This post was originally published on this site

It’s been a volatile year for U.S. and global markets as the COVID-19 pandemic that gripped the world in 2020 moved into a new phase thanks to the omicron variant, but returns for equity investors have been strong on the back of fiscal and monetary policy that has kept interest rates at or near 0%.

Thus far, since taking the oath of office on Jan. 20, 2021, Democratic President Joe Biden can boast the best annual performance for the S&P 500 index

SPX,

since the first term of President Barack Obama, who sought to extricate America from the Great Recession of 2008-09 along with then-Vice President Biden.

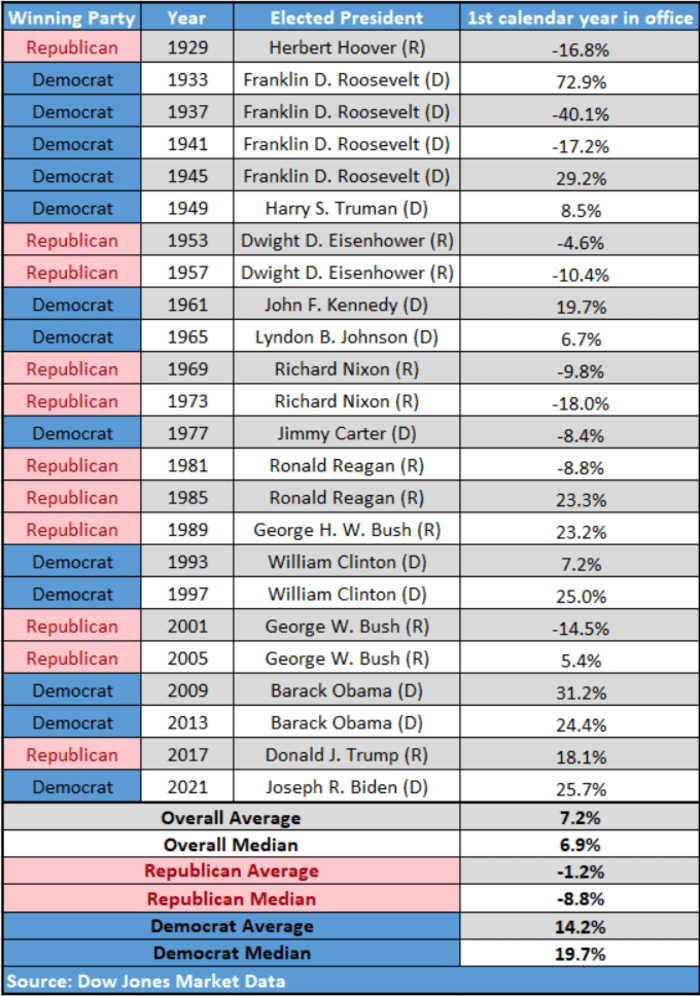

Near midday Friday, the S&P 500 was up over 25% in Biden’s first calendar year in office, compared with a 31.2% gain in the broad-market index under Obama. The equity market return for Biden is better than President Donald Trump’s 18.1% for the same index in 2017.

In fact, the average performance in the first year of a Democratic president since their swearing until the end of first year is a gain of 14.2% on average, compared with a 1.2% loss for the GOP.

Check out the attached table for a fuller list of the benchmark’s performance under other presidents since 1929.

Dow Jones Market Data

The performance of other benchmarks during Biden’s tenure also has been strong but aren’t as good as Trump’s first year, data show.

For example, the Dow Jones Industrial Average

DJIA,

was on track for a 17.5% return since Biden was sworn in compared with a 25.3% for the blue-chip gauge under Trump. The Nasdaq Composite

COMP,

has gained about 19% under Biden but rose 25% in Trump’s first year.

Trump saw greater outperformance compared to Biden in small-capitalization stocks, which can be more sensitive to economic expectations and the threat of higher interest rates. The small-capitalization Russell 2000 index was up a modest 4.7% this year, versus 14.1% in Trump’s first year.

Biden has pushed through a number of legislative packages through Congress to combat economic weakness created by the pandemic, including direct financial aid for many Americans and a $1.2 trillion infrastructure spending plan.

The Biden administration and many economists say the president’s proposed roughly $2 trillion spending plan for family support and climate change measures would add to inflation only slightly over the short term, while some Republicans argue against more government spending citing concerns about the fastest rise in consumer prices this year since the 1980’s, partly caused by supply-chain bottlenecks and labor shortages in the wake of the pandemic.

Democratic Sen. Joe Manchin (D., W.Va.) has cited inflation concerns as a key reason for his opposition to the social-spending package still being debated in Congress.

Peter Baker, chief White House correspondent for The New York Times and an MSNBC analyst noted via Twitter that the S&P 500 has seen 70 record-high closes, compared with 62 such records in Trump’s first year.

Technically, speaking those figures should be 61 S&P 500 records for Trump in 2017, with one of those all-time highs coming under Obama’s second term and 68 for Biden, with two records produced while Trump was still officially in office.

To be sure, the stock market usually trades based on the prospects and expected agenda under the new presidential regime after Election Day outcomes are determined.

Ken Jimenez contributed to this article