This post was originally published on this site

Expect more volatility this summer, but perhaps not as bad a Monday’s sharp market rout.

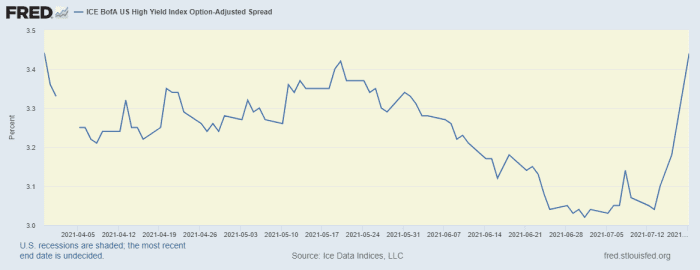

That’s the message coming from the riskiest part of the $10.7 trillion U.S. corporate bond market on Tuesday, a day after non-investment grade, or “junk bond,” spreads gapped out by a jaw-dropping 22 basis points.

“At some point, spreads can’t continue to fall,” said Collin Martin, fixed income strategist at Schwab Center for Financial Research, who pegged Monday’s selloff as the biggest lurch higher in junk-bond spreads since November. “That’s nothing to sneeze at.”

“I think it’s probably a wake-up call for some investors,” he told MarketWatch. “It’s been such a smooth ride, but there are risks. There comes a point when you are not being compensated enough.”

Spreads on U.S. junk bonds had been climbing since early July, from near-record lows of about 302 basis points above Treasurys three weeks ago to 344 basis points on Monday, a level last seen in October.

Spreads on junk bond climb.

Federal Reserve Bank of St. Louis

Spreads are the level of compensation investors earn on bonds above a risk-free benchmark, like Treasurys

TMUBMUSD10Y,

to help compensate for default risks. Lower, or “tighter,” spreads often signal a hunt for yield by investors or increased appetite for risk, even if buyers are getting paid less.

Schwab’s Martin said that while easy U.S. monetary policies helped keep credit flowing to junk-rated companies during the pandemic, some of the broader “supports we’ve seen for the past year-plus are not there anymore.”

Like others, he thinks markets already may have benefited from “peak everything,” including growth, earnings and fiscal stimulus. The Federal Reserve also has been selling down the rest of its corporate debt holdings accumulated during the crisis, after making a historic leap into the sector during the pandemic.

Read: Is the Fed ‘tightening cycle’ already happening?

On the plus side, defaults in the junk-bond market have been near historic lows. The Fed also has yet to signal any pullback in its monthly $120 billion bond-buying program of Treasurys and agency mortgage debt, while benchmark rates are expected to remain near zero until 2023.

“There’s a lot of positive factors out there,” Martin said. “Hopefully the rally we are seeing today continues.”

The Dow Jones Industrial Average

DJIA,

on Tuesday clawed back most of its 725- point tumble a day before, its worst fall since October, on concerns about the spreading delta variant of COVID-19 and rising U.S. -China tensions.

Publicly traded junk-bond funds on Tuesday, including the closely watched SPDR Bloomberg Barclays High Yield Bond ETF

JNK,

and iShares iBoxx $ High Yield Corporate Bond ETF

HYG,

rallied by 0.4% and 0.5%, respectively.

“The market has been waiting for a pullback,” said David Norris, head of U.S. Credit at TwentyFour Asset Management, adding that his team took the opportunity during Monday’s selloff to add names it likes, while getting paid a bit more.

“Coming into the summer months, generally there are lighter flows and thinner markets,” he told MarketWatch.

But when you add in the heightened awareness around the delta variant and rising COVID cases, Norris thinks the “next six to seven weeks” leading up to the Fed’s Jackson Hole, Wyo., summit in late August could be choppy.

“We do expect a little bit of volatility, but nothing like yesterday,” he said.