our own EPS views to the P/E calculation, it’s worth noting that multiples are still decently below the last few major peaks. In our minds, while this is worrisome, it’s not sufficient to call an imminent end to the summer rebound.”

How are other assets faring

-

The overall risk-off tone in the market is impacting most asset classes. Oil futures

CL.1,

-0.24%

were lower with U.S. crude down 2% to $89.01 a barrel. -

Bitcoin

BTCUSD,

-1.13%

fell 2.4% to $21006. -

In Europe, the Stoxx 600 equity index

SXXP,

-0.93%

fell 1.2%. In Asia most bourses were also lower, though China’s Shanghai Composite

SHCOMP,

+0.61%

bucked the trend with a 0.6% gain after the central bank trimmed mortgage rates to support the struggling property sector.