This post was originally published on this site

Even if the Federal Reserve can pull off the difficult task of cooling high inflation without driving the economy into a ditch, that doesn’t necessarily mean markets will be out of the woods.

Stocks and bonds already endured a rough start the year, in advance of the Fed kicking off its monetary policy tightening cycle in earnest. Next week the central bank is expected to pull the trigger on its first half-percentage point rate increase in more than two decades, and start shrinking its near $9 trillion balance sheet.

The Fed’s efforts aim to ease the climbing cost of living, now at the highest since early 1980s, before a recession takes hold, but higher interest rates and tighter financial conditions also could mean more pain to come on Wall Street.

“A lot of the discussion seems to be around if the Fed can achieve a ‘soft landing’ for the economy,” said David Del Vecchio, co-head of U.S. investment-grade corporates at PGIM Fixed Income, by phone. “That seems really challenging in this environment where they’re really behind the curve.”

With Goldman Sachs putting the odds of a recession at 35% over the next 24 months, Del Vecchio said, “the probability of markets selling off is even higher.”

Stock-market carnage

Stocks finished a bruising April even lower on Friday, with both the Dow Jones Industrial Average

DJIA,

and S&P 500 index

SPX,

booking their sharpest monthly percentage fall since March 2020.

The ongoing carnage in once highflying technology stocks helped land the S&P 500 index back into correction territory for a second time in 2022, while handing the Nasdaq Composite Index

COMP,

a 13.3% decline in April, its steepest monthly plunge since October 2008.

“The S&P 500 rode” the rally, as a handful of major technology companies helped U.S. corporates put up record profit last year, said Don Townswick, director of equity strategies at Conning, by phone.

“Unfortunately, it’s going to ride those stocks down a little bit,” he said. “The market became very dependent on these companies for its direction.”

What’s more, a hawkish Fed will keep pressure on growth stocks, said Steve Chiavarone, senior portfolio manager and equity strategist at Federated Hermes, in a Thursday client note.

While there soon could be “tactical opportunities” in technology and related growth stocks given their recent violent selloff, Chiavarone warned that “valuations continue to get squeezed,” mainly from rising rates.

Bond rout

Bonds often pitched as steady, boring and lower-risk investments have capitulated too, with highly rated U.S. corporate bonds putting in their worst performance since the collapse of Lehman Brothers in 2008.

“Total returns have been much more negative than we’ve been used to for a very long time,” Del Vecchio said.

Goldman analysts pegged total returns on the year at negative -12% for U.S. investment-grade corporate bonds, debt issued by many Fortune 500 companies.

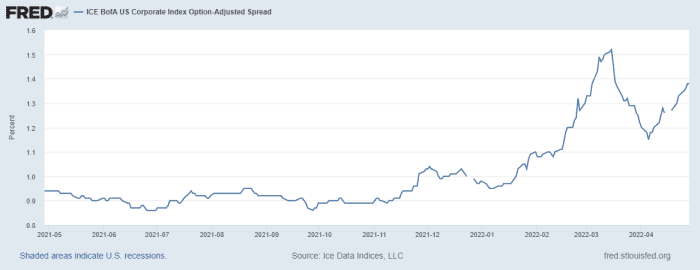

Spreads in the sector, or the premium bonds pay over risk-free Treasury yields to help offset default risk, have widened about 50 basis points (see chart) from last year’s lows too.

Investment-grade corporate bonds climb from lows

Federal Reserve FRED data. ICE BofA US Corporate Index

“The backdrop was so good that spreads were able to tighten into very rich levels,” Del Vecchio said. Recent levels appear closer to “fair value,” he said, but thinks they still could cheapen given uncertainty around the path of rate hikes, geopolitics and the Fed’s balance sheet reduction plans.

“I think you want to be selective here,” he said. “Because given the potential runway to a recession is pretty long, that means you probably will have some rallies between now and then. And you probably should think carefully, and use those rallies, if they come, to lighten up on risk.”