This post was originally published on this site

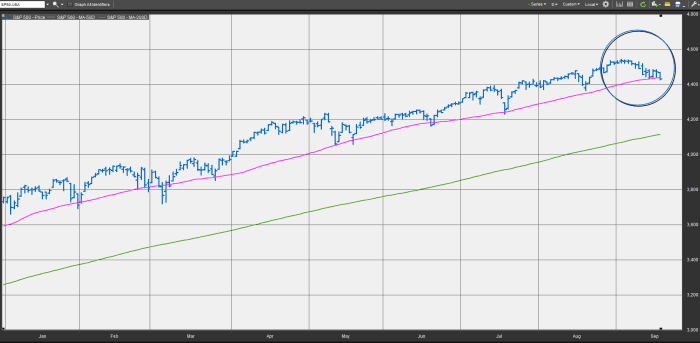

The broad-market S&P 500 index closed below its short-term trend line for the first time since mid June, signaling that a bearish turn is taking hold of the U.S. stock market ahead of the policy-setting Federal Open Market Committee meeting next week.

The S&P 500 index

SPX,

closed on Friday down 0.9% at 4,432.99, ending beneath its 50-day moving average at 4,436.67, FactSet data show. That marks the first breach of that short-term line in the sand since June 18, according to Dow Jones Market Data.

FactSet

Many technical analysts see the 50-day MA as a guide to the short- to intermediate-term trend, so a close below the line could portend further weakness.

Friday’s decline marked the second in a row for the S&P 500, led by a drop on the session in information technology

SP500.45,

and materials shares

SP500.15,

wiping out the index’s weekly advance.

The S&P 500 ended the week off 0.6%, while the Dow Jones Industrial Average

DJIA,

and the Nasdaq Composite indexes

COMP,

which both finished Friday lower, logged a weekly decline of 0.1% and 0.5%, respectively.