This post was originally published on this site

It is 15,000 and counting for the Nasdaq Composite Index.

The popular index that was launched back in 1971 has been considered a bellwether for the information technology sector, the future of the American economy, and it is ringing up a notable round-number milestone on Tuesday that took the Dow Jones Industrial Average

DJIA,

more than a half-century longer to achieve: 15,000.

The Nasdaq Composite

COMP,

took 136 days from its last milestone at 14,000 to close at 15,019.80, marking the longest stretch before knocking out a thousand-point landmark since the 335 sessions between 8,000 and 9,000 back in 2018-19, according to Dow Jones Market Data.

Dow Jones Market Data

To be sure, despite the plodding move by the Nasdaq Composite to 15,000, anyone with a passing familiarity with arithmetic would note that such achievements become less impressive the higher the market advances. The move from 8,000 to 9,000 was a 12.5% rise for the Nasdaq Composite, compared with the 7.1% rise to 15,000, this time around.

But is it still worth busting out a 15,000 hat and a banner and popping the bubbly?

Art Hogan, chief market strategist at National Securities Corp. in New York, told MarketWatch on Tuesday that there is something to be said for the psychological impact that achieving a round-number has on the psyche of the average American watching market movements and in sentiment for investors.

“Round numbers are always important because it brings the story of the market to the people who don’t watch it everyday,” Hogan said, noting that news stories on the achievements of stock indexes are heralded with more gusto on such occasions.

“It may be one of the only stories that Aunt Joan is going to read tomorrow,” the National Securities Corp. strategist explained.

That said, this milestone, also the 29th record closing high for the Nasdaq Composite in 2021, comes with the added benefit of records for the broader market index, too. The S&P 500 index

SPX,

is marking its 50th all-time closing high of the year at 4,486.23.

What trading on Tuesday tells us “is that it is a reaffirmation that while there are plenty of concerns…on stimulus going away, on the delta variant…companies are growing their earnings and their revenue,” Hogan noted.

It is a great opportunity to remind bears and people who don’t track markets for a living that the market is moving along nicely.

Tech stocks in particular have been whipsawed in recent weeks and months as concerns about the delta variant and rising Treasury yields have caused a steady and uneven rotation out of investments that were expected to perform well during the pandemic to stocks that might do better as the economy reopens.

Financial conditions, thus far, have been favorable to rising asset values, with the Federal Reserve expected to move slowly in tapering its monetary-policy accommodations and interest rates projected to hold at a range between 0% and 0.25% for at least until late 2022.

The coronavirus delta variant, however, has created some questions about how smoothly the U.S. economy will transition back to any semblance of normalcy.

It is far from an apples-to-apples comparison, but it took the Nasdaq Composite 50 years to achieve 15,000 while it took the Dow 117 years when it hit 15,000 in 2013.

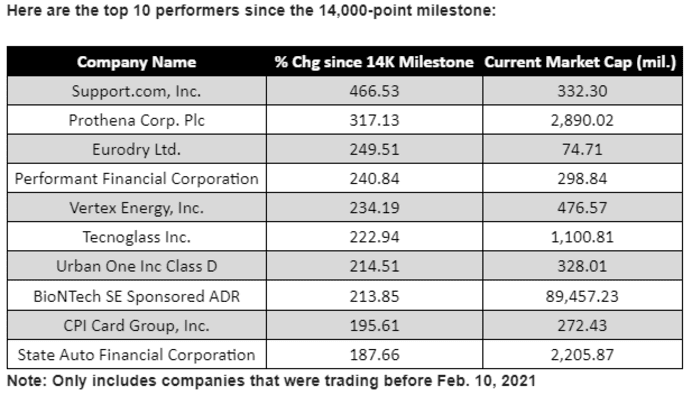

The top performers for the Nasdaq Composite in its climb to 15,000 include Support.com Inc.

SPRT,

up 466%, Prothena Corp. PLC

PRTA,

, rising by about 317%, and Eurodry Ltd.

EDRY,

advancing 250%. BioNTech’s U.S.’s listed stock also tops the list, up by about 214%.

Dow Jones Market Data