This post was originally published on this site

A combination of unrelated factors is raising the likelihood that higher-than-normal U.S. inflation could turn durable, lasting anywhere from a few years to a full decade, according to investors bracing for next week’s latest update on price gains.

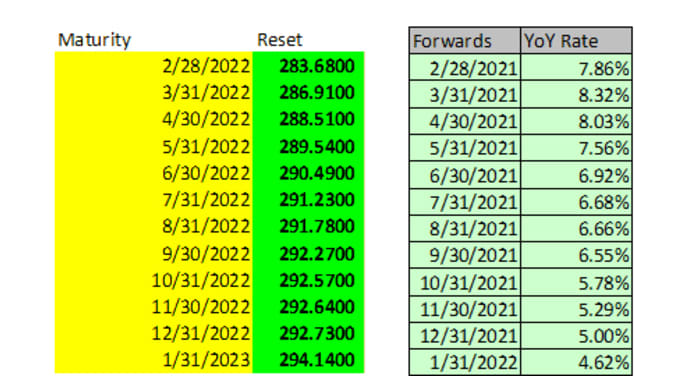

Traders expect Thursday this coming week to bring the first in a string of annual consumer price index headline figures close to or above 8%. Derivative-like instruments known as “fixings” imply the year-over-year rate for February is likely to be 7.9%, followed by 8.3% for March and 8% for April. That would be the longest stretch of such high readings since September 1978 to January 1982, when the U.S. stagflation that lasted a decade wound down.

Bloomberg

Russia’s attack on Ukraine in the past week has shifted the calculus, by putting a much longer stretch of high U.S. inflation firmly within the realm of possibilities. The war is creating havoc in oil markets, roiling commodity prices, and trickling down to American consumers at a time when the inflation rate is already at a 40-year high of 7.5%.

Earlier this week, U.S. crude oil topped $116 a barrel for the first time in over a decade, exacerbating other inflationary forces under way during the pandemic. They include persistent labor shortages and rising wages, a higher cost of shelter, and even higher energy prices driven by climate change. Add to this a Federal Reserve reluctant to deliver aggressive interest rate hikes for now, given the central bank is loathe to tip the economy into a recession.

“Stagflation has absolutely become more likely, with growth being impeded by a variety of factors that already existed coming into the year,” said David Spika, president and chief investment officer of GuideStone Capital Management, which manages $18.2 billion from Dallas. “Ukraine has compounded that.”

Traders, policy makers and economists alike are all counting on inflation to trail off this year, while persisting above the Fed’s 2% target. However, many have turned out to be wrong for months and inflation has yet to show signs of peaking.

Fed Chairman Jerome Powell has assured policy makers of his support for a quarter percentage point rise in benchmark interest rates this month, which would lift the fed funds rate target to between 0.25% and 0.5%, though he says central bankers are prepared to do more if needed. However, policy makers are somewhat hamstrung from executing more aggressive rate hikes right away, given the chances of an economic slowdown. Meanwhile, some investors remain hopeful that plans to shrink the Fed’s almost $9 trillion balance sheet can complement rate hikes, though the precise impact of so-called quantitative tightening is a matter of debate.

“Our base-case view is that as long as the economy avoids a recession, we think sustainable sticky inflation north of 3% is likely to stay for more than a year,” GuideStone’s Spika said via phone. “We could see an extended period of inflation if the Fed does not respond forcefully enough, though I wouldn’t rule out the impact that significant balance-sheet reduction could have.”

Read: ‘Stagflation’ Is Coming. What You Need to Know.

Traders currently see a better-than-50% chance the Fed will lift its main policy rate target to 1.5% to 1.75%, or higher, by year-end. But that’s not nearly enough to get serious about inflation: Rich Kelly of TD Securities, an arm of Toronto-Dominion Bank

TD,

says the central bank would need to hike the fed funds rate target by 800 basis points immediately to match its typical reaction function relative to past decades. And Bank of America

BAC,

rate strategists say a formula, known as the Taylor Rule, suggests the fed funds rate target should already be above 6%.

“ “It’s easier to imagine us getting into stagflationary scenario than it was pre-Russia and Ukraine.””

Not everyone is convinced the U.S. is headed for stagflation, or stagnant growth combined with high inflation. Kevin Flanagan, head of fixed income strategy at New York-based WisdomTree Investments

WETF,

says he’s “on board with the ‘flation’ part of that” word, but thinks “we are going to avoid the ‘stag’ part” as the U.S. economy expands 3% to 4% in 2022. Inflation should persist at 3% or higher for the next 12 months, he says, though it’s also “fair” to say price gains could stay elevated for the next two years. In the meantime, Flanagan says he’s relying on two-year Treasury floating rate notes

USFR,

as one way to mitigate the risk of higher rates.

“The commodity-price shock is a new and a potent driver of higher inflation and we’re still in the early innings of trying to understand what that means for the U.S. outlook,” said Bill Adams, the Toledo, Ohio-based chief economist for Comerica Inc.

CMA,

“It’s easier to imagine us getting into a stagflationary scenario than it was pre-Russia and Ukraine, but that’s not my base case,” Adams said via phone. “My base case is that we see high inflation over the next few months, before CPI falls off to 4% year-over-year in the fourth quarter as the pandemic fades, labor force participation rises, and shortages ease. We could see disinflationary effects play out. Russia-Ukraine is clearly inflationary, it’s just a question of the magnitude and persistence of the shock.”

Thursday’s CPI report is the most important, potentially market-moving data due next week, landing during the traditional media blackout period for Fed speakers ahead of the central bank’s March 15-16 policy meeting.

Monday brings January data on consumer credit, followed by Tuesday’s release of the NFIB small-business index and a revision to wholesale inventories. Data on job openings and quits are due Wednesday. And weekly jobless benefit claims are published Thursday, followed by Friday’s release of the University of Michigan consumer sentiment index and a preliminary reading of five-year inflation expectations.

“Everyone is fearful of a 1970’s style wage-price spiral, with wages being one of the most durable elements of inflation,” said Eric Leve, chief investment officer at Bailard, a $5.6 billion asset and wealth manager in the San Francisco Bay Area. He says “a reasonable goal” for inflation “is 3% long term for the next decade.”

“This year will test the mettle of central bankers around the world,” he told MarketWatch. “The question for them is, `How do you deflate the economy in a way that doesn’t create a growth shock?”