This post was originally published on this site

The wheels appear to be slowly coming off the bull wagon for U.S. stocks, at least in the near term.

The broad-market S&P 500 index

SPX,

notched its sixth decline in seven sessions Tuesday, according to data compiled by Dow Jones Market Data.

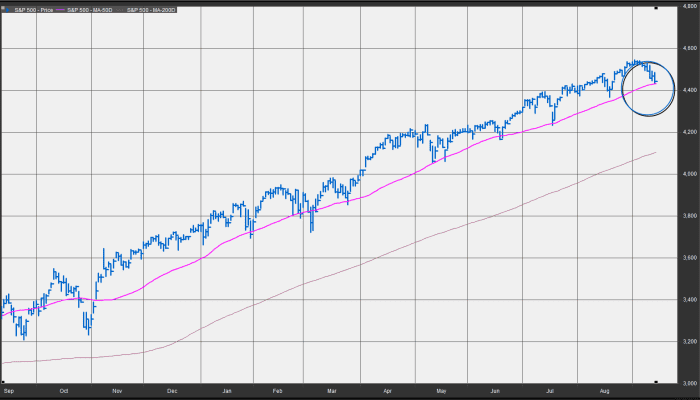

On top of that, the S&P 500 has been struggling to keep aloft of its 50-day moving average, which it hasn’t closed below since June 18. Many market technicians see the 50-day moving average as a guide to the short- to intermediate-term trend, so a close below that level tends to portend further weakness.

FactSet

Back in June, the S&P 500’s 50-day moving average stood at 4,181.95. Now, it is 4,429.09, according to FactSet data, with the index closing at about 4,443 on Tuesday.

The decline for the index comes as Wall Street has confronted a bout of weakness that also helped push the Dow Jones Industrial Average

DJIA,

and the technology-laden Nasdaq Composite Index

COMP,

lower Tuesday, a week ahead of an important meeting of the Federal Reserve, which could announce plans to taper its market-supportive asset purchases.

Bearish sentiment also has been elevated as concerns increase around the spread of cases of the delta variant of COVID-19, and the possibility that the deadly infection could deliver a fresh hit to economic activity. Stocks also have been hovering near levels that many strategists consider richly valued.

On Tuesday, the Dow logged a 0.6% drop, while the Nasdaq Composite finished 0.5% lower on the day. The small-capitalization Russell 2000 index

RUT,

was down by about 1.4%, at last check.

Markets on Tuesday briefly bounced higher after a reading of U.S. consumer-price index rose 0.3% in August, while the core reading, which excludes volatile food and energy prices, was up just 0.1%. The CPI increased 5.3% year over year, compared a rise of 5.5% for the year in July. The year-over-year change in core CPI fell back to 4%, from 4.3% in July.

However, markets saw an initial “relief rally” fade on the lighter-than-expected CPI reading, as it was deemed by some as unlikely to change the Fed’s plans for announcing a tapering of monthly purchases of $120 billion in Treasurys and mortgage-backed securities before the end of 2021.

Related: Why the Fed can now ‘sideline’ its large-scale asset purchases, according to Raymond James’ CIO