This post was originally published on this site

Investors looking for signs that the spread of the coronavirus delta variant is crimping economic activity, despite the lack of new widespread lockdowns, are so far finding little evidence in the types of high-frequency economic data that exploded in popularity during the early days of the pandemic.

A recent market narrative held that even without widespread lockdowns, the spread of the delta variant was likely to result in a slowdown in activities that can be measured by a range of publicly available data, including airline passenger check-ins, restaurant reservations, hotel occupancy and others.

“We’ve not seen that same trend play out,” said Garrett Melson, portfolio strategist at Natixis Investment Managers Solutions, in a phone interview.

“What we’ve seen is sentiment is taking a hit in terms of delta fears, but it’s not really flowing through to mobility data,” he said.

Read: Delta variant is creating cascade of reasons to question U.S. recovery in the second half

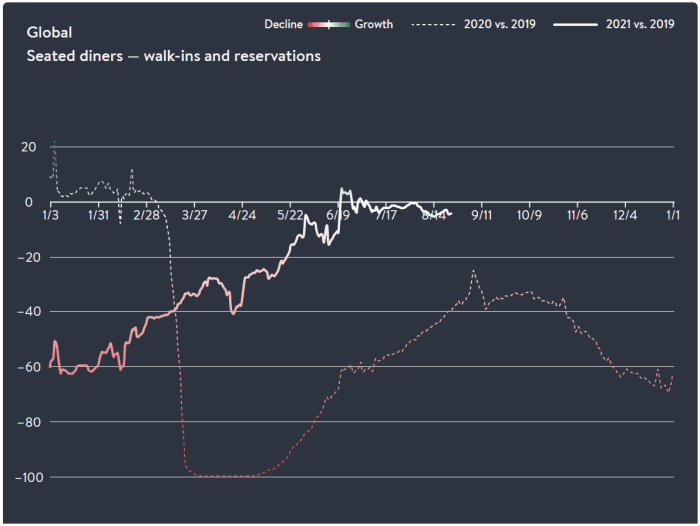

Take, for example, restaurant-reservation app OpenTable’s data on seated diners from reservations and walk-ins. As shown in the chart below, which tracks global 2020 and 2021 seatings, respectively, versus 2019 seatings, activity has stuck close to pre-pandemic levels in recent weeks.

The chart measures activity in 2020 and 2021 versus the same weekday in 2019.

OpenTable

In the U.S., Florida and Texas — two states among those hardest hit by the spread of the delta variant — saw restaurant bookings suffer a notable decline in early August, but stabilize last week, said Aneta Markowska, chief financial economist at Jefferies, in a Monday note. And there has been no clear response in retail foot traffic, which fell in Florida but rose in Texas, and elsewhere, she noted.

Related: This may be the post-pandemic economy’s most closely watched indicator

Flight and transit activity have appeared to stall, she said, along with hotel occupancy rates, but there was no evidence of harm to the labor market. The Jefferies U.S. Economic Activity Index rose modestly last week to 99.3, at the high end of its recent range, Markowska said. The index has been largely unchanged over the past five weeks, with gains in movement and employment offset by declines in consumer activity.

The various data have shown some signs of “flattening,” Melson said, but some of those indications are in line with seasonal patterns that investors have to be wary of when using so-called alternative data. Unlike official government releases that come with seasonal and other adjustments baked in, many such series need to be cleaned by investors and economists to give an accurate picture of underlying trends.

Melson said the largely resilient readings are a sign that the spread of the delta variant isn’t translating into the type of economic hit that some prognosticators had feared could take place as consumers take steps on their own to protect themselves from COVID-19.

The number of U.S. COVID-19 hospitalizations has continued to tick up, with new data showing that 100,000 people were currently hospitalized, a figure that is on track with levels seen over the winter.

Stocks, commodities and other assets viewed as risky fell last week, in a move attributed to growing fears over the spread of the delta variant. Many of those assets roared back this week, however, with analysts citing expectations the peak of the delta spread may be near.

U.S. stocks were slightly lower Thursday, but have seen solid gains this week, with the S&P 500

SPX,

and Nasdaq Composite

COMP,

closing at records on Wednesday.

Jeff Kleintop, chief global investment strategist at Charles Schwab & Co., argued that the data has become less useful as a signal of economic activity. A year ago, changes in mobility and other measures were closely correlated to the economy.

Heading into late summer this year, economic data has started to disappoint, he said, but investors got little warning from high-frequency indicators. Meanwhile, consumer confidence, as measured by the University of Michigan, took a big hit in August, falling to its lowest since 2011. July U.S. retail sales came in well below expectations, signaling a slowdown in spending.

The resilience of high-frequency data is likely “a sign that people have adapted physically to the virus,” Kleintop said. “It seems like it affects how they feel,but not what they do.”

“There’s a recognition that it’s just not that easy anymore to gauge economic activity from where people are physically. It makes it a little bit more complicated,” he said.

Understanding such adaptations is important, economists said.

“The relationship between an important indicator like mobility and economic activity overall is changing over time because humans learn and adapt,” said economist Jens Nordvig, founder of research firm Exante Data, in an Aug. 4 Barron’s Live interview with MarketWatch.

Watch Barron’s Live replay: Alternative Data: What Investors Need to Know

Early on in the pandemic, mobility data that measured items like how often individuals visited grocery stores or other retail outlets was very closely correlated to economic activity, Nordvig said. That relationship between mobility and economic activity has changed.

Consumers that stay away from stores find other ways to spend, he said. Workers staying away from the office soon learned to become more productive.

“Mobility is still an important indicator, but how you map it into economic activity is a nonlinear thing that changes over time, and, therefore, we have to be very careful about just assuming these relationships are linear,” he said.

Melson agreed that the relationship between the data and activity has changed over time, but remained upbeat about near-term economic prospects. He played down recent weakness in confidence and retail sales data.

Related: How investors are using alternative data to track the inflation debate

The drop in the consumer confidence reading may have reflected what’s become an increasingly partisan divide between Republican and Democratic consumers, he said, while the timing of Amazon.com Inc.’s “Prime Day” shopping event may have affected month-over-month retail sales numbers.

Delta fears appear unlikely to lead to a significant downturn in consumer activity in the current and fourth quarter, he said, though supply-chain disruptions could weigh on earnings expectations. Upward revisions are likely to continue for next year, while plenty of potential growth catalysts, including high consumer savings and strong corporate spending, remain in the pipeline.

At worst, that delays some growth that would have taken place in the second half of 2021 into next year, Melson said.

While the delta variant is slowing the economy somewhat, the effect on activity “is not nearly to the extent suggested by the University of Michigan index,” Markowska wrote. “Real-world impacts so far have been much more modest and amount merely to a loss of momentum rather than a pullback in economic activity.”

Read next: How Fidelity is playing ‘Moneyball’ in asset management