This post was originally published on this site

Market gurus are eager to see if a technical signal that helped tactical traders wring profits from last year’s market rout will continue to work in 2023, as stocks struggle to hold ground Monday after breaking a streak of weekly losses.

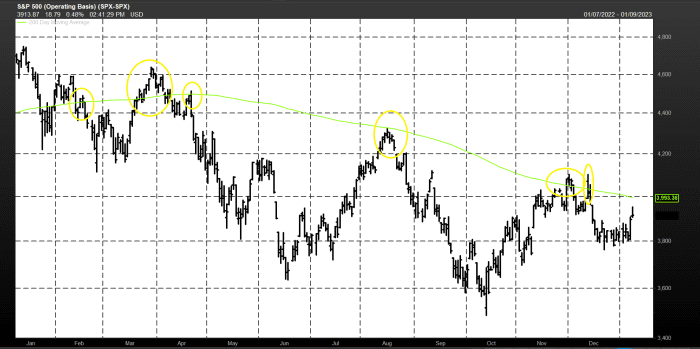

As markets trended lower in 2022, many technically-oriented traders hit upon a strategy that seemed to work: selling, or shorting, U.S. stocks once the S&P 500 hit its 200-day moving average.

In this case, the moving average, which is a gauge of the market’s long-term direction, served as a reliable indicator that the latest flash-in-the-pan rally — often driven by signs of cooling inflation or fleeting hopes for a less-aggressive Federal Reserve — had exhausted itself.

See: Morgan Stanley’s Mike Wilson warns U.S. stocks could slump another 22% if recession arrives in 2023

As the 200-day moving average declined for most of last year, this pattern emerged nearly half a dozen times, according to FactSet data and market strategists including BTIG Chief Technical Strategist Jonathan Krinsky. Although, the exact number may vary depending on the criteria one uses.

Sometimes the S&P 500

SPX,

last year lingered above the average for a week or more before turning lower, (see chart), like it did in March. Sometimes, it merely tapped the 200-day moving average in intraday trading, as was the case in August.

FACTSET

In many instances, shorting stocks at the 200-day moving average offered a reliable source of profits during one of the most dismal years for markets in recent memory.

Why did the strategy work so well?

Since the slope of the 200-day average represents the dominant directional trend for U.S. equities, when stock cross that level it signaled they were deviating from the underlying downward trend, according to Krinsky, in an interview with MarketWatch over the phone.

To be sure, this behavior isn’t exactly new: During the decade-long bull market that began in 2009, the 200-day moving average served as a reliable indicator for when investors should start buying after a brief pullback, Krinsky said.

Now, it has simply inverted as the trading environment has shifted from a bull market to a bear market. Krinsky and others said they expect technical signals like these to remain useful for traders.

Stocks often rebounded from brief selloffs during the decade-long bull run that followed the financial crisis, helped by rock-bottom interest rates and ample liquidity driven by the Fed’s bond-buying program. The pattern ultimately gave rise to a trading strategy known simply as “buying the dip.”

Now, traders are grappling with the opposite phenomenon, which some have called “selling the rip.”

How long it will continue remains to be seen. But strategists like Krinsky and Tom Essaye, president of Sevens Report Research, who also spoke to MarketWatch about the market’s trend-following tendencies, expect it will continue until the fundamental outlook for the U.S. economy changes.

What, exactly, would need to change to rescue markets from their doldrums?

According to Essaye, it would require the Fed signaling that it’s done hiking interest rates. The emergence of reliable signs that the U.S. economy has pulled off the “soft landing” that the central bank has been aiming for could also do the trick.

“A sustained break above the 200-day moving average would imply that investors are becoming fundamentally more optimistic about the market,” said Tom Essaye, founder of the Sevens Report.

“That would require real progress toward the Fed actually stopping its rate-hike campaign. Or progress toward the economy actually achieving a soft landing. Or progress toward inflation falling somewhere that is reasonably more acceptable to the Fed,” he said.

An imminent change on any of these fronts appears unlikely, according to Matt Tuttle, CEO of Tuttle Capital Management.

Also, senior Fed officials indicated that they don’t expect to start cutting interest rates until early 2024 in a batch of projections released at the Fed’s most recent meeting in December. Minutes from that meeting, released last week, supported this view.

A key reason why “selling the rip” worked so well last year was that investors repeatedly tried to front-run a shift in Fed policy by bidding up stocks, only for their hopes to be repeatedly dashed, often by Fed Chairman Jerome Powell.

Tuttle expects this tension between investors’ wishful thinking and the Fed’s insistence on defeating the most severe inflation seen in the U.S. in decades to persist for the foreseeable future.

“Don’t fight the Fed — people don’t say that just to say it. It’s great investment advice,” Tuttle said.

“The problem you’re going to run into [in 2023] is this constant battle of the Fed saying, ‘Hey we’re doing this’, and the market saying, ‘We don’t believe you’.”

Both the Dow Jones Industrial Average DJIA and the S&P 500 finished Monday with modest losses, while the tech-heavy Nasdaq Composite COMP booked a 0.6% gain.

Investors are looking ahead to comments from Powell due out Tuesday morning. Some, including Tuttle, suspect the central bank chief might poor more cold water on the market’s latest rally, as some have speculated that higher equity prices and lower Treasury yields could make it more difficult for the Fed to defeat inflation.