This post was originally published on this site

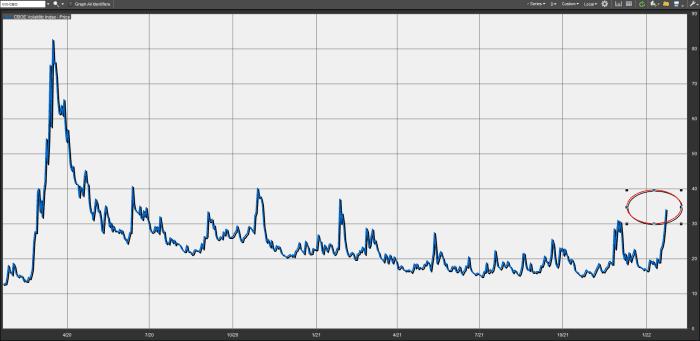

The Cboe Volatility Index, or VIX, also known as Wall Street’s fear gauge—is on track for its sharpest gain to start a year on record and its biggest monthly surge since the COVID pandemic took hold two years, as anxieties about Federal Reserve policy, surging inflation and the economic rebound from the viral epidemic converge to knock risk assets decidedly lower.

The VIX

VIX,

was trading nearly 98% higher so far in January, which would mark its sharpest monthly gain, if the advance holds, since the a 112% surge in February of 2020, FactSet data show.

FactSet

According to Dow Jones Market Data, the VIX is up 103% over the first 15 trading days to start the year, which would mark the largest gain through the first 15 trading days of the new year on record, based on all available data back to 1990.

The monthly gain also was set to be its third-largest on record.

The index is based on volatility expectations of options on the S&P 500 in the coming 30 days and tends to rise when stocks are falling and decline when stocks climb. The index tends to see a surge when markets face a sharp decline. It hit an record of 82.69 on March 16 in 2020, when fears about the COVID panic were at an apex in U.S. markets.

Check out: Stocks Plunge, Bitcoin’s Slide Deepens—and What Else Is Happening in the Stock Market Today

Fears on Monday were pegged to a confluence of events, including a Federal Reserve meeting on Tuesday and Wednesday, in which the central bank is expected to shed more light on its tactics for combating a surge in inflation. Mounting tensions between Russia over the military buildup on the border with Ukraine also has market concerns riding higher.

Against the backdrop, the S&P 500 index

SPX,

was plunging toward its first correction since February of 2020, as the Dow Jones Industrial Average

DJIA,

and the Nasdaq Composite Index

COMP,

also fell precipitously during a volatile period in equity trading to start 2022.

Equity markets had enjoyed a series of all-time highs until earlier this year, as the Fed signaled more clearly that it would tighten policy faster and more significantly as it wrestles with too-hot inflation.