This post was originally published on this site

The Dow Jones Industrial Average clambered to a new high Tuesday morning, putting the blue-chip index within shouting distance of 37,000, a day after it booked its first record since November.

Read: Odds of a March rate hike by the Federal Reserve are back above 50%

To be sure, 1,000-point milestones for the Dow

DJIA,

on their own don’t carry much significance in terms of market fundamentals or even technicals, but some analysts contend they are at least symbolically important as the bull market in stocks appears to maintain its hold in 2022.

That said, the Nasdaq Composite

COMP,

and the S&P 500

SPX,

indexes were under pressure, down 1.6% and 0.1%, respectively, to underscore the divergence between the benchmark stock gauge and its peers which were driven lower due to losses in technology-related equities.

The Dow finished Monday trade, the first session of the new year, up by 246.76 points, or 0.7%, at 36,585.06, extending its steady ascent to end 2021.

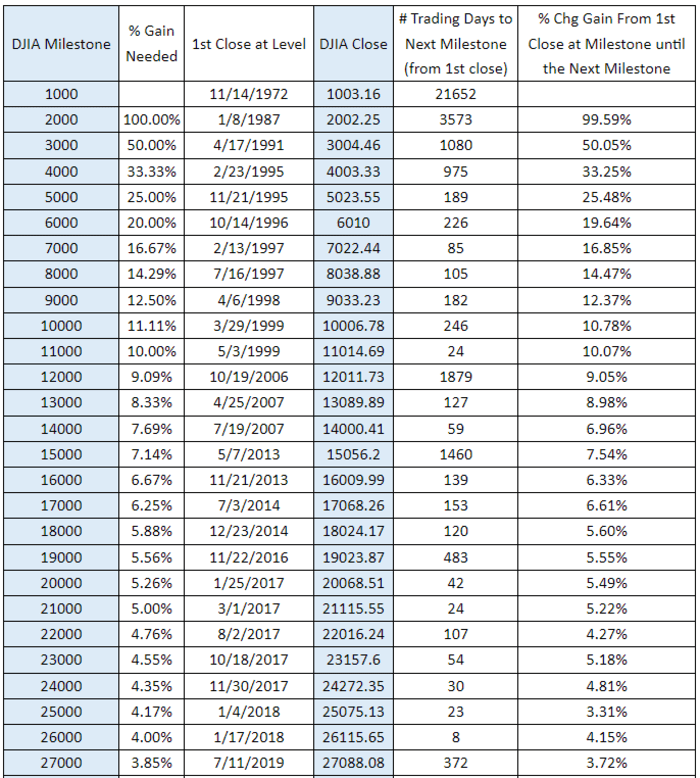

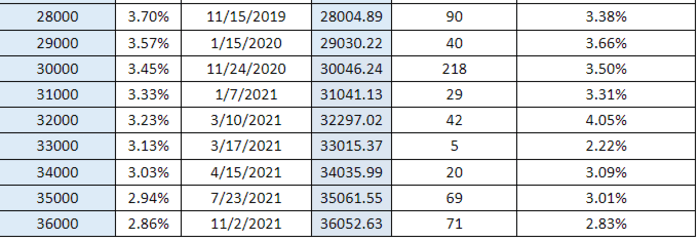

Dow Jones Market Data

Dow Jones Market Data

It has been about 40 trading days since the Dow last cleared a 1,000-point milestone on Nov. 2. A close above 37,000 would mark its fastest milestone run since it completed a move from 33,000 to 34,000 in mid-April of last year.

Any finish above 37,000 at any point is less impressive because the moves mathematically become less significant the higher the Dow industrials grow overall. For example, the climb from 36,000 represents a roughly 2.8% gain.

Among the Dow’s 30 components that have helped the price-weighted index climb during this most recent stretch are Goldman Sachs Group Inc.

GS,

Amgen

AMGN,

and McDonald’s Corp.

MCD,

while the biggest drags have been UnitedHealth Group

UNH,

Apple Inc.

AAPL,

and salesforce.com Inc.

CRM,