This post was originally published on this site

The U.S. dollar soared versus the Japanese yen Friday, taking it to another five-year high as the Federal Reserve and Bank of Japan prepare for monetary policy meetings next week.

The dollar jumped 0.9% versus the Japanese currency

USDJPY,

to fetch 117.17 yen, trading at a level last seen on Jan. 4, 2017, according to Tullet Prebon data. It would be the dollar’s strongest daily jump versus the yen since November.

“Today’s (and arguably this week’s) most noteworthy FX move is the break of resistance in USDJPY,” wrote BMO Capital Markets currency strategists Greg Anderson and Stephen Gallo, in a Friday note.

The currency pair had made two trips above 116 yen earlier this year, but met selling around the 116.30 yen level to turn back sharply lower, they noted. But the pair pushed to 116.40 early in the Asian session Friday, turned back briefly, then broke above 116.50 on a second wave.

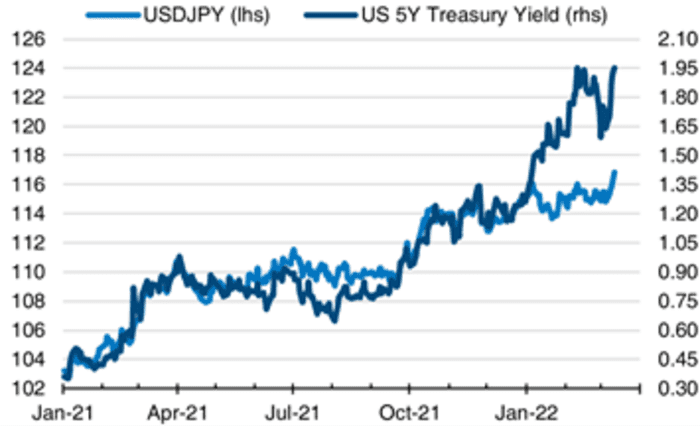

Anderson and Gallo have argued the pair should be trading above 120 yen given movements in U.S. bond yields (see chart below), while oil

CL.1,

BRN00,

trading above $100 a barrel is a “hugely negative” factor for the yen, given the country’s reliance on energy imports.

BMO Capital Markets

They said the price action also appeared to reflect the usual squaring up of transactions by Japanese financial institutions ahead of he country’s March 31 financial year-end.

Meanwhile, the Fed is widely expected to kick off an interest rate-hike cycle when it meets in the week ahead, with traders looking for a quarter percentage point rise in the fed-funds rate. The Bank of Japan, which also meets, is likely to cut its forecasts for economic growth and inflation despite rising energy and commodity prices, wrote Matthew Weller, global head of research at FOREX.com and City Index.

Traders will be eager to see if the Fed follows in the footsteps of the European Central Bank, which on Thursday emphasized the inflation risks around Russia’s invasion of Ukraine over the hit to economic growth, he said.

While a quarter-point increase by the Fed is seen as nearly a “done deal,” the release of the Fed’s Summary of Economic Projections, known as the “dot plot,” and any guidance on plans to shrink the balance sheet could have a big impact on dollar/yen, Weller said.