This post was originally published on this site

Concerns about the U.S. economy slipping into a recession isn’t the only thing nagging at corporate bond investors.

Trading in the riskier high-yield, or “junk-bond,” segment of corporate debt also has become a lot trickier in recent weeks, including as investors flee bond funds and the S&P 500 index

SPX,

teeters on entering another bear market.

Read: The S&P 500 is trading in bear-market territory. How far could it fall?

With trading activity serving as a key engine of functioning financial markets, big intraday gaps, in terms of where investors are willing to buy or sell bonds, can matter a lot, particularly as fears rise and liquidity drains from markets.

“Extreme risk aversion, defensive positioning, poor sentiment and funding concerns” all are gripping the U.S. high-yield bond market, said Oleg Melentyev’s strategy team at BofA Global, in a Friday client note.

Unlike transparency in stocks trading on exchanges, a huge swath of the U.S. bond market still trades with delayed transparency, making sentiment hard to gauge in real time.

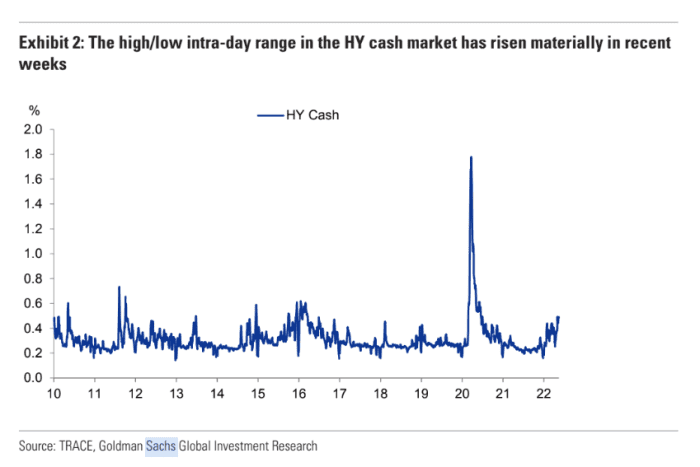

To that end, Goldman Sachs analysts analyzed the divergence between where buyers and sellers have been willing to transact (see chart) in the U.S. junk-bond market over time. They found recent high-low intraday swings, or the “bid-ask spread,” nearing levels last seen amid in the wake of the March 2020 pandemic panic, in a weekly client note.

Liquidity pinch? Intraday volatility is picking up in junk bonds

TRACE, Goldman Sachs Global Investment Research

The Goldman team, led by Lotfi Karoui, pointed to a “notable uptick in intraday volatility, across the board,” including for the large iShares iBoxx $ High Yield Corporate Bond ETF,

HYG,

where the high-low intraday range “suggests a higher hurdle for investors to deploy capital.”

Corporate bonds, from a total return perspective, have been deeply negative this year as the Federal Reserve works to fight high inflation by raising interest rates and cutting the size of its record $9 trillion balance sheet.

Until May, most of the negative performance was attributed to rates volatility, with the 10-year Treasury rate

TMUBMUSD10Y,

topping 3.2% earlier this month, nearing a peak level last seen in 2018, or before the 2020 pandemic recession hit.

Bond yields and prices move in the opposite directions, sinking many longer dated corporate bonds by major U.S. companies to $70 prices, and lower, from around $100 to start the year.

What’s more, the Goldman team tracked $87 billion in notional U.S. high-yield bonds as trading at distressed levels, or a spread of at least 1,000 basis points above the risk-free Treasury rate, up from $24 billion as of July 2021, a post-financial crisis low for spreads in the sector.

On the recession-watch front, a key index for riskier CCC rated junk bonds and below crossed into distressed territory this week, last pegged at a spread of 1,061 basis points above Treasurys.

Read next: Has the junk-bond market hit bottom? Liquidity issues may be up next, warns this industry veteran