This post was originally published on this site

Igal Namdar and Elliot Nassim first teamed up a decade ago to buy problem U.S. shopping malls.

Now they rank among the biggest all-cash buyers of the nation’s hard-luck malls. The pandemic has made it even tougher for mall property owners already struggling to keep up on mortgage payments, resulting in several major players throwing in the towel on distressed properties and with more likely.

The duo, through Namdar Realty Group and Mason Asset Management out of Great Neck, Long Island, currently owns about 60 million square feet of shopping center space, including roughly of 100 open-air properties are 65 enclosed malls. That kind of footprint puts them in league with Macerich Co.

MAC,

and other major mall owners with a coast-to-coast reach.

Instead of U.S. stockholders and quarterly reports, the team keeps things simple: Namdar focuses on management side of the properties. Nassim handles leasing and asset management. Namdar, through Namco Realty Ltd, also a few years ago raised millions in Israel by selling bonds tied to his properties.

But what really sets them apart is a steady stream of all-cash offers to sellers who want out. In return, they want a discount.

“We see that a lot of these malls are being sold by lenders,” said Igal Namdar, the company’s president, in an interview with MarketWatch. “And the surety of close is an important thing for them.”

“We see that being able to close all-cash, often times gets you a discount from where the market it,” he said. “That is where we kind of make our money.”

Several market experts pointed to Nadmar and Nassim as among the sector’s biggest cash mall buyers. “I would say that we probably bid on more malls than any other company,” Namdar said.

Bloomberg News recently reported on legal issues stemming from the “bottom feeder” strategy, while pegging Namdar’s personal net worth at roughly $2 billion.

Namdar declined to comment on that net worth estimate when asked by MarketWatch. “While we cannot comment on matters of active litigation, we do take any lawsuits against our team very seriously,” the team told MarketWatch. “It is always our goal to add value to our properties, and we are diligent in our efforts to remedy any maintenance or management issue that is brought to our attention.”

In a nutshell, theirs is a bet that any mall can produce a profit, if the price paid is less than cash coming in from tenant leases. If some old malls can be used in new, creative ways, such as the “mini-casino” plan for an old Macy’s store at Namdar-owned Nittany Mall in State College, Penn, all the better.

Billions on the line

The financial issues tied to struggling U.S. malls already runs into the billions.

About $4.6 billion of U.S. shopping center debt has been pegged to likely deed-in-lieu of foreclosure events, liquidations or real estate owned (REO) properties, according to a list compiled by Bill Petersen, co-founder of CREDiQ, a commercial real estate analytics firm.

An REO property is one where a property is owned by a lender because it failed to sell in a foreclosure auction after the borrower defaulted on the mortgage.

Because many properties remain in limbo, the worst of the crisis for mall mortgage bond investors likely has yet to come.

Roughly $3 billion shopping mall loans in commercial mortgage bond deals have been identified as at-risk of being handed back to lenders, according to research firm and data tracker Trepp.

“I think some mall owners will muddle through with the help of loan modifications and maybe some peripheral debt forgiveness,” said Manus Clancy, senior managing director and head of research at Trepp. “Others will be handed back to lenders through an uncontested or confrontational foreclosure process.”

The Drano for Underwater Malls

Much has been written about the death of American mall, including recently by the New York Times in an article that notes the “deep nostalgia” many people have for local malls, even as many property owners have been struggling for years to keep the lights on.

Morgan Stanley’s retail team of analysts forecast last October that the pandemic could force 35% of U.S. shopping malls to shut permanently. Trillions of dollars worth of fiscal and monetary stimulus by the federal government and Federal Reserve helped staunch the carnage, with only 13 malls so far this year trading to new owners.

Namdar and Nassim might help to unclog the debt backlog of underwater mall properties.

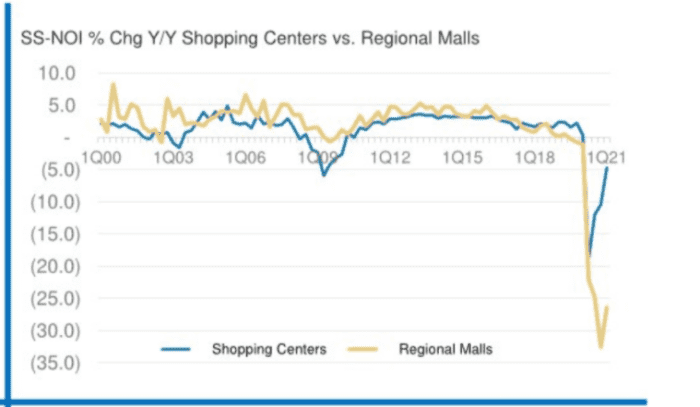

In part, that’s because financials could continue to head downhill for many lower-quality mall owners. Regional malls watched same-store net operating income plunge on average by minus 26.1% in the first quarter from a year ago, according to Morgan Stanley.

Malls see net operating income plunge

Morgan Stanley Research

Lifting of pandemic restrictions in recent months has been a boon for shares of top mall operators like Simon Property Group

SPG,

and Kimco Realty Corp.

KIM,

both up more than 40% on the year so far. That compares with a 18.4% gain for the S&P 500 Index

SPX,

for the year as of Tuesday, while the Dow Jones Industrial Average

DJIA,

was up 15.4%.

The surge in retail REIT stocks comes despite a backdrop of big-picture challenges, not only from slumping retail rents and occupancy levels, but also a crush of tenant leases coming due over the next three to four years.

That’s when Morgan Stanley’s team estimates that 50% of mall-based specialty leases, including those of American Eagle Outfitters Inc.

AEO,

the Gap Inc

GPS,

and others, come up for renewal.

The pandemic also isn’t over yet, including in the U.S., where COVID hospitalizations have been climbing, despite widespread availability of vaccines for adults, raising concerns around the recovery.

The government’s release Tuesday of July U.S. retail sales showed a sharp 1.1% drop on a monthly basis, underscoring anxieties tied to the delta variant of the coronavirus, but also a shift in priorities from “goods to services,” James Knightley, ING’s chief international economist, wrote in emailed comments.

The properties Namdar and Nassim began scooping up after the 2008 financial crisis were “C” or “D” malls, categories, like exam grades, that point to room for improvement or near failure. Lately, the team has been moving up in quality.

“We are a very low leverage company. And we are out there looking all the time for opportunities to purchase better assets than when we first started,” Namdar told MarketWatch. “As we build our portfolio, we want to constantly improve the quality by having better assets.”

No one doubts the best U.S. malls will survive — and even thrive — once the pandemic carnage plays out, said Daniel McNamara, a principal at MP Securitized Credit Partners. But he still sees the problem as too much debt on lower quality properties financed years ago, when mall valuations were pegged at much higher levels.

“The Class A operators are doing great,” McNamara told MarketWatch. “But almost anything below ‘Class A,’ there really has been no bid for, except for the Namdar’s of the world. And it has to be all cash.”

Like billionaire Carl Icahn, McNamara’s hedge fund has been betting on the debt of older malls going bad.

BofA Global’s research team recently put it this way, “while online shopping had already been cannibalizing brick and mortar retail, the pain felt by many retailers prior to Covid was exacerbated during the pandemic,” in a weekly note.

Major shopping mall owners, including Simon Property, Starwood Capital, Brookfield Asset Management and others have reacted to the upheaval by handing back the keys to lenders on some properties, rather than “throw good money” after bad.

The Green Street Commercial Property Price Index has mall values down 18% since before the pandemic.

The Namdar team hopes more, higher quality malls will keep shaking loose.

“During the pandemic, there have been less deals out there,” Namdar said, adding that most lenders have been working with their borrowers, but also that many have been unwilling “to take a big write off yet.”

“But we are told in the next year or 18 months, there will be a lot of deals coming to the market,” he said.