This post was originally published on this site

A string of record highs for the S&P 500 index aren’t yet signaling a contrarian move into euphoric territory, according to a new market tool that developers say aims to filter out herd-like behavioral biases and allow investors to reap the wisdom of the crowd.

Using the SPDR S&P 500 Trust ETF

SPY,

as a proxy, “we’re seeing near parity at the moment,” said Mark Gorzycki, referring to the OVTLYR (pronounced “outlier”) platform he developed with fellow data scientist Mahesh Kashyap and launched earlier this year.

Gorzycki and Kashyap, the co-founders of Kievanos LLC, a predictive-analytics company, began developing the online platform around five years ago, building on an interest in behavioral economics. As they describe it, the system consumes a variety of publicly available and non-personally identifiable data around an asset, which is then used to generate distributions that are used to identify propensities toward an array of cognitive biases.

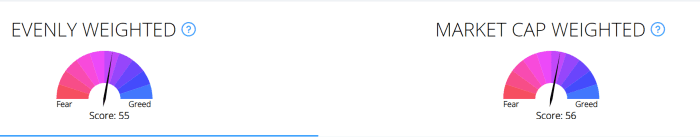

The presence or absence of those biases are variables in a model that produces a “discrete, directional probability” of where the asset is headed. This is charted as an oscillator, with low values corresponding to “fearful” markets and higher values corresponding to overly “greedy” markets.

The platform tracks each asset to identify correlations between what’s seen in the behavioral model and what’s happpening in the market. That’s displayed in a heat map, with red zones indicating price pullbacks alongside corroborating behavioral data, and blue zones that represent run-ups.

Currently operating as a free pilot program with around 4,000 to 5,000 users, Kashyap and Gorzycki aim to move OVTLYR to a “freemium” model by early next year.

A reading of 50% is considered “neutral.” As for SPY, it was displaying readings Tuesday of 55% and 56% on an even- and cap-weighted basis, respectively (see chart below).

OVTLYR

“These values are very slight in terms of an indicator; however, taking recent data/values into consideration, we appear to be moving further into the ‘greed’ direction, at which point the contrarian indication (bearish) would grow stronger,” Gorzycki said.

The oscillators don’t flip on a dime. Gorzycki and Kashyap said traders shouldn’t view them as outright buy or sell signals, but as a tool similar to traditional technical or price indicators. However, they said they plan to release a model portfolio solution in coming weeks that would be capable of automating allocations toward selected assets.

The S&P 500

SPX,

and Dow Jones Industrial Average

DJIA,

closed at records on Monday — the fifth straight for both. Stocks were pulling back sharply Tuesday, but remain up solidly for the month and year-to-date. Through Monday, the S&P 500 had risen 100.2% from its pandemic low set on March 23, 2020, according to Dow Jones Market Data.

The “wisdom of crowds”, a surprising phenomenon in which crowdsourcing answers questions, such as how many marbles are in a jar, has proved surprisingly accurate in experiments, though it is not foolproof. The concept was popularized by financial journalist James Surowiecki’s 2004 book of the same name, itself a takeoff of Charles’s MacKay’s “Extraordinary Popular Delusions and the Madness of Crowds,” published in 1841.

That madness is still often on display in herd-like behavior that drives asset prices to extremes.

OVTLYR tracks more than 1,300 of the largest, most liquid assets on the New York Stock Exchange and Nasdaq. Among the challenges was coming up with a system that worked across stocks. “It can’t be something that works for Microsoft but doesn’t work for Google,” Kashyap said.

The OVLTYR system, needless to say, likely isn’t ideal for super-active day traders.

“A lot of these movements from the greed zone to the fear zone take a few weeks to a few months,” Kashyap said. “If you’re looking to day trade, it may not be a good idea.”

Gorzycki said rehabilitated day traders might be the ideal users of the system, though it could benefit users “on both ends of the spectrum” from passive to active, he said.

“If we can pull someone away from the day-trading edge and say, look, you’re hurting yourself on frequency, you’re being highly speculative and it’s damaging to your results…here are some ways you could perhaps be more targeted.”