This post was originally published on this site

The Dixie Fire in Northern California, already ranking as the state’s eighth largest ever, burned a small town overnight and prompted area evacuations, weeks after Pacific Gas and Electric said its equipment may have sparked the blaze.

The three-week old fire comes during extreme weather and a historic drought in the state. Wednesday night the Dixie Fire destroyed the historic northern Sierra Nevada town of Greenville, which dates back to the Gold Rush era.

It already has burned more than 320,000 acres and 45 known structures, as damage assessment continues. Dry, windy conditions have helped fuel the fast-moving blaze, which was last reported as only 35% contained, according to the California Department of Forestry and Fire Protection.

Bonds issued by Pacific Gas and Electric, California’s largest utility, also have taken a lashing since the company in mid-July first alerted the California Public Utilities Commission, in a preliminary report, that a blown fuse on one of its utility poles may have ignited the fire. The investigation around the cause of the fire continues.

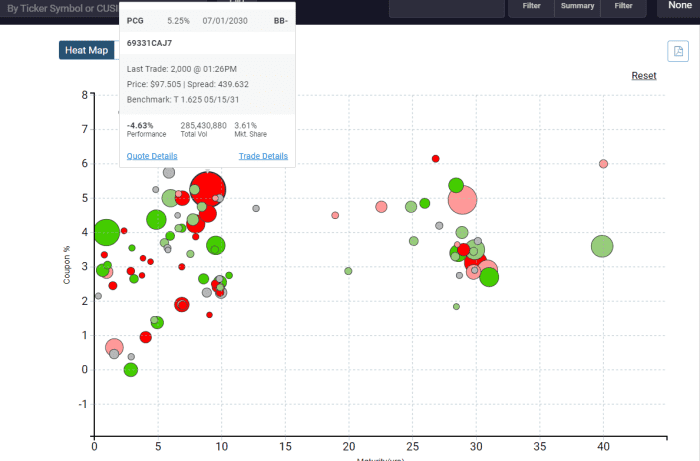

But since then, PG&E’s

PCG,

BB- rated corporate debt has come under sharp pressure and has seen heavy trading volumes. Its 5.25% bonds due July 2030 have been at the heart of the action, with spreads gapping out by roughly 40 basis points to about 439 basis points above Treasurys, according to BondCliq data.

PG&E’s stock was about 3.8% lower at last check Thursday, and on pace for a weekly fall of 5.1%, according to FactSet.

Bond spreads are the level investors are compensated above a risk-free benchmark, often Treasurys

TMUBMUSD10Y,

to help account for default risk. Wider spreads often point to market jitters or concerns around a specific company. Overall spreads for the broader ICE BofA BB U.S. High Yield index were last spotted at 241 basis points over Treasurys.

This chart highlights the downward trading pressure on PG&E’s July 2030 bonds relative to its utility company peers since mid-July.

PG&E bonds get lashing as Dixie Fire grows

BondCliq

PG&E’s overall debt also has been the most actively traded in that stretch, according to BondCliq.

A spokesman for the utility didn’t immediately respond to a request for comment on the trading action of the company’s bonds or stocks.

Instead, the company provided a link to an earlier statement that provides an update on the extra measures it will be taking during the growing wildfire threat, including an initiative to bury 10,000 miles of power lines in the highest fire-threat areas.

Stocks were poised for modest gains Thursday, with the Dow Jones Industrial Average

DJIA,

up 0.6% and the S&P 500 index

SPX,

0.4% higher.